Finance Administration Panel Overview

The Finance Administration Panel is the essential tool for you to work with your online application. Here you can manage balances for both corporations and endusers and generate virtual cards also. The presented solution is prepared for rebranding for the client's brand. The document is divided into sections that describe the various components of the system. Each section contains a screen presenting the functionality and a detailed description of the states occurring in it.

Purpose and scope

This product guide provides a high-level overview of Admin Panel Finance section. This document covers the following topics:

-

managing End-user Balance,

-

managing Master balances,

- managing Company balances,

-

transaction clearing,

-

partner accounting,

- AML user lock

- privileges per role.

Terminology

This section explains a number of key terms and concepts used in this document.

|

Name |

Description |

| Customer, Partner |

Customer who uses MPA. |

|

Operator |

User using the Admin Panel. |

|

BIN Sponsor |

Financial institution holding a direct license from card networks (e.g., Visa, Mastercard). The BIN Sponsor provides its Bank Identification Number (BIN) and acts as the formal guarantor responsible for the regulatory and legal compliance of transactions processed by its Client. |

|

Balance |

Representation of funding collection in specific currency. |

|

Session token |

Access to the system by a web application user is secured using a session token to uniquely associate the session with the user. It is required to perform any action. |

|

IBAN |

International Bank Account Number |

|

AML |

Anti-Money Laundering |

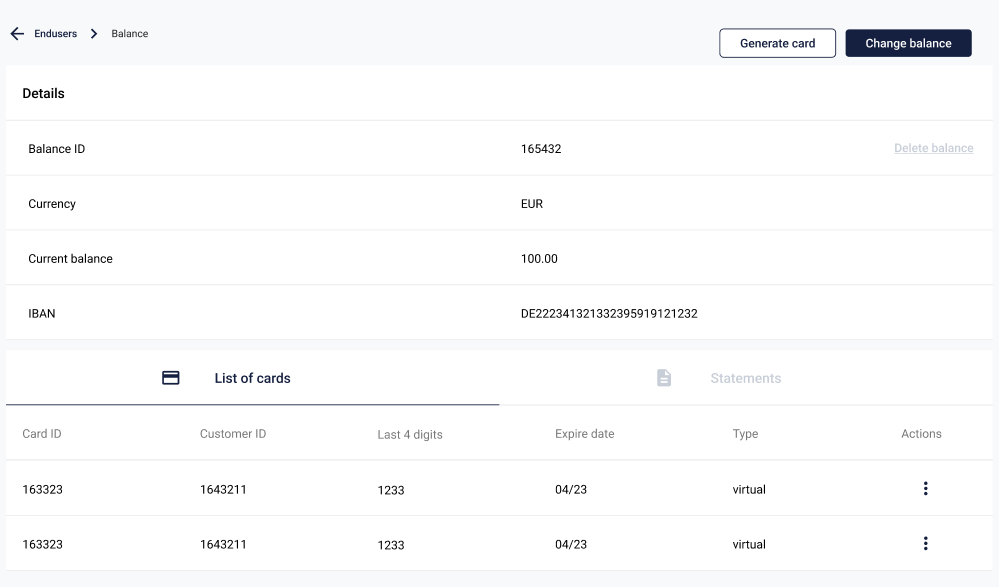

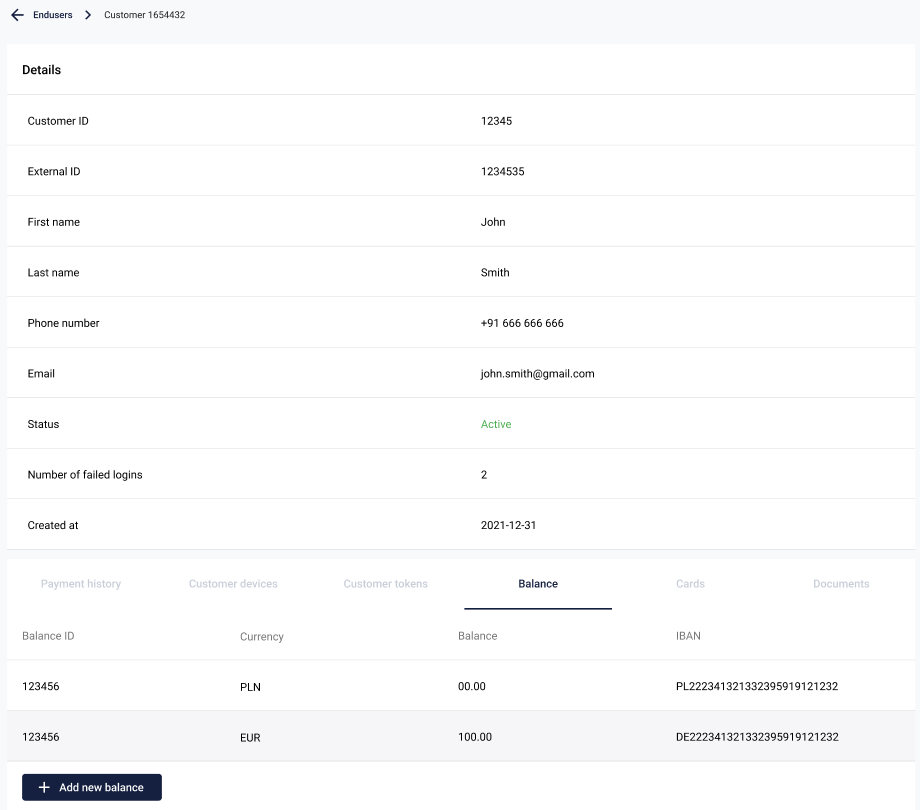

Customer Balance

Customer balances can be managed from end-user detail view, in "Balances" section. (Customers tab -> Endusers tab -> Enduser details -> Balances section).

Balance view provides the following key information for each entry:

|

Parameter |

Description |

|

Balance ID |

Unique balance ID. |

| Currency |

Currency for given balance in ISO 4217 format. |

| Balance |

Amount of funds available on the balance. |

| IBAN |

IBAN for the given balance. By default, it is hidden for security reasons and can be viewed by clicking the 'Reveal' button. This functionality is available only if IBANs are within the scope of the project.

|

Add new balance

Operator can create new balances with Add new balance button. After clicking it, operator should choose currency for new balance from dropdown list. Newly created balance is visible on Balances list right away.

Balances can be created for any currency. However cards can be created only for currency compliant with end-user balance currency and currency configured in terminal for given project.

Balance detail view

Balance detail view can be entered by click on a row in Balance table, described above.

The page is divided into four distinct sections:

1. Details

Contains: Balance ID, Balance Currency and Current Balance.

2. List of IBANs

Contains all IBAN information: IBAN ID, Created date, Currency, IBAN, Status.

3. List of cards

Contains all cards assigned to given balance along with informations: Card ID, Activation date, Expiration date, Type and Processor ID.

4. Statements

A list of statements generated for the given balance. These statements can be automatically generated and added on a monthly basis.

Generate card

This functionality enables the Operator to create a virtual card. Upon clicking Generate card, a pop-up displays a list of terminals configured for the project.

The Operator must select a terminal with a currency that corresponds to the end-user's balance currency. The newly generated virtual card is verified immediately.

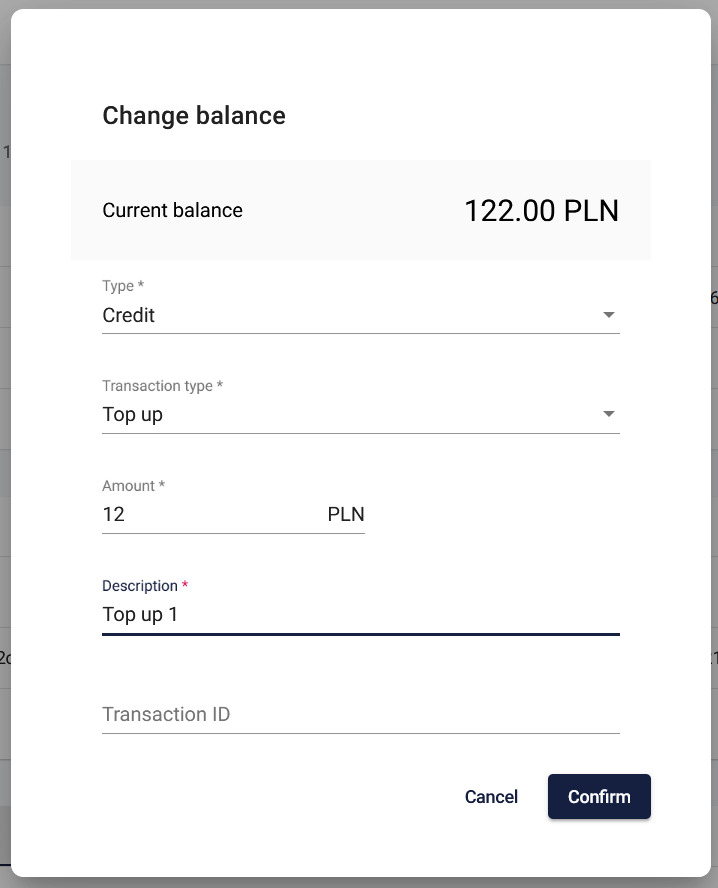

Change balance

Operator with Admin role can change end-user balance using Change balance button.

- Select Type:

a) Credit - A transaction crediting the balance

b) Debit - A transaction debiting the balance - Select Transaction type (described in the table below).

- Enter Transaction amount.

- Enter Transaction description.

- Enter Transaction ID - optional parameter.

- Click

Confirm.

The balance is updated immediately.

|

Type |

Transaction type |

Description |

|

Credit |

Cashback |

Internal transaction for a Partner who wants to top up the user's balance as part of the loyalty program. Antaca automatically debits the credit Master balance with this transaction. |

| Loan |

Internal transaction for a Partner who want to top up end user's balance as part of the credit agreement. Antaca automatically debits the credit Master Balance with this transaction. |

|

| Payment |

Internal transaction type used to top up the user's balance. This type indicates that the funds come from the Antaca system, usually in conjunction with a funding type a debit transaction on the user's balance. Antaca automatically debits the credit Master balance with this transaction. |

|

| Top up |

Internal transaction type used to top up end user balance. This type indicates that the funds come from outside the Antaca system, e.g. payment to an account at a bank branch. Antaca automatically debits the credit Master balance with this transaction. |

|

|

Debit |

Commission |

Internal transaction for a partner who wants to debit user balance as a commission referenced to the other transaction. |

| Fee |

Internal transaction for a partner who wants to debit user balance as a fee. Antaca automatically credits Company balance with the funds debited from end user balance. |

|

| Funding |

Internal transaction type used to debit the user's balance. This type indicates that the funds still remain in the Antaca system, usually in conjunction with a credit type transaction on the user's balance. Antaca automatically credits the credit Master Balance with this transaction. |

|

| Withdrawal |

Internal transaction type used to debit end user balance. This type indicates that the funds go outside of Antaca system, e.g. withdrawal from an account at a bank branch. |

Delete balance

Delete balance option is available only for balances equal to 0.00 and all transactions are cleared. Deleted balance is no longer visible in the End-user's Balances tab. All cards assigned to deleted balance are deleted as well.

Operator with Admin or Manager role can delete end-user balance on balance detail view.

Master balance

The Master Balance tab allows for the management of the Master Balance account and provides visibility into all transactions that have been executed on that balance.

1. Deposits - includes a list of Master Balances created for Partner with amount of funds and currency.

2. Filters - allow searching for transactions specific for given time frame, type (credit or debit), amount and transaction title.

3. List of transactions - list of transactions generated for selected Master Balance.

List includes following information:

|

Parameter |

Description |

|

Transaction date |

Transaction date in YYYY-MM-DD format and 24 hour format (UTC+0). |

| Title |

Description of the transaction. |

| Amount |

Amount of transaction with currency code. |

| Type |

Type of transaction. Available values "Debit" and "Credit". |

Change balance

To generate a transaction on the Master Balance, the Operator should perform the following actions:

1. Select proper Master balance.

2. Select "Change balance" button.

3. Select transaction type.

4. Enter transaction amount.

5. Enter transaction description.

6. Add transaction ID (optional).

7. Click "Confirm".

This action results in a change to the Master Balance and the immediate saving of a transaction in the "List of transactions" table. These transactions are recorded instantly with the status CLEARED.

Only the BIN Sponsor is authorized to modify the state of the Master Balance.

Generate report

Additionally, this screen allows for the generation of a transaction report based on the applied filters.

The report includes the following data fields:

|

Parameter |

Description |

| ID |

Unique ID of the transaction. |

| External ID |

An identifier from an external system linked to this transaction. |

| EventType |

Indicates the type of event that triggered the transaction. Available values: Credit, Debit. |

| Type |

Transaction type. |

| TransactionDate |

The date and time when the transaction was initiated. |

| Amount |

The original value of the transaction before any adjustments or reversals (minor value). |

| AdjustmentAmount |

The amount added or subtracted due to a correction or modification of the original transaction. This value is typically 0 for Master Balance transactions. |

| ReversalAmount |

The amount related to the cancellation or partial-reversal a previously posted transaction. This value is typically 0 for Master Balance transactions. |

| Finalamount |

The final amount calculated after considering the original amount, adjustments, and reversals. |

| Currency |

The three-letter ISO 4217 code of the currency used for the transaction amount (e.g., PLN, USD). |

| Description |

Description of the transaction. |

| Status |

The current processing status of the transaction. This value is typically |

| ReferenceTransactionId |

The ID of another transaction related to this transaction. |

| AccountingBalance |

The balance of the company account after this transaction was cleared. |

| ClearedAt |

The date and time when the transaction was finally settled (cleared). |

| TerminalId |

The ID of the card terminal that processed the transaction associated with this record. |

The maximum time range allowable for generating reports is 3 months.

Balance statistics

The Balance Statistics page provides crucial information regarding the necessary capital a Partner must maintain in their bank account to ensure money liquidity for their project. It aggregates the totals of end users' balances and the Partner's own balances for a selected currency.

On this screen, you can choose the currency you are interested in. After selection, the page shows the current values for:

|

Parameter |

Description |

|

Total user balance |

The aggregate funds across all end-user balances. |

| Total company balance |

The total amount held in the company balance. |

| Total deposit Master balance |

The total amount held in the deposit Master balance. Is applicable only if the Partner has the deposit Master Balance enabled. |

| Total credit Master balance |

The total amount held in the credit Master balance. Is applicable only if the Partner has the credit Master Balance enabled. |

| Bank Account |

The sum of the Total User Balance, Total Company Balance, and Total Master Balance. |

Manual clearings

The Manual Clearings page displays all transactions registered in Antaca as well as settlements generated within the payment network. The Manual Clearings feature enables the BIN Sponsor to clear transactions that were not processed automatically.

Page is divided into two sections:

1. Transactions

Operator can filter transactions using following filters:

- Date from,

- Date to,

- Terminal,

- Transaction ID,

- Customer ID,

- Card ID,

- Type,

- Status

The main list provides the following information about the transactions:

|

Parameter |

Description |

|

Transaction ID |

An identifier from an external system linked to this transaction. |

| Description |

Description of the transaction. |

| Card ID |

The unique, internal numerical identifier assigned to the card (integer). |

| Type |

Type of transaction. |

| Final amount |

The final amount calculated after considering the original amount, adjustments, and reversals (gross value). |

| Transaction date |

Transaction date in YYYY-MM-DD format and 24 hour format (UTC+0). |

| Status |

The current processing status of the transaction. Available values:

|

Clicking on a transaction record opens a popup window displaying the detailed transaction information:

|

Parameter |

Description |

|

Transaction ID |

Unique ID of the transaction. |

|

Transaction External ID |

An identifier from an external system linked to this transaction. |

| Amount |

The original value of the transaction before any adjustments or reversals (gross value). |

| Currency |

The three-letter ISO 4217 code of the currency used for the transaction amount (e.g., PLN, USD). |

| Adjustment amount |

The amount added or subtracted due to a correction or modification of the original transaction. |

| Reversal amount |

The amount related to the cancellation or partial-reversal a previously posted transaction. |

|

Related transactions |

A list of transactional events (e.g., authorizations, settlements, reversals, adjustments) that influenced to the final state and amount of the current transaction record. |

2. Settlements

Operator can filter settlements using following filters:

- Date from,

- Date to,

- Terminal,

- Transaction ID,

- Customer ID,

- Card ID,

- Status,

- Processed.

The main list provides the following information about the settlements:

|

Parametr |

Description |

|

Transaction ID |

An identifier from an external system linked to this transaction. |

| Description |

Transaction description. |

| Card ID |

The unique, internal numerical identifier assigned to the card (integer). |

| Amount |

The final, confirmed amount transferred during the clearing process. |

| Transaction date |

Transaction date in YYYY-MM-DD format and 24 hour format (UTC+0). |

| Processed at |

Settlement clearing date in YYYY-MM-DD format and 24 hour format (UTC+0). |

Clicking on a settlement record opens a popup window displaying the detailed information:

|

Parameter |

Description |

|

Currency |

The three-letter ISO 4217 code of the currency used for the transaction amount (e.g., PLN, USD). |

| Type |

describes the transaction type, such as:

|

| Settlement amount |

Settlement amount of the transaction. |

| Transaction narrative |

The merchant’s description. |

| System date |

Issuer processor's system date. |

|

Sequence number |

Unique sequence card identifier from the Issuer processor. |

|

Tracking number |

Unique tracking identifier from the Issuer processor. |

|

Interchange amount |

Cost or income generated as a result of settlement previously authorized transactions. |

Download settlement

Download settlement option allows for the re-initiation of the settlement file download for a specific day and terminal, in cases where the automatic download failed for any reason.

Reverse transaction

It is possible to reverse a transaction that remains in the AUTHORIZED status (not CLEARED or REVERSED).

-

Select the relevant transaction on the list.

-

Choose the "Clear transaction" option.

-

Enter the amount to be reversed.

Possible results:

-

Partial Reversal - If the amount entered is lower than the authorized transaction amount, a partial reversal should be generated.

-

Full Reversal - If the amount entered is equal to the authorized transaction amount, the entire transaction is reversed, and its status changes to

REVERSED. -

Error - If the amount entered is higher than the authorized transaction amount, an error should be returned indicating this discrepancy.

Clear transactions

To clear transactions, the Operator should perform the following actions:

-

Select one or more transactions to be cleared.

-

Select the settlement to be linked with the transactions chosen in step 1 (this step is optional).

-

Click the Clear transactions button at the top right of the page.

Following this process:

-

-

The status of the selected transactions is changed to

CLEARED. -

The settlement chosen in step 2 (if selected) will have its

Processed atparameter set to the date of the clearing action. -

The corresponding

INTERCHANGEtransaction will be generated.

-

Manual clearings tab is only available to the BIN Sponsor.

Partner accounting

The Partner Accounting page was designed to present information regarding the Partner's profit for a given project. It contains a list of transactions, such as fees, interchange, FX conversion and transactions generated manually by the BIN Sponsor.

The page is divided into 3 sections:

1. Company balance - list of Partner balances with balanceId and specific currency.

2. Filters - allow searching for transactions specific for given time frame and type of transaction (credit or debit).

3. List of transactions

|

Parametr |

Description |

|

Transaction date |

Transaction date in YYYY-MM-DD format and 24 hour format (UTC+0). |

| Title |

Transaction description. |

| Amount |

Transaction gross value with currency. |

| Type |

Transaction type. Available values: Credit, Debit. |

| Subtype |

Detailed transaction classification Examples:

|

| Terminal ID |

The ID of the card terminal that processed the transaction associated with this record. |

Generate a transaction

To generate a transaction and modify the Company balance, the Operator should perform the following actions:

- Select proper company balance.

2. Select 'Generate a transaction' button.

3. Select transaction type.

4. Enter transaction amount.

5. Enter transaction description.

6. Add transaction ID (optional).

7. Click 'Confirm'. - The transaction will be processed with a subType of

COMPANY.

The 'Generate a transaction' action can only be performed by the BIN Sponsor.

Generate a report

Additionally, this screen allows for the generation of a transaction report based on the applied filters.

The report includes the following data fields:

|

Parameter |

Description |

| ID |

Unique ID of the transaction. |

| External ID |

An identifier from an external system linked to this transaction. |

| EventType |

Indicates the type of event that triggered the transaction. Available values: Credit, Debit. |

| Type |

Transaction type. |

| TransactionDate |

The date and time when the transaction was initiated. |

| Amount |

The original value of the transaction before any adjustments or reversals (minor value). |

| AdjustmentAmount |

The amount added or subtracted due to a correction or modification of the original transaction. This value is typically 0 for Company Balance transactions. |

| ReversalAmount |

The amount related to the cancellation or partial-reversal a previously posted transaction. This value is typically 0 for Company Balance transactions. |

| Finalamount |

The final amount calculated after considering the original amount, adjustments, and reversals. |

| Currency |

The three-letter ISO 4217 code of the currency used for the transaction amount (e.g., PLN, USD). |

| Description |

Description of the transaction. |

| Status |

The current processing status of the transaction. This value is typically |

| ReferenceTransactionId |

The ID of another transaction related to this transaction. |

| AccountingBalance |

The balance of the company account after this transaction was cleared. |

| ClearedAt |

The date and time when the transaction was finally settled (cleared). |

| TerminalId |

The ID of the card terminal that processed the transaction associated with this record. |

The maximum time range allowable for generating reports is 3 months.

Operator with any role can use 'Generate report' functionality.

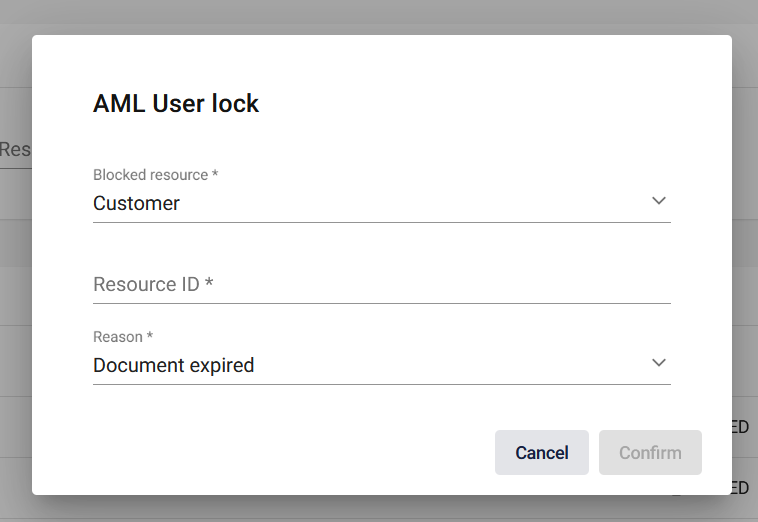

AML User lock

The AML User Lock enables an Operator with any role to lock a resource that does not comply with AML (Anti-Money Laundering) regulations. This functionality results in the transactional blockade of the resource. Any transaction being processed for the locked resource will be automatically rejected with the reason code: FRAUD_SUSPECTED.

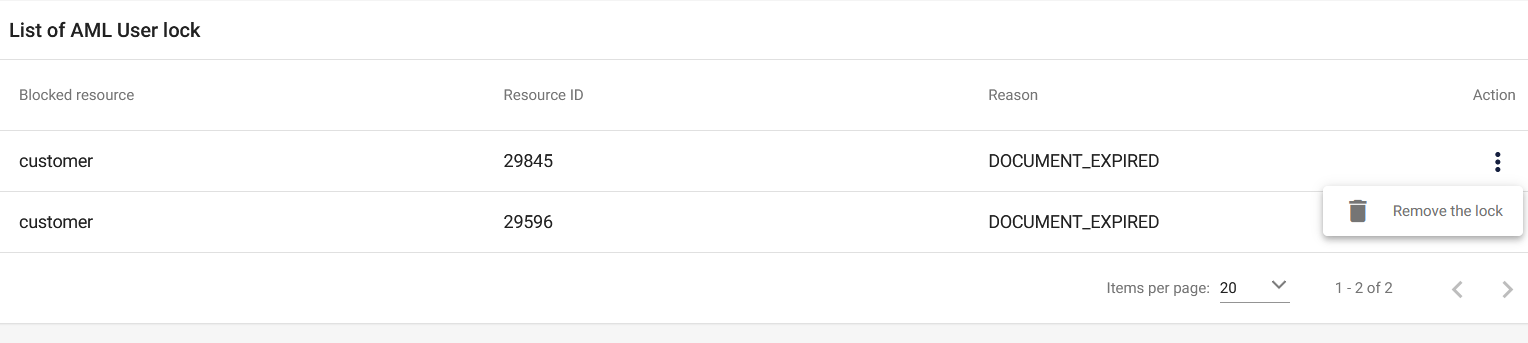

The page is divided into two main sections:

-

Filters – Allows browsing locked resources by their type (e.g., Customer), ID, and Lock reason.

-

List of locked resources – Displays the resulting list of locked entries.

|

Parameter |

Description |

| Blocked resource |

Shows blocked resource type. Available values: CUSTOMER CORPORATION |

| Resource ID |

Verestro ID for given resource. |

| Reason |

Available values: DOCUMENT EXPIRED |

| Action |

Available actions: - Remove the lock. |

Add new lock

To create a new lock, use the "New lock" button in the top right corner of the page. Clicking this button opens a popup window:

Once the Blocked resource, Resource ID, and Reason for lock are entered, the newly added lock becomes visible in the list of locked resources.

Remove the lock

To remove the lock, the Operator should click on the 'Action' menu within the lock list and select the "Remove the lock" option.

The lock will be instantly removed from the list.

The 'Remove the lock' option is available only to Operators with the Admin role.

Automatic Lock Triggers

In addition to manual creation by an Operator, locks may also be imposed by automated processes. These automated locks typically occur based on predefined system rules or risk assessments. Automated processes that can result in a lock being placed are:

- Document Expired - Applied when the documents required for the KYC (Know Your Customer) process have expired.

- Screening Detected - Applied when a customer screening reveals a match on a sanctions list.

Default privileges per role in the portal

Below are the default function settings for described product divided into areas.

|

Area |

Action |

Admin |

Manager |

Employee |

| Customer Balance |

View Company Balance |

x | x | - |

| Create Customer Balance | x | x | - | |

| View Customer Balance | x | x | x | |

| View Customer Balance Details | x | x | x | |

| Topup Customer Balance | x | - | - | |

| Delete Customer Balance | x | x | - | |

| Customer |

Delete Customer | x | x | - |

| Master Balances |

View Master Balance |

x |

x |

- |

| Edit Master Balance |

x |

- |

- |

|

| KYC |

View KYC applications |

x |

x |

- |

| Update KYC applications |

x |

x |

- |

|

| Cards |

Create virtual card |

x |

x |

x |

| View cards |

x |

x |

- |

|

| Delete cards |

x |

x |

- |

|

| Create Card Limit | x | x | x | |

| View Card Limits | x | x | x | |

| Update Card Limits | x | x | x | |

| Delete Card Limits | x | x | x | |

| Generate CVV | x | x | x | |

| Clearing | Manual clearing | x | - | - |

| Manual reversal | x | - | - | |

| Partner accounting |

View Company Balance |

x | x | - |

|

Edit Company Balance |

x | - | - | |

|

Report generating |

x | x | x | |

| AML User Lock | List of locks | x | - | - |

| Add new lock | x | - | - | |

| Remove the lock | x | - | - |