Payment service providers as eCommerce payment aggregators

In the digital age, where online shopping has become everyday life for millions of consumers around the world, eCommerce payments play a key role in shaping the shopping experience. Convenience and security are factors that influence purchasing decisions, and technological innovations make the payment process more and more complex and diverse.

ECommerce payment - what is it?

ECommerce payments are financial transactions carried out over the Internet that allow users to purchase for their shopping online. They include various payment methods such as:

- Credit and debit cards - the most popular payment method. It involves providing your payment card (e.g. Visa or Mastercard) details in the payment form issued by the payment gateway.

- Electronic wallets - services such as Apple Pay or Google Pay where card tokens generated for a specific card are returned to make a payment.

- Open banking - direct transfers from your bank account.

- Crypto - an increasingly popular method, although less common. This is a way of making transactions in which digital currencies based on blockchain technology are used instead of traditional fiat currency (such as dollars, euros or zlotys), e.g. Bitcoin, Ethereum, Litecoin or Ripple

ECommerce payments place a strong emphasis on security and convenience to meet the needs of both sellers and consumers. Additionally, they often involve various security systems, such as SSL, to protect users' personal and financial information and to

prevent them from frauds.

As this field develops, more and more eCommerce payment methods are being created, and therefore there is a need for entities to aggregate available payment options in one place and allow them to manage sensitive card data in the name of the merchants that are not PCI DSS compliant. Such an entity is the Verestro Paytool, a payment gateway and a payment service provider that supports above mentioned payment methods such as credit and debit cards, payment with Google Pay and Apple Pay wallets and payment using the BLIK code.

How does it work?

- Selection of goods or services

- The customer selects the products or services he or she wants to buy and adds them to a shopping cart on the online store's website.

- Moving to checkout

- After completing the purchase, the customer goes to the “checkout” section, where he or she enters his/her contact information, shipping address and chooses a payment method.

- Choosing a payment method

- Online stores offer various payment methods, such as: Credit or debit card payments (Visa, Mastercard, etc.).

- Credit and debit cards - the most popular payment method. It involves providing your payment card details in the payment form issued by the payment gateway.

- Electronic wallets - services such as Apple Pay or Google Pay where card tokens generated for a specific card are returned to make a payment.

- Open banking - direct transfers from your bank account.

- Crypto - an increasingly popular method, although less common.

- Online stores offer various payment methods, such as: Credit or debit card payments (Visa, Mastercard, etc.).

- Payment authorization

- Depending on the payment method selected, the authorization process can be carried out in different ways:

- Card payment: the customer enters the card data (number, expiration date, CVV code) and approves the transaction. The payment system (e.g. Stripe, PayPal) then sends the data to the bank for authorization.

- Online transfer: the system redirects the customer to his/her bank's website, where he/she logs into his/her account and approves the transfer.

- Electronic wallet: after selecting a payment method, the customer logs into his/her wallet (e.g. PayPal), where he/she approves the payment.

- Depending on the payment method selected, the authorization process can be carried out in different ways:

- Transaction security

- Transactions are usually secured with encryption protocols, such as SSL (Secure Socket Layer), to prevent third parties from intercepting payment data.

- In addition, some payment methods (such as card payments) require identity verification, such as 3D Secure, which is an additional verification step (such as an SMS code or approval in a bank app).

- Transfer of funds

- After a successful payment, the funds are transferred to the seller's account. Transaction processing time may vary depending on the payment method selected.

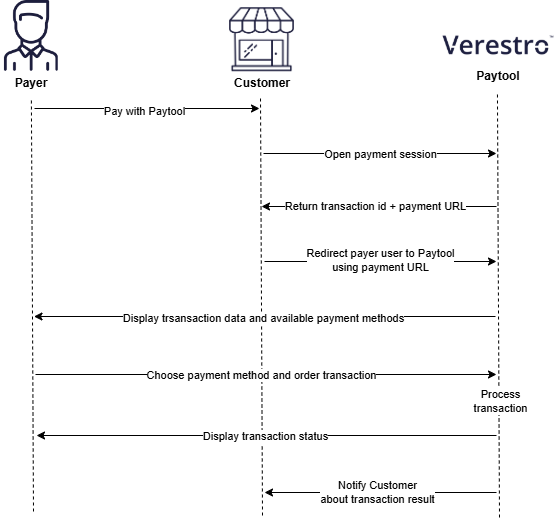

ECommerce payment flow using the Paytool payment service provider

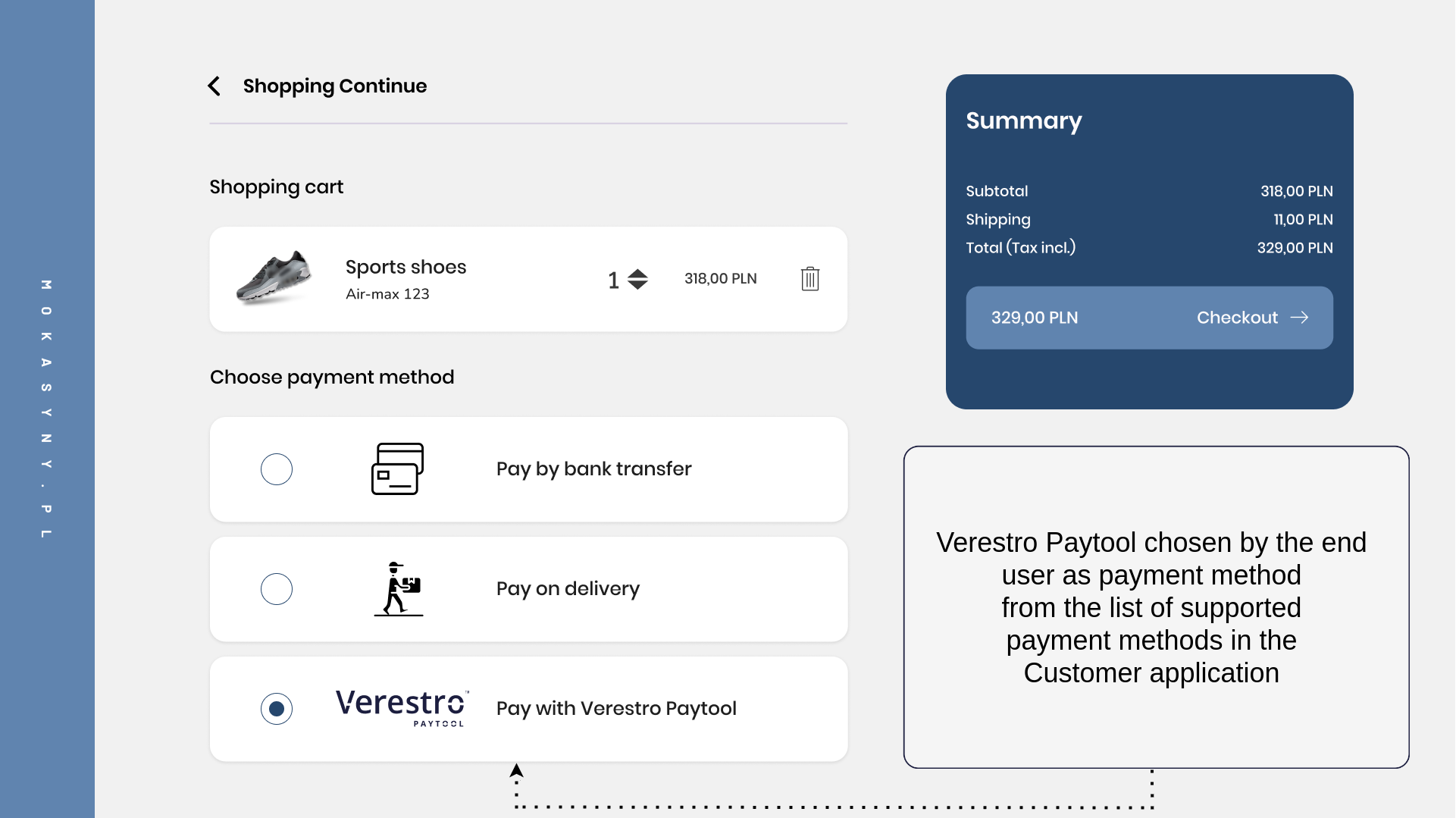

The first step of each transaction always takes place in a merchant's application. Such an application is usually integrated with the various payment gateways (payment service providers) such as the Verestro Paytool. Choosing to pay using a particular payment service provider redirects the payer to the PSP's web view, where all payment methods offered by the PSP are listed. The view of such a use case from the end user's perspective has been shown below.

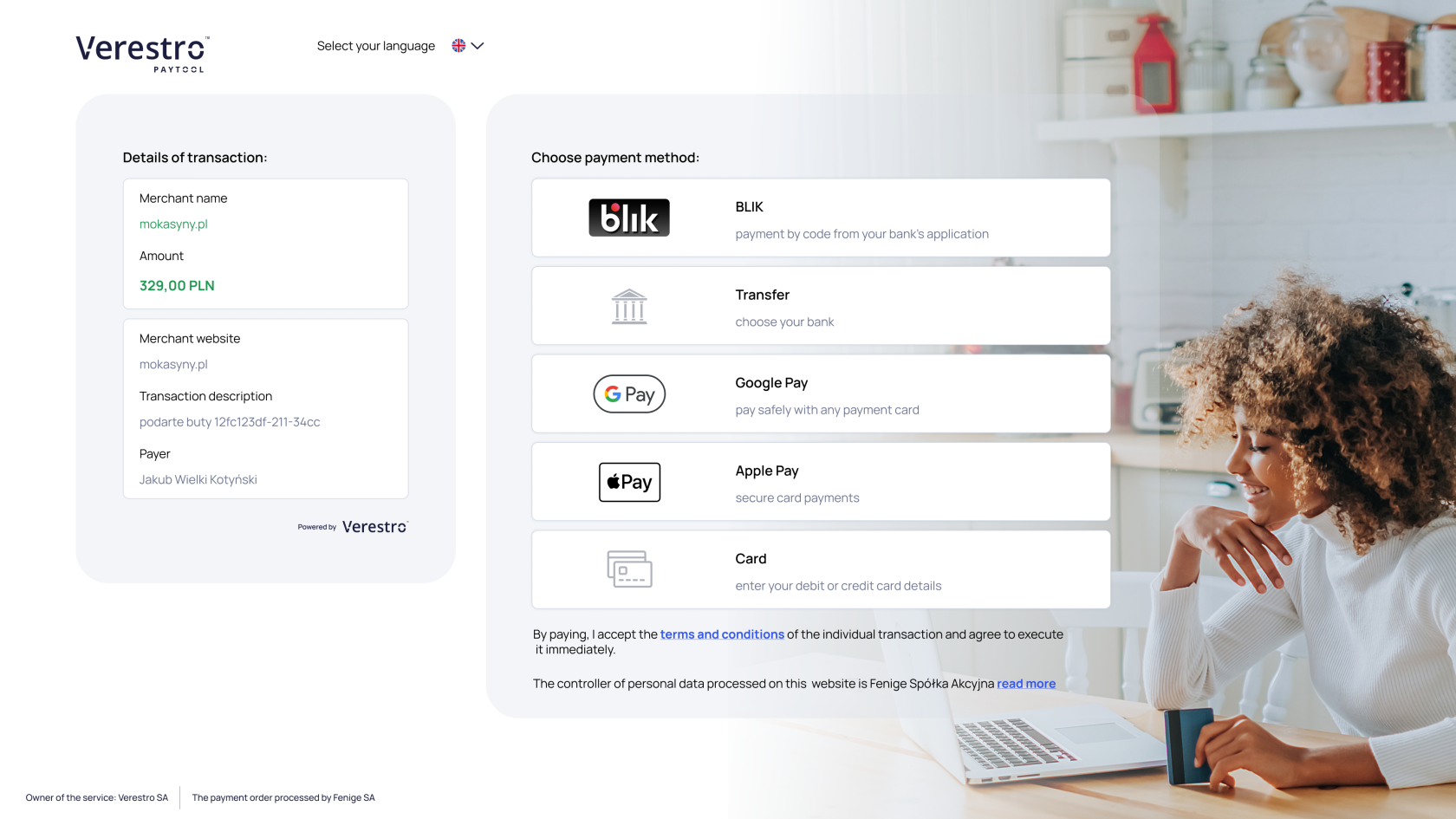

At the level of the view of the list with all available payment methods, the payment service provider - in this case the Verestro Paytool - is already responsible for the entire transaction. Regardless of which eCommerce payment method the payer chooses, the payment service provider must enable the payer to write out the card data or retrieve it from the mobile wallet (e.g. Google Pay, Apple Pay or Click to Pay), check the correctness of the data, perform payer and their card authentication (e.g. 3D Secure) or finally perform the transaction itself and inform the merchant and the payer about transaction final status.

How to integrate with the Verestro Paytool?

Leverage our quick and easy integration! Here you'll find instructions on how to integrate the Verestro Paytool solution: How to integrate | Verestro Developer Zone. Before using this solution, you must complete the onboarding process and create an account in the Verestro Paytool system.

If you are interested in Verestro's payment gateway, visit our website and contact us.