Cashback - Boost Customer Loyalty and Spending

In today's competitive financial landscape, cashback has emerged as a game-changing strategy for businesses looking to attract and retain customers. But what exactly is cashback, and why should your company consider implementing it? Let's dive into the world of cashback and explore its benefits and versatile applications.

Why Should We Use Cashback?

Cashback is more than just a perk – it's a powerful tool that can transform your business. Here's why:

- Enhance Customer Loyalty: By offering a percentage of money back on purchases, you create a compelling reason for customers to choose your service over competitors. This incentive encourages repeat business and fosters long-term relationships.

- Boost Customer Spending: The prospect of earning cashback motivates customers to spend more. It's a win-win situation: customers feel they're getting more value, while your business sees increased revenue.

- Gain a Competitive Edge: In a crowded marketplace, cashback can be the differentiator that sets your product apart. It's an attractive benefit that can sway potential customers in your favor.

- Real-Time Gratification: With immediate calculation and allocation of cashback after transactions, customers experience instant rewards, reinforcing positive associations with your brand.

- Flexible and Customizable: Cashback programs can be tailored to suit your business model and customer preferences, allowing for targeted promotions and strategic incentives.

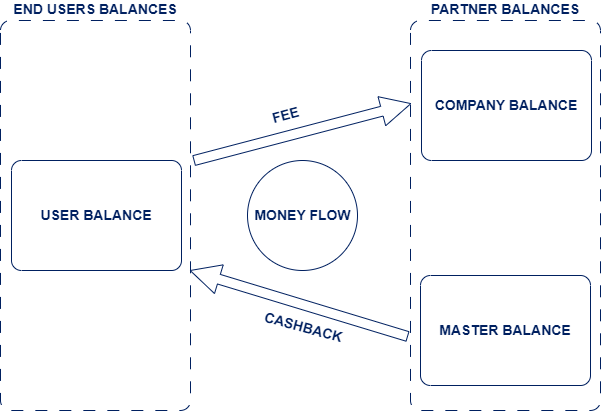

Cashback & fees money flow

Cashback is an internal transaction for a partner who wants to top up the user's balance as part of the loyalty program.

Our card & balances management system (Antaca) automatically debits the masterbalance with this transaction.

Cashback Rules: How to Maximize Your Rewards

The true power of cashback lies in its flexibility. Here are some innovative rules and use cases you can implement:

- Percentage-Based Rewards: Offer a consistent cashback percentage on all purchases (flat rate), such as 0.5% cashback on every transaction. Alternatively, implement tiered rates to reward bigger spenders, like 0.2% for transactions up to $100, and 0.5% for transactions over $100.

- Fixed Amount Rewards: Provide a fixed cashback amount for each qualifying transaction, regardless of the purchase amount. You can also offer different fixed cashback amounts based on transaction value ranges.

- Merchant-Specific Cashback: Boost partnerships by offering higher cashback rates for specific merchants. For example, 2% cashback on purchases from your partner stores.

- Category-Based Rewards: Encourage spending in particular sectors by offering higher cashback rates for specific transaction categories. For instance, 3% cashback on all bookstore purchases (MCC code 5942).

- Payment Method Incentives: Promote certain payment methods by offering higher cashback rates. For example, 0.5% extra cashback for transactions made with Samsung Pay.

- Geographical Targeting: Encourage local or international spending with location-based cashback rules. Offer 1% cashback on all transactions made within the EU.

- Currency-Specific Rewards: Incentivize transactions in specific currencies, such as offering 0.75% cashback on all USD transactions.

- Time-Limited Promotions: Create urgency with limited-time cashback offers. For example, double cashback rates during holiday shopping seasons.

- Cumulative Rewards: Reward loyal customers with increasing cashback rates based on their total spend over time. For instance, unlock 1% cashback after $1000 in total purchases.

Cumulative Rewards feature needs implementation.

How to implement cashback?

Please feel free to contact us and we will setup various cashback rules on Verestro platform for you.

Please make sure you build your cashback network with partners, merchants etc.

It is not part of our responsibilities at the moment.