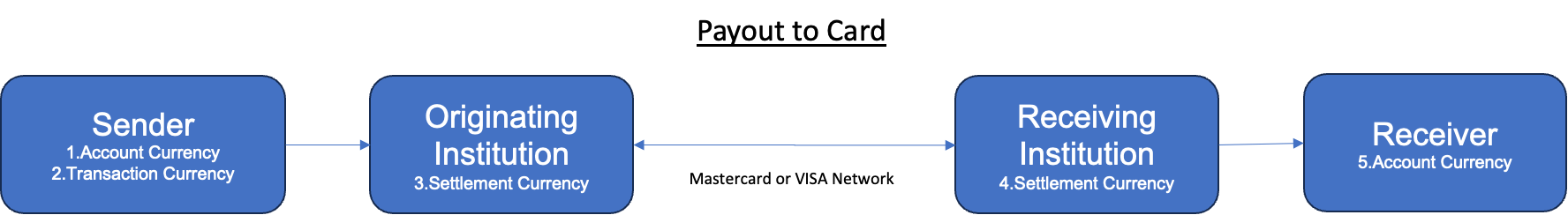

Currency Management in Payouts to Cards

There are many questions about how to manage currencies in payout products. Let me briefly describe several possible scenarios.

Let's start with dependencies that have an impact on choosing various scenarios.

- Sender's card account currency - first you have a user with a payment account in a particular currency, for example USD, EUR, CHF, RON etc.

- Transaction currency - transaction that sending user can choose

- Acquirer settlement currency - there are settlement currencies that an acquiring institution (Originating Institution) cooperating with VISA or Mastercard uses to settle money with them, for example USD, EUR, PLN. Of course, it can differ from the user account currency.

- Receiver's card issuer settlement currency - a bank, which issues a card for the receiver, can have various settlement currencies with Mastercard or VISA.

- Receiving card settlement currency - additionally, there is a settlement currency of the receiver's card, issued by another bank. It can be any currency, for example UAH, CZK.

That's why it is complex. At various levels of transactions there are various currencies and of course in case of currency conversion at any step various additional FX fees apply. That's why the choice of currency management strategy is not an easy one.

Additional decision factors are related to particular use cases I want to present. There are a few possible ways of offering Payouts to the user. Let's have a look at 3 scenarios:

- User chooses how much money in their currency they want to transfer - example: User has an account in USD and wants to send 100 USD to a friend. User does not know if the friend has an account in USD, EUR or PLN. He/she does not care.

- A. In such a case there is no problem if Sender and Receiver, Acquirer and Issuer have an account in the same currency as available settlement accounts of Acquirer. Transactions will be processed and settled in the same currency through the chain. This almost always applies for USD, EUR transactions.

- B. If Sender has an account in USD, Acquirer has a settlement currency in USD, Issuer has a settlement currency in EUR, Receiver has a card account in EUR, there will be currency conversion that will happen on Receiver's side. His/her bank (card issuer) will convert the incoming USD to EUR and charge currency conversion fees.

- C. If Sender has an account in CZK, but Acquirer does not have a settlement currency in CZK, but only USD and Receiver has an account in USD, there will be conversion happening on Sender's (acquirer) side. The sending institution will convert 1000 CZK of User to USD, will charge currency conversion fees and Receiver will receive USD after conversion. Receiver's bank will not get any currency conversion fees.

- User chooses currency of Receiver - Example: User has an account in USD but needs to pay 100 EUR to Receiver because he/she knows that Receiver wants to get 100 EUR.

- D. It is possible to recognise the settlement currency of Receiver thanks to BIN tables shared through payment schemes. Thanks to it Sender will know that Receiver's card is issued in USD, so only USD will be allowed for this transaction. In such a case currency conversion will always happen on Sender's side. In case User has an account with EUR, their Acquirer (Originating Institution) will convert 100 EUR to USD and will initiate a transaction in USD. In case User account is in a different currency than the settlement account of Acquirer, additional currency conversion fees will apply and will be charged by Acquirer.

- User does not have a choice - in such a case we offer only a payment in currency defined by the payment provider, for example always the same currency as the User account.

- E. In such a case User can send only one currency. Usually the same as his/her account currency. If User's account currency is the same as the settlement account of Acquirer, the transaction will be processed as in point 1B, which means that currency conversion can happen on Receiver's side if Receiver's card currency is different from the settlement currency.

- F. In case User can send money in the currency which is not the settlement account of Acquirer in, some additional conversion fees will apply on Acquirer's side (like in scenario 1C).

It may look complicated, but if you look at it from the point of view of currency conversion points (5 places where conversion can happen) it is easier to understand.

Our recommendation is to use Scenario 1 and focus on implementing Scenario 1A (we can enable currencies which will be the most popular for your payment corridors). In some cases our partners use Scenario 2. It is important that calculation of commissions and spread is always dynamic, so Sender knows in advance the cost of these transactions.

I hope this article can help you understand currency conversion details. Thank you for reading.