Example of Profit & Loss calculation in card issuing

Calculating profits and losses in card issuing is not easy, especially when various card issuers offer different fee and revenue models. Below I would like to show a few examples.

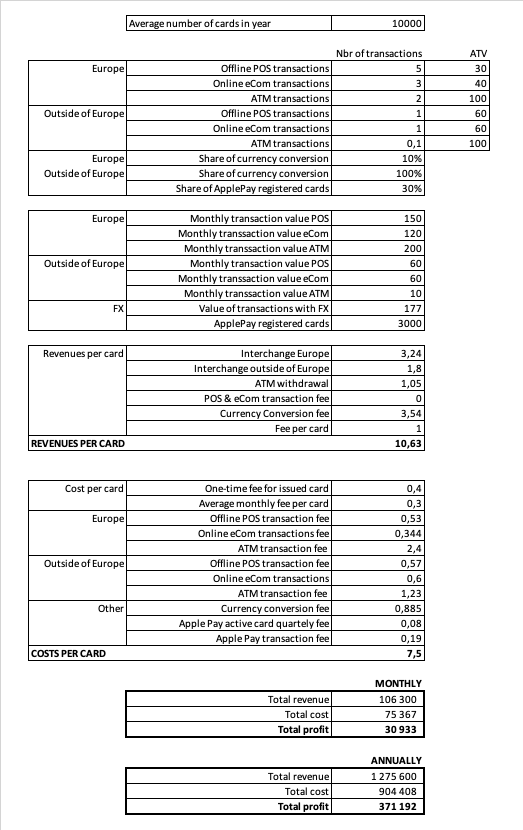

Let's imagine we are a fintech wallet with 10.000 users and we would like to issue cards for these users. The first step we need to take is to try to forecast key parameters of product, transaction, revenue and cost assumptions:

- Product

- Product - Debit Business Mastercard card

- Settlement currency - EUR

- Transactions

- Average number of cards in a year - 10.000

- Offline POS transactions in Europe: Number of transactions per month - 5 ; Average Transaction Value (ATV) - 30 EUR

- Online eCom transactions in Europe: Number of transactions per month - 3 ; ATV - 40 EUR

- ATM transactions in Europe: Number of transactions per month - 2 ; ATV - 100 EUR

- Share of currency conversion transactions in Europe - 10% (transactions done in Polish zloty, Czech koruna, Romanian Lei, Swedish krona etc.

- Offline POS transactions outside of Europe: Number of transactions per month - 1 ; Average Transaction Value (ATV) - 60 EUR

- Online eCom transactions outside of Europe: Number of transactions per month - 1 ; ATV - 60 EUR

- ATM transactions outside of Europe: Number of transactions per month - 0,1 ; ATV - 100 EUR

- Share of currency conversion transactions outside of Europe - 100% (transactions done in Polish zloty, Czech koruna, Romanian lei, Swedish krona etc.

- Share of registered ApplePay cards - 30%

- Share of ApplePay transactions - 20% for online and 90% for offline contactless

- Revenue

- Interchange fee for business cards (fee from POS and eCommerce transactions; we assume 100% of interchange stays with partner)

- in Europe - 1.2%

- outside Europe - 1.5%

- ATM withdrawal fee - 0.5%

- POS and eCommerce transaction fee - 0%

- Currency conversion fee - 2%

- Monthly fee per card - 1 EUR

- Interchange fee for business cards (fee from POS and eCommerce transactions; we assume 100% of interchange stays with partner)

- Costs

- One-time fee for an issued card - 0,4 EUR

- Average monthly fee per card - 0,3 EUR

- Fee for offline POS transactions in Europe - 0,10 EUR + 0,1%

- Fee for online eCom transactions in Europe - 0,10 EUR + 0,11%

- Fee for ATM transactions in Europe - 0,9 EUR + 0,3%

- Fee for offline POS transactions outside of Europe - 0,3 EUR + 0,45%

- Fee for online eCom transactions outside of Europe - 0,3 EUR + 0,5%

- Fee for ATM transactions outside of Europe - 0,3 EUR + 1.2%

- Currency conversion fee - 0,5%

- Apple Pay active card quarterly fee - 0,25 EUR

Let's do quick calculations.

Please treat it as example and make your own calculation. There will be many dependencies connected with segment, type of portfolio, detailed pricing, volume estimations etc.

Taking into account the above assumptions, you could earn 30.933 EUR monthly and 371.192 EUR annually on such a portfolio. Seems high? Interested what cost of investment is needed? Contact us.

Thanks for reading.

PS. If you are interested in receiving an Excel file related to these calculations, let us know at sales@verestro.com.