Payouts, eCom Transactions or Card-to-Card Payments?

While thinking about card-based money transfer solutions, our partners usually ask for three products - payouts to cards, eCom transactions or card-to-card payments. In this article we will describe differences between those 3 ways of money transfers.

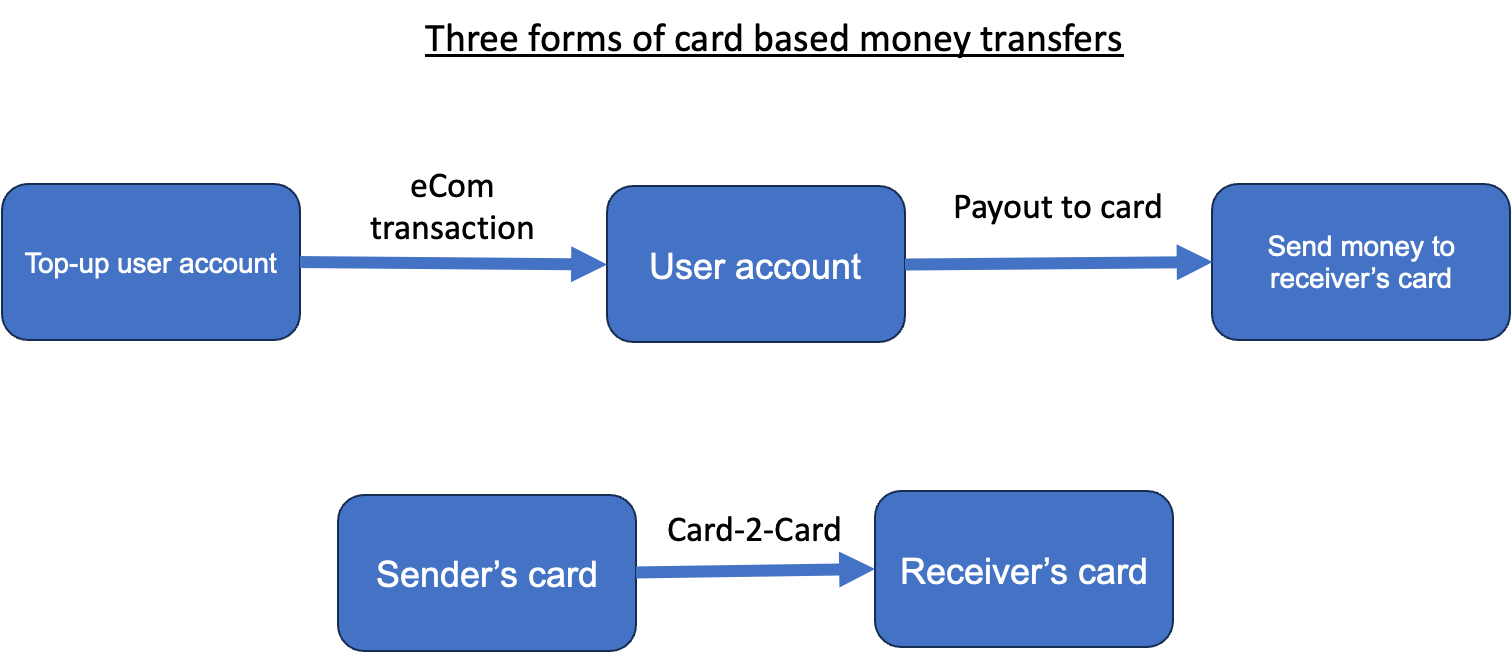

Let me start with a chart.

There are three use cases that you may be interested in. The choice of product depends on a use case decision.

Use Case 1. Top-up user account - in this case our starting point is the user's account kept somewhere in your systems. Your users need to reload this account with money. You can use various forms of transfers to your account, but if you want to reload an account from Mastercard or VISA card, we should enable eCom transactions to you. You will be registered as a merchant with our partnering acquirers and we will enable payments using cards, Apple Pay, Google Pay or other means of payment.

Use Case 2. Payout to card - in this case we assume that your user has an account and money on this account. We need to enable payments from this account to any card in the world. This money transfer will be very quick - less than 30 minutes. In this case you should be using our product called "Payouts to cards". This will enable your user to transfer money to any Mastercard or VISA card.

Use Case 3. Card-2-Card - in this case our assumption is that you do not have a user's account. You do not store the money of your users. You just want to enable a money transfer service from one card to another card. From Mastercard to VISA, VISA to Mastercard or Mastercard to Mastercard or VISA to VISA card. In such a case we recommend that you use our card-2-card product.

It is important not to mix those use cases and choose the correct product. All three products have different fees, AML requirements so please think of your use case and let's decide what to use.

Thanks for reading.