Payment schemes

In this document we describe how payment schemes (Mastercard and VISA) work.

Payment card business is a large global market, which was developed in the USA in the first half of XX century and has grown globally. In this document we will describe the main business principles and in the next chapters we will go into more details. We will focus mainly on Mastercard and VISA operations, as these are the largest payment schemes in the world and the main partners we work with.

Four Party Model

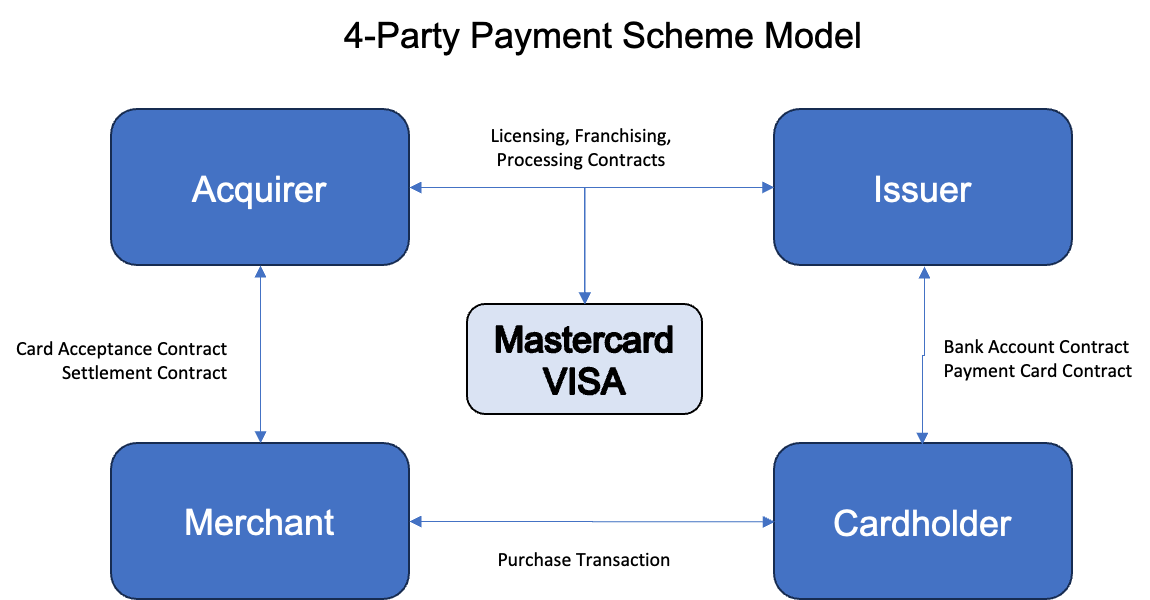

Let's start with the general relationships between the parties. In the Mastercard and VISA 4-party model (which is actually 5-party model) there are the following players:

1. Cardholder - has a contract with Card Issuer, which is usually a bank, financial institution, payment institution, credit union, etc. Cardholder keeps a card in a plastic or virtual form that he/she gets from Issuer. Cardholder makes a purchase transaction at Merchant or sometimes withdraws money from an ATM. In the case of an ATM transaction, the ATM operator (usually a bank) acts as Merchant in a standard purchase transaction.

- Cardholder is happy because he/she does not need to carry cash all the time and has money all the time in their pocket or phone.

- Cardholder has to pay card fees to Issuer for getting a payment card.

2. Merchant - delivers goods to Cardholder, but does not receive cash immediately, but accepts the card transaction, which gives him/her almost 100% confidence that he/she will receive money in a few hours or days.

- Merchant is happy because he/she sold goods, usually having sold more than Cardholder could afford with cash. Imagine the situation where you have to pay cash all the time. Would you always carry enough cash with you? What if you want to buy something, but you do not have enough cash?

- Merchant has to pay the so called "Merchant Fees" to Acquirer for processing the transaction. Usually, Merchant Fees are between 0,5-3% depending on transaction value, country, merchant segment, type of card etc. Merchant fees cover most, if not all, of the transaction processing costs. They usually include all the fees charged by Acquirer, Issuer, Mastercard or VISA for the transaction.

3. Issuer - Issuer is usually a bank, credit union or any other payment institution that delivers payment cards to cardholders (consumers or businesses). Issuer signs contracts with cardholders. On the other side of business, Issuer has a franchising or licensing contract with VISA and Mastercard and connects to their network using Issuing Processors. Verestro and our partners (for example Quicko) plays the role of Issuer and Issuer Processor in our card issuing or BIN sponsorship projects. During the transaction process, Issuer usually gets authorization, clearing and settlement messages that result in transfer of money from a cardholder account to Acquirer so that Acquirer could settle the transaction with Merchant.

- Issuer is happy because they charge card fees to Cardholder (for example monthly per card) and get transaction fees called Interchange Fee from Acquirer. Interchange fee is a very important part of Merchant Fees. In the European Union for consumer cards it is usually in the value of 0,2-0,3%, but in many countries, especially for business and credit cards, it can amount to 1-2% of the transaction value.

- Issuer has to cover costs of card issuing, which include:

- Cost of payment scheme (Mastercard or VISA) incl. monthly connection, license, authorization, clearing and many many other fees. This is usually the main part of Issuer's costs.

- Cost of other processors incl. transaction authorisation, card maintenance, card tokenization, plastic card manufacturing, personalisation, delivery, etc.

- Regulatory costs incl. payment license operations, Anti-Money Laundering processes, etc.

- Various costs connected with maintaining a relationship with Cardholder incl. proper communications, SLAs, etc.

4. Acquirer - Acquirer is usually a bank or payment institution that signs contracts with merchants, settles payment transactions with merchants and has acquiring contracts with a payment scheme. Acquirer usually provides a payment terminal to merchant locations, and makes sure if it works and is ready for transactions.

- Acquirer is happy because they charge Merchant Fees that usually consist of transaction fees (0,5-3%), sometimes fixed fees per transaction (0,01-0,5 EUR) and monthly fees per terminal.

- Acquirer needs to cover various fees, including regulatory fees, payment scheme costs, cost of processors, terminal purchase and costs of operations.

5. Payment Scheme - Payment Scheme (i.e. Mastercard or VISA) are key for keeping the model running. They develop technical systems that issuers and acquirers are connected to, they process transactions, they develop the market. However, they are also the biggest beneficiaries of the market growth as every new transaction represents revenue for Mastercard and VISA.

Key Processes

There are several processes that take place during card and transaction processing, and here we will briefly describe the most important ones:

- Card issuing process - this process or set of processes consists of multiple actions that Card Issuer needs to perform to issue a payment card. They are the following:

- regulatory compliance - every card issuer in the world needs to comply with law, get license from a national bank or financial regulator, work according to their recommendations and rules,

- Mastercard integration and licensing - it consists of a formal process, providing necessary cash collaterals, doing technical integration, getting security certifications etc.,

- card creation process - after signing a contract by a user, Card Issuer needs to create a new card number (using BIN of the issuer - BIN = first 6 or 8 digits of card). When a card number (PAN = Primary Account Number) is created, the card can immediately work as a virtual card or can be sent for personalisation if it is a plastic card. Usually, after the user receives the card (virtual or plastic), the user starts the card activation process, sets the card PIN and can start using it.

- Transaction process - this process consists of several operations that result in transfer of money from Cardholder account to Merchant. They are the following:

- Authorization process is an action that ensures that Merchant can immediately get information if Cardholder has money on his/her card account and if this card is not stolen. The authorisation can happen online (a direct request to Issuer's system to check the balance and card status) or offline (in this case a chip on the card makes a decision if it can approve the transaction without asking Issuer's systems).

- Clearing process is an action of payment scheme during which clearing files are delivered by acquirers to payment scheme and payment scheme calculates how much money each Acquirer should receive from each Issuer in the world.

- Settlement process is a process of transferring money from issuers to acquirers and later to merchants so that finally Merchant receives the transaction amount, less Merchant Fees, on his/her bank account. Every Issuer and Acquirer has settlement bank accounts that are used for transferring money from or to. Payment Schemes operate those accounts using something like Direct Debit / Credit to transfer money between Settlement Accounts of various financial institutions.

- 3DS - sometimes additional authentication mechanisms are used to ensure that the person initiating the card transaction is the actual cardholder. In the case of eCommerce transactions this process is called 3DS. During an Internet transaction, the user's browser opens the bank's website, where the user can authenticate the transaction using one-time passwords or other forms of authentication developed by Issuer. After the 3DS authentication is verified, Acquirer receives a special cryptogram that is included in the authorization message and validated later by Issuer during the authorization process.

- Tokenization - tokenization is a process of exchanging a real card number into a token number (similar to a card number) to enable digital and contactless payments. Usually it is connected with transactions performed in cooperation with the so called X-Pays (i.e. Apple Pay, Google Pay, Fitbit Pay etc.). The process of tokenization requires an integration with Mastercard Digital Enablement System (MDES) or Visa Tokenization system (VTS) to enable tokenized payments.

- Refund and reversal - special type of transactions that enable reversing payment transaction either immediately (reversal) or later (refund). Once this process has been initiated, Cardholder can receive money back after successful authorisation.

- Chargeback - process of complaint management. It can be initiated by Issuer in case Cardholder informs Issuer that he/she did not do the transaction or did not authorize it, or goods were not delivered etc. The process is costly for Issuer and Acquirer but ensures security of the system for cardholders.

- Card-to-card transactions and payouts - the so called "payment" or "credit transactions". In a standard purchase transaction money is transferred from Cardholder to Merchant. In a card-to-card transaction or payout transactions, the user gets money on his/her card or on the account linked to the card.

There are other important processes associated with payment systems and card transaction processing, but let's stop here and take a short break to understand these critical processes.