MDES administration panel

The MDES Administration Panel (or the admin portal/portal for short) is the essential tool for you to work with your online application. Here you can manage customers, their cards, IBANs, devices and track history of payments. The presented solution is prepared for rebranding for the client's brand. The document is divided into sections that describe the various components of the system. Each section contains a screen presenting the functionality and a detailed description of the states occurring in it.

Purpose and scope

This product guide provides a high-level overview of Admin Panel Management. This document covers the following topics:

-

description of the all aggregates of customer, including detailed information and possible actions,

-

description of possible configurations,

-

granting access,

-

description of main processes as: login, reset password,

-

additional and optional functionalities.

Abbreviations & Acronyms

This section explains a number of key terms and concepts used in this document.

|

Name |

Description |

| VPN |

Virtual Private Network |

| MPA |

Mobile Payment Application |

| IBAN |

International Bank Account Number |

| MCBP |

Mastercard Cloud Base Payment |

| MDES |

Mastercard Digital Enablement Services |

| LCAPI |

Lifecycle API |

Terminology

This section explains a number of key terms and concepts used in this document.

|

Name |

Description |

| Customer |

Customer who uses MPA. |

|

User |

User using the Admin Panel. |

|

Card |

Section contains information about customer PANs – physical cards added by customer manually in MPA or bank using LC API. |

|

IBAN |

Customer bank account number. MCBP enables bank account numbers to be digitized and used for payments. |

|

Token |

Payment Token in context of MCBP. Tokens are result of correct digitization. Each token has one wallet account, one card/IBAN number and one device related. |

|

Device |

Device is data aggregate related to customer. Device is entity in MDES – created during MDES registration. Each registration of customer has device on Verestro side, but each customer may have multiple MDES registrations. |

|

Payment history |

It’s possible that transaction history will be stored on Verestro wallet server for infinite time (this setting can be specified during onboarding with Mastercard). If these options are enabled, MPA can retrieve transaction history for given user and payment instrument ID. Transactions are returned in corresponding parts for better user experience. Particular transaction may appear on the list with delay – depending on integrated external components. |

|

LCAPI |

API Used for direct integration to partner. Allows to manage users, cards, etc. |

|

Session token |

Access to the system by a web application user is secured using a session token to uniquely associate the session with the user. It is required to perform any action. |

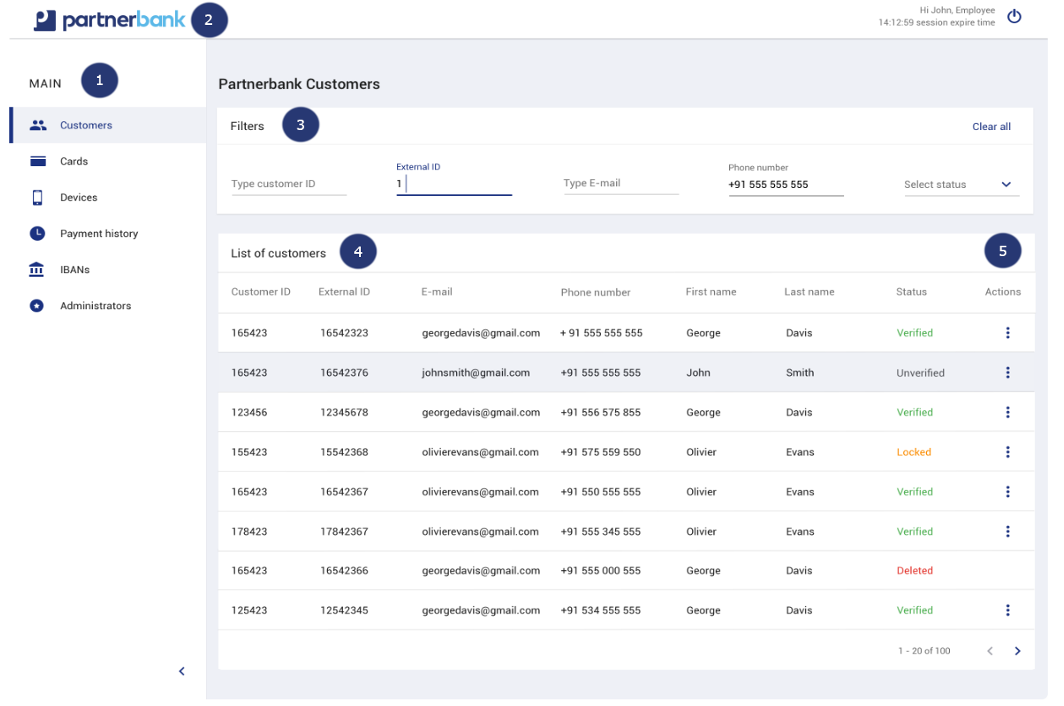

Main view

Once the authentication process is properly completed, the bank employee has access to the panel. He is shown the main screen of the system. Depending on the assigned rights group its appearance may vary. Different roles in the system have different tabs available.

The components that make up the Admin Portal are:

1) Main menu contains aggregates as: customers, cards, devices, payment history, IBANs, project administration (administrators, visuals, logs),

2) Admin Panel adjusted to the client’s colours and logotype.

3) Filters allows to select multiple filter options and display results that contain information all the selected criteria.

4) List of the most important information referring to each aggregate (example: customers).

5) Actions allows admin to change the status of aggregate or edit data.

Customers management

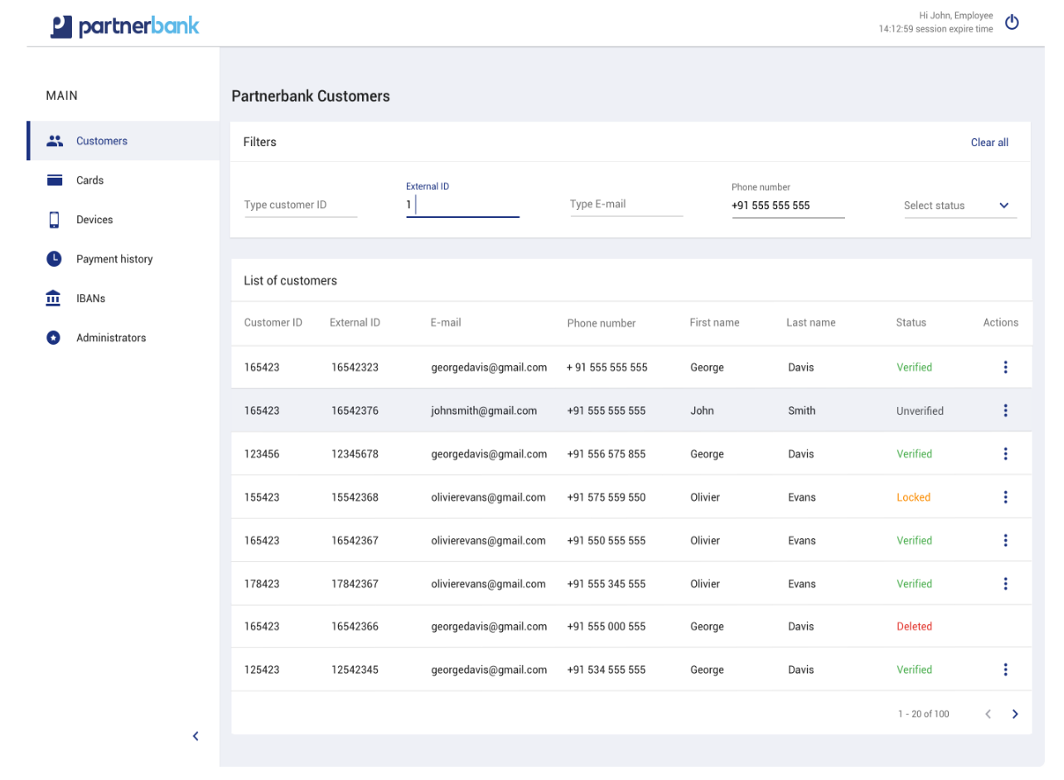

Customers list

Customer list contains filters and columns with dates. The filters are used for dynamic searching, such data as: customer ID, external ID, e-mail, phone number, status (unverified, verified, locked, deleted).

Basic list includes following information:

|

Parameter |

Description |

|

Customer ID |

Internal Verestro Id of customer. |

|

External ID |

External customer identifier provided by client (for example: recordID). |

|

|

Customer e-mail address. |

|

Phone number |

Customer phone number with country prefix. |

|

First name |

Customer first name. |

|

Last name |

Customer last name. |

|

Status |

Customer status (described in customer statuses part). |

|

Action |

Action which can be performed on particular customer (described in customer actions part). |

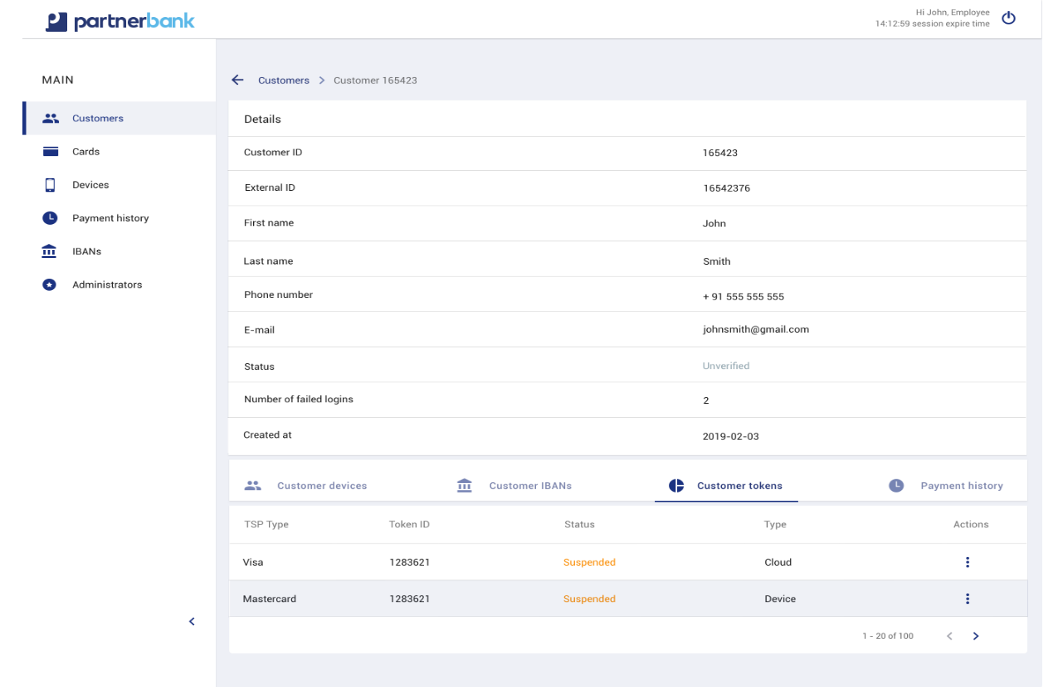

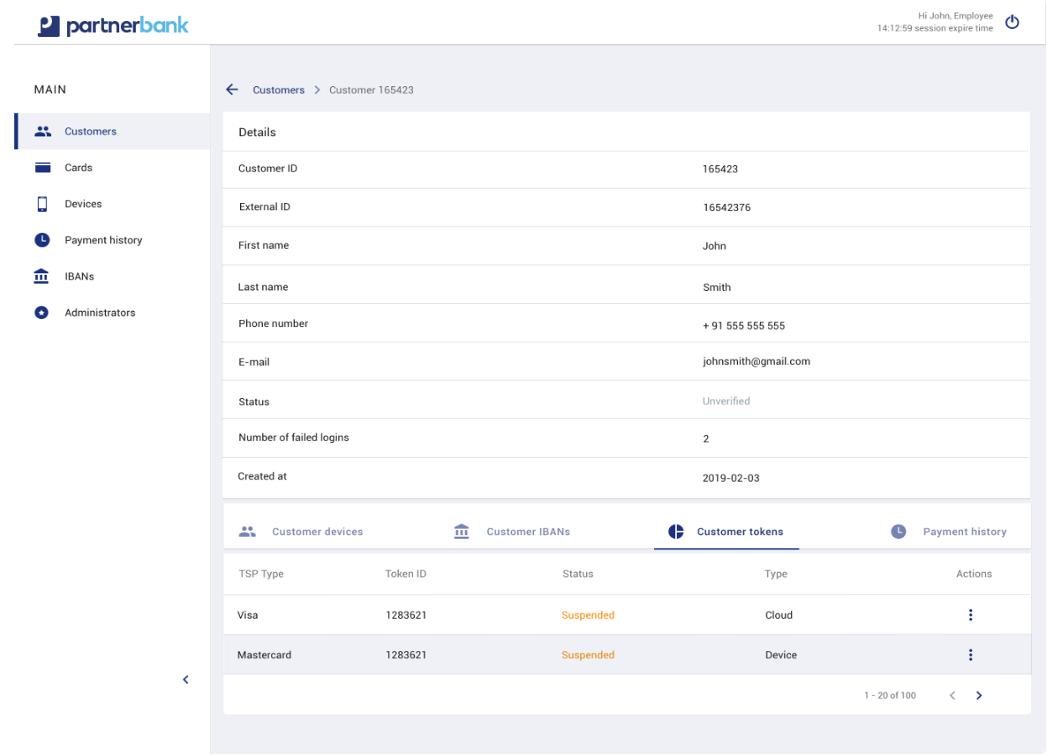

Customers details

Selecting a specific user allows to see more detailed data. In addition to personal information, a list of related devices, IBANs, tokens, and payment history is available.

Detailed list includes following information:

|

Parameter |

Description |

|

Customer ID |

Internal Verestro Id of customer. |

|

External ID |

External customer identifier provided by client (for example: record ID). |

|

First name |

Customer first name. |

|

Last name |

Customer last name. |

|

Phone number |

Customer phone number with country prefix. |

|

|

Customer e-mail address. |

|

Status |

Customer status. |

|

Number of failed logins |

Number of login failures. |

|

Created at |

Date of customer registration. |

|

Deleted at |

Date of customer deletion (parameter displayed only if customer has been removed from system). |

Additionally, in details are available lists of aggregates related to the particular customer:

• customer devices (more information in devices management),

• customer IBANs (more information in IBANs management),

• customer cards (more information in cards management),

• customer tokens (more information in tokens management),

• payment history (more information in payment history).

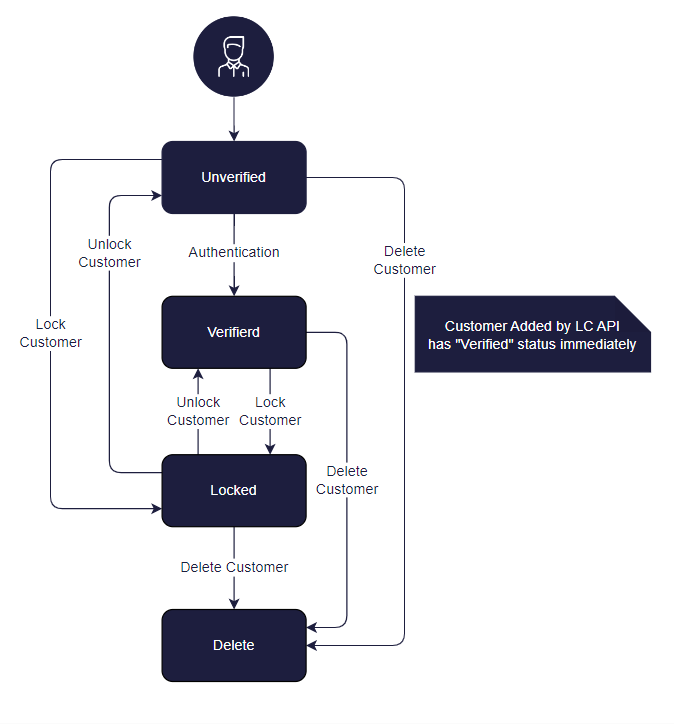

Customer statuses

A user can be defined by one of four statuses. The system created by Verestro divides the statuses into the following:

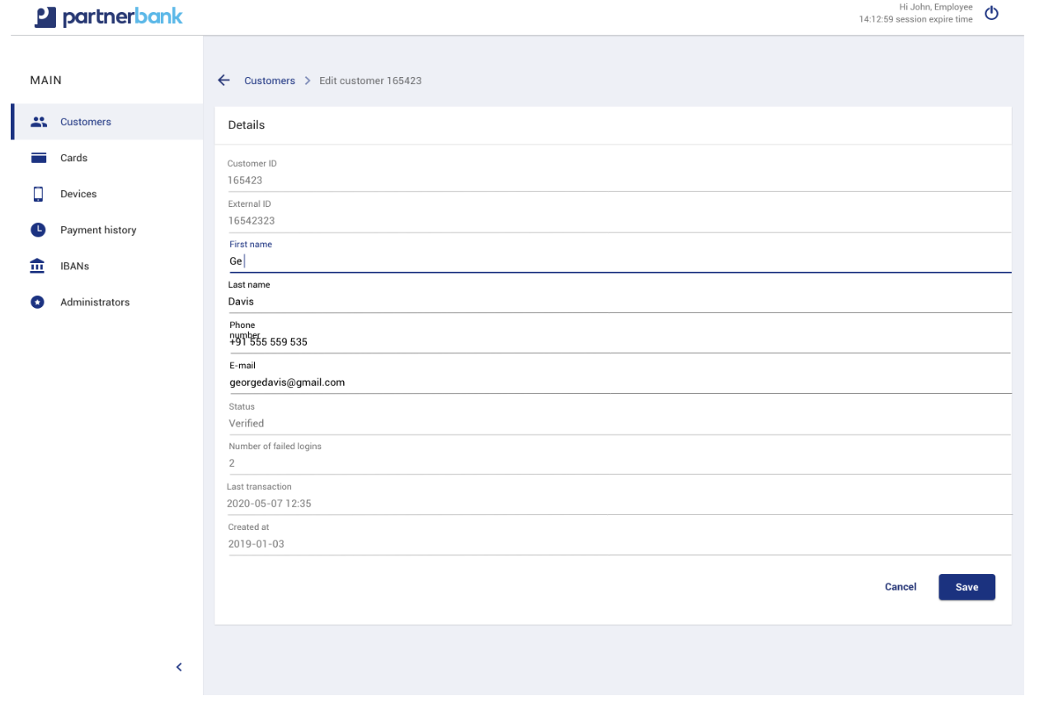

Customer actions

Admin can perform the following actions on the particular customer:

a) view customer – redirect to the screen with customer details data,

b) edit customer – redirect to the screen with edition (screen below). The following data can be edited:

• first name,

• last name,

• phone number,

• e-mail,

c) lock customer – temporary lock of customer (more information in customer statuses part),

d) delete customer – permanent delete customer data (more information in customer statuses part).

The following table shows the states of the user's token after performing each action.

|

Action |

Token status |

|

Add customer |

Unverified |

|

User authentication |

Verified |

|

Lock customer |

Locked |

|

Unlock customer |

Verified |

|

Delete customer |

Deleted |

Referring to the above table, a diagram has been created showing the change of states of the user token. This allows for better visualization of actions and dependencies between them.

Cards management

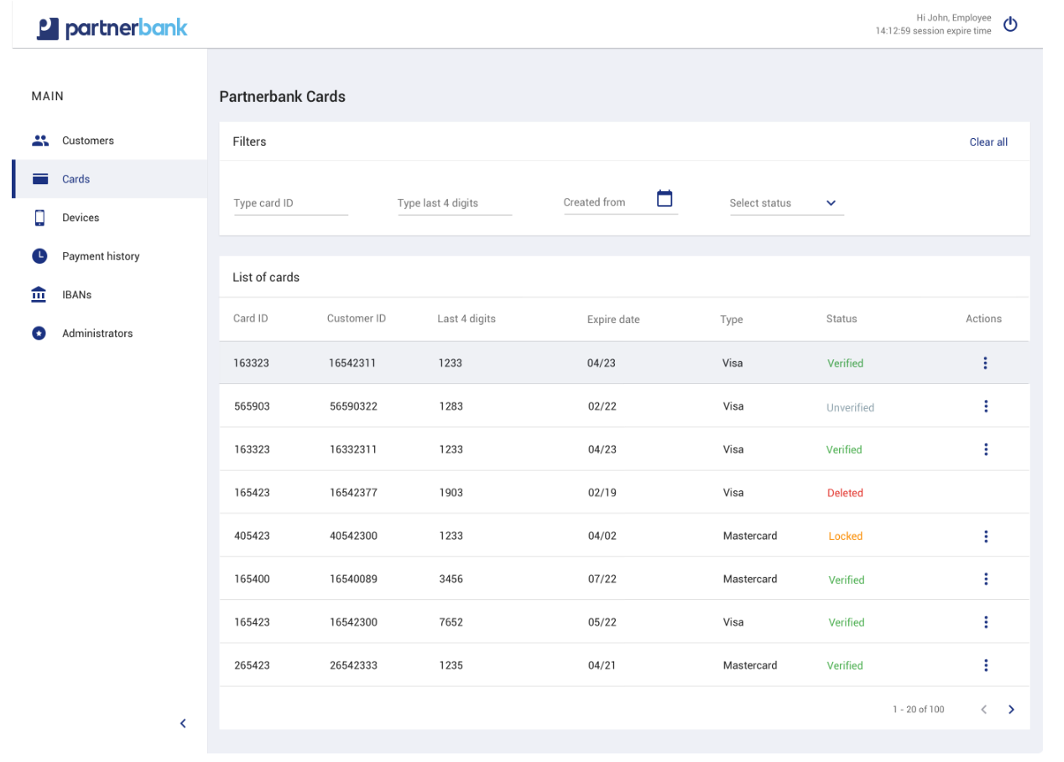

Cards list

Cards list contains filters and columns with dates. The filters are used for dynamic searching, such data as: card ID, last 4 digits, date of creation, status (available: unverified, verified, locked, deleted).

Basic list includes following information:

|

Parameter |

Description |

|

Card ID |

Internal Verestro Id of card. |

|

Customer ID |

Internal Verestro Id of customer. |

|

Last 4 digits |

Last four digits of physical PAN. |

|

Exp date |

Expiration date in MM/YY format. |

|

Type |

Card type (Mastercard, Visa). |

|

Status |

Card status (described in card statuses part). |

|

Action |

Action which can be performed on particular card (described in card actions part). |

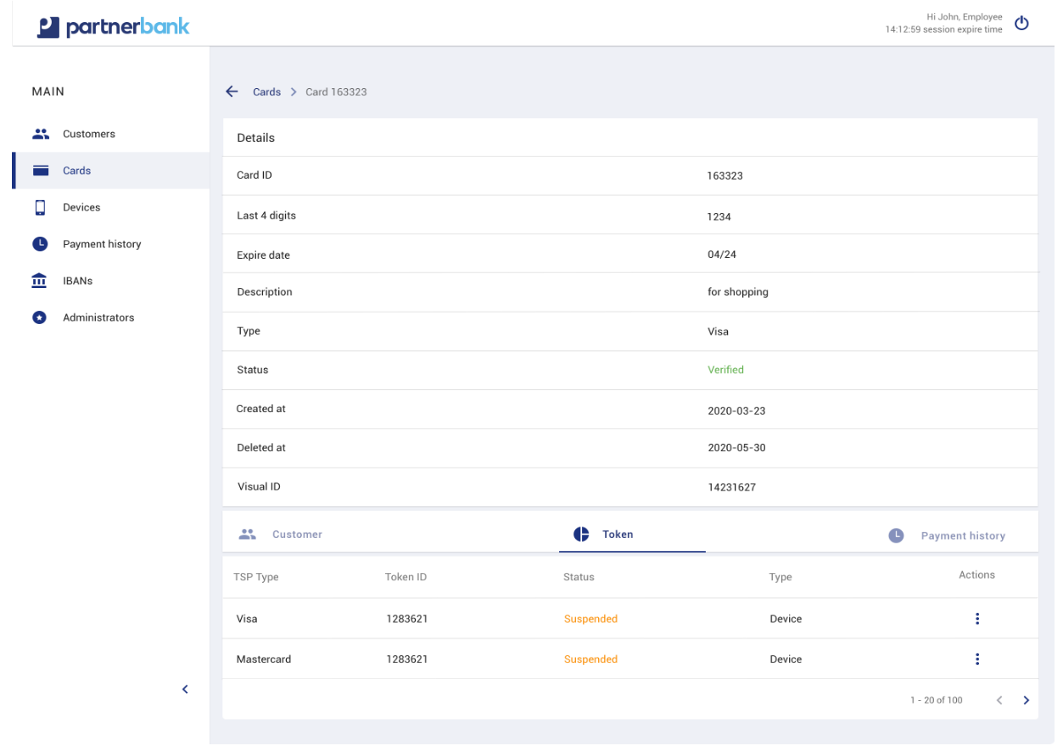

Card details

Selecting a specific card allows to see more detailed data. In addition to basic information, a list of related customers, and payment history is available.

Detailed list includes following information:

|

Parameter |

Description |

|

Card ID |

Internal Verestro Id of card. |

|

Last 4 digits |

Last four digits of physical PAN. |

|

Expire date |

Expiration date in MM/YY format. |

|

Description |

Friendly name of card. |

|

Type |

Card type (Mastercard, Visa). |

|

Status |

Card status. Available: verified, unverified, deleted, locked. |

|

Created at |

Date of card addition to the wallet database. |

|

Deleted at |

Date of card deletion from the wallet database. |

Additionally, in details are available aggregates related to the particular card:

• customers (more information in customers management),

• customer tokens (more information in tokens management),

• payment history (more information in payment history).

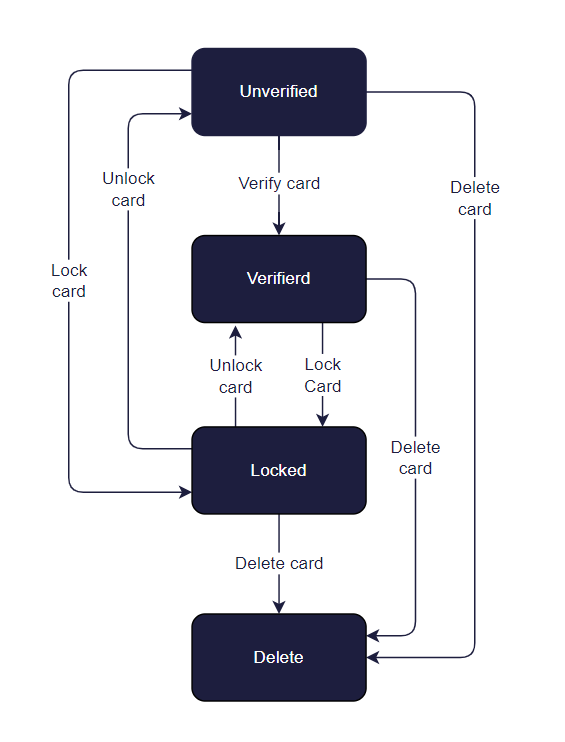

Card statuses

A customer can be defined by one of four statuses. The system created by Verestro divides the statuses into the following:

Card actions

Admin can perform the following actions on the particular card:

a) view card – redirect to the screen with card details data,

b) lock card – temporary lock of card (more information in card statuses part)

c) delete card – permanent delete card data (more information in card statuses part).

Below table presents how action may change the statuses of card

|

Action |

Statuses |

|

|

|

Card’s status |

Token’s status |

|

Add card |

Unverified |

|

|

Verify card |

Verified |

|

|

Lock card |

Locked |

Suspended |

|

Unlock card |

Verified |

Active |

|

Delete card |

Deleted |

Deleted |

Referring to the above table, a diagram has been created showing the change of states of the card. This allows for better visualization of actions and dependencies between them.

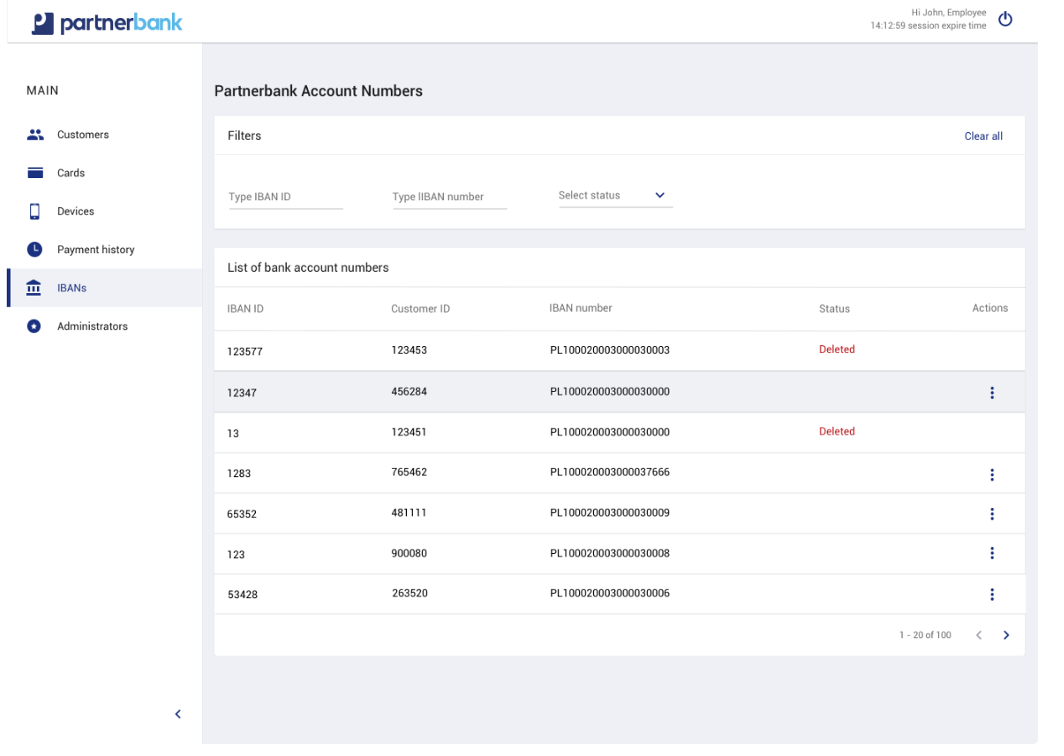

IBANs management

IBANs list

IBANs list contains filters and columns with dates. The filters are used for dynamic searching, such data as: IBAN ID, IBAN number, status (active, deleted).

Basic list includes following information:

|

Parameter |

Description |

|

IBAN ID |

Internal Verestro Id of IBAN. |

|

Customer ID |

Internal Verestro Id of customer. |

|

IBAN number |

IBAN number; example. IBAN=PL100020003000030000. |

|

Status |

IBAN status (described in IBAN statuses part). |

|

Action |

Action which can be performed on particular IBAN (described in IBAN actions part). |

IBANs details

Selecting a specific IBAN allows to see more detailed data. In addition to basic information, a list of related customers, and payment history is available.

Detailed list includes following information:

|

Parameter |

Description |

|

IBAN ID |

Internal Verestro Id of IBAN. |

|

IBAN number |

IBAN number eg. IBAN=PL100020003000030000. |

|

Created at |

Date of IBAN addition to the wallet database. |

|

Deleted at |

Date of card deletion from the wallet database. |

Additionally, in details are available aggregates related to the particular IBAN:

• customer (more information in customers management),

• tokens (more information in tokens management),

• payment history (more information in payment history).

IBAN statuses

IBAN actions

Admin can perform the following actions on the particular IBAN:

a) view IBAN – redirect to the screen with IBAN details data,

b) delete IBAN – permanent delete IBAN data (more information In IBAN statuses section)

|

Action |

Statuses |

|

|

|

IBAN’s status |

Token’s status |

|

Add IBAN |

Active |

Active |

|

Delete IBAN |

Deleted |

Deleted |

Tokens management

Subsection tokens list

Tokens list contains basic information such as TSP Type, Token ID, Status or Type. This section is available under the following tabs: Customers (screen below), Cards, Devices, IBANs.

Basic list includes following information:

|

Parameter |

Description |

|

TSP Type |

Payment token tsp type.* |

|

Token ID |

Internal Verestro Id of Token. |

|

Status |

Payment token status (described in token statuses part). |

|

Type |

Payment token type.** |

|

Action |

Action which can be performed on particular token (described in token actions part). |

*TSP Types of payment token:

a) Mastercard,

b) Visa.

**Types of token:

a) device – type is created after payment instrument digitization for contactless payments,

b) cloud – type is created after payment instrument digitization for e-commerce payments.

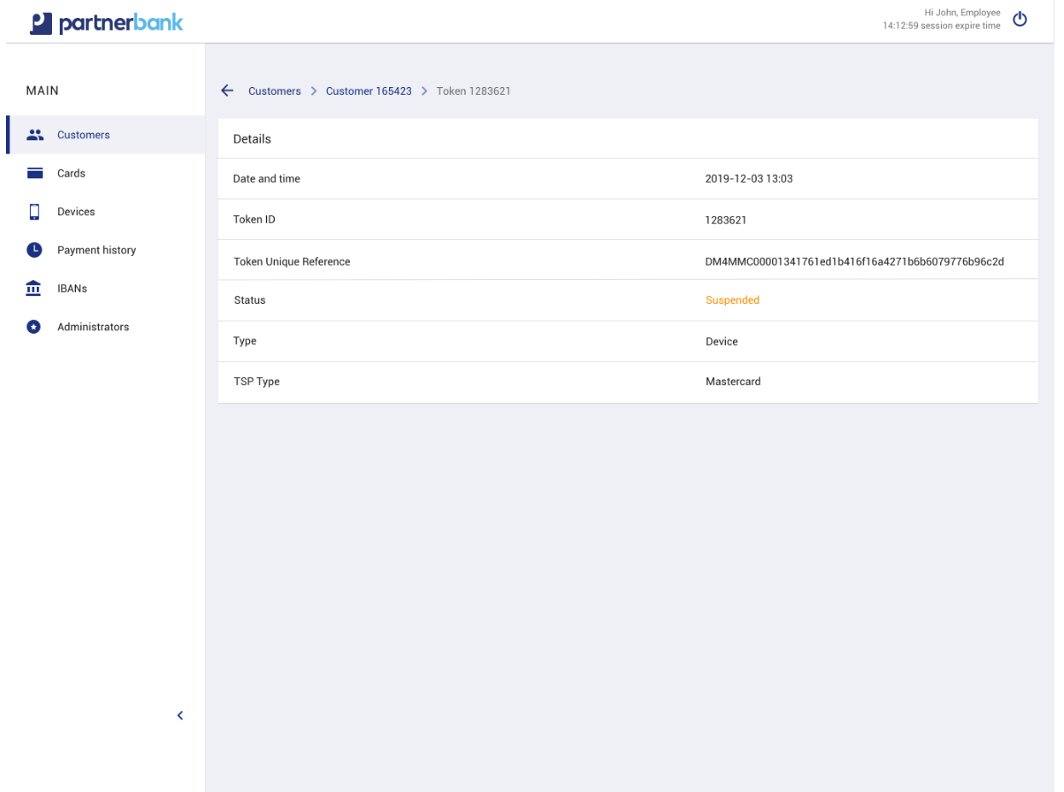

Token details

Selecting a specific token allows to see more detailed data.

Detailed list includes following information:

|

Parameter |

Description |

|

Date and time |

The date/time stamp when status of payment token has last changed represented ISO 8601 format. |

|

Token ID |

Internal Verestro Id of Token. |

|

Token Unique Reference |

Token unique reference. Exists if tsp type is MASTERCARD. |

|

Status |

Payment token status. |

|

Type |

Payment token type. |

|

TSP Type |

Payment token tsp type. |

Tokens statuses

Tokens action

Customer can perform the following actions on the token:

a) view token,

b) suspend token,

c) unsuspend token,

d) delete token.

Below table presents how action may change the statuses of token.

|

Action |

Token’s status |

|

Digitization |

Inactive |

|

Provisioning |

Active |

|

Suspend token |

Suspended |

|

Unsuspended token |

Active |

|

Delete token |

Deleted |

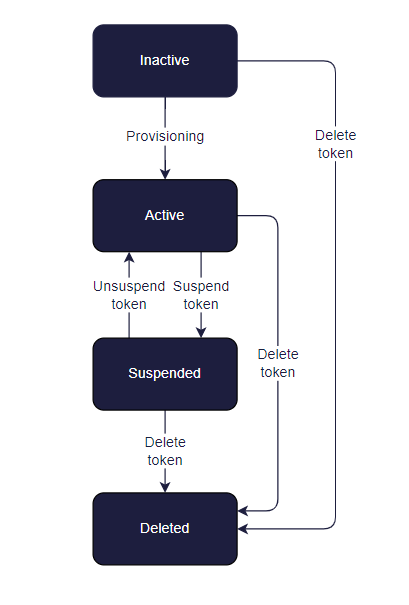

Referring to the above table, a diagram has been created showing the change of states of the token. This allows for better visualization of actions and dependencies between them.

Devices management

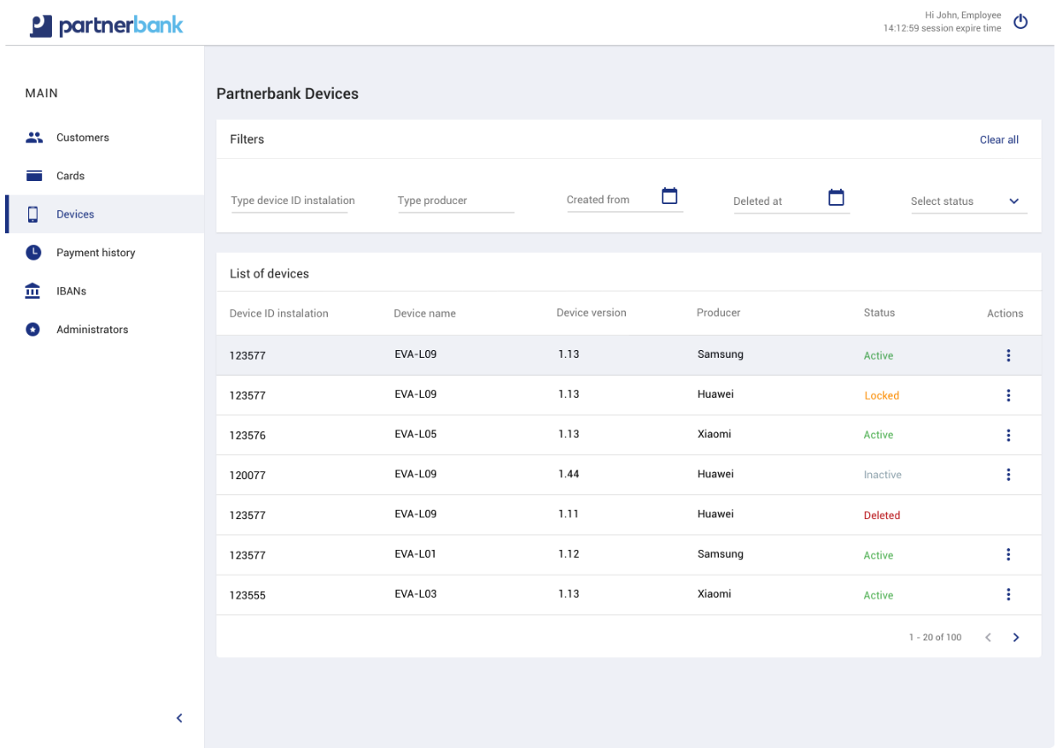

Devices list

Devices list contains filters and columns with dates. The filters are used for dynamic searching, such data as: device ID, producer, creation date, deletion date, status (available: inactive, active, locked, deleted).

Basic list includes following information:

|

Parameter |

Description |

|

Device ID |

Unique identifier of app installed on device. |

|

Device name |

Description of phone device model. |

|

Version |

Version of operating system. |

|

Producer |

Description of phone device manufacturer. |

|

Status |

Device status (described in device statuses part). |

|

Actions |

Action which can be performed on particular token (described in token actions part). |

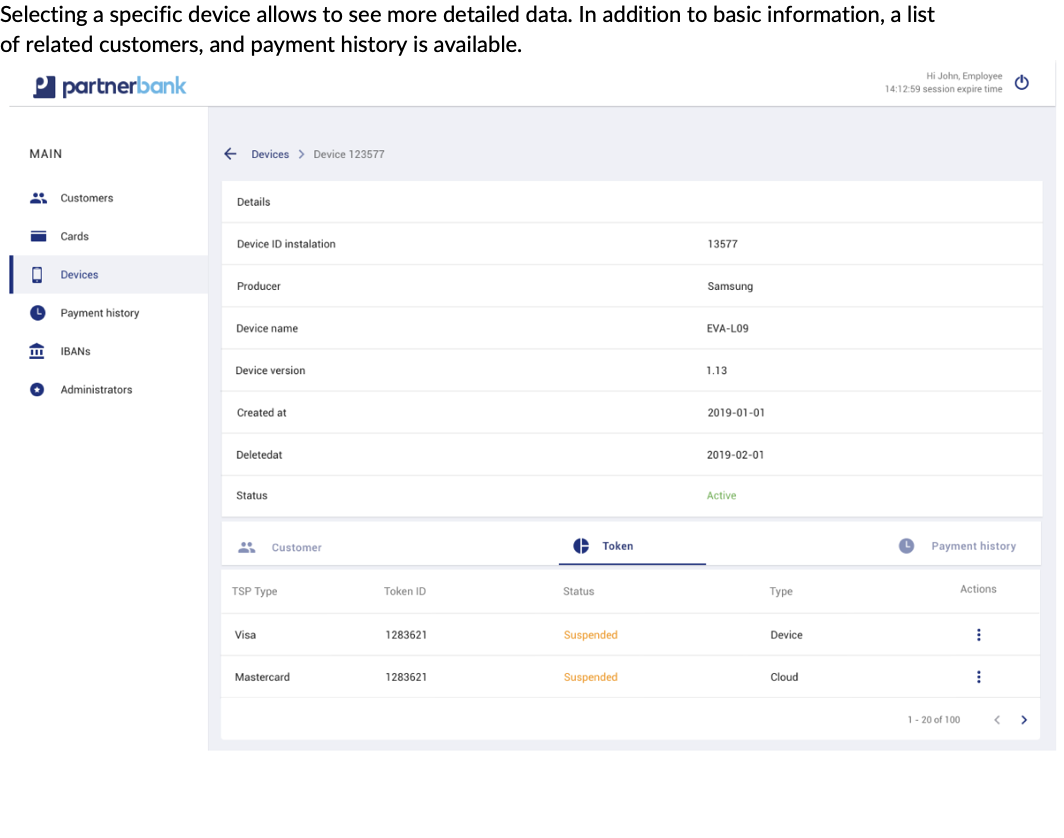

Devices details

Selecting a specific device allows to see more detailed data. In addition to basic information, a list of related customers, and payment history is available.

Detailed list includes following information:

|

Parameter |

Description |

|

Device ID installation |

Unique identifier of app installed on device. |

|

Producer |

Description of phone device manufacturer. |

|

Device name |

Description of phone device model. |

|

Device version |

Version of operating system. |

|

Created at |

Creation date greater than specified date or equal. Format Y-M-D. |

|

Deleted at |

Deletion date greater than specified date or equal. Format Y-M-D. |

|

Status |

Device status. |

In details there are available aggregates related to the particular device:

• customers (more information in customers management),

• customer tokens (more information in tokens management),

• payment history (more information in payment history).

Device statuses

Device actions

Device actions

Admin can perform the following actions on the particular device:

a) view device – redirect to the screen with device details data,

b) lock device – lock of device. None actions on this device are possible

c) delete device – permanent delete device data.

Below table presents how action may change the statuses of device

|

Action |

Statuses |

|

|

|

Device’s status |

Token’s status |

|

Add device (not paired yet) |

Inactive |

- |

|

Pair device |

Active |

- |

|

Lock device |

Locked |

Suspended |

|

Unlock device |

Active |

Active |

|

Delete device |

Deleted |

Deleted |

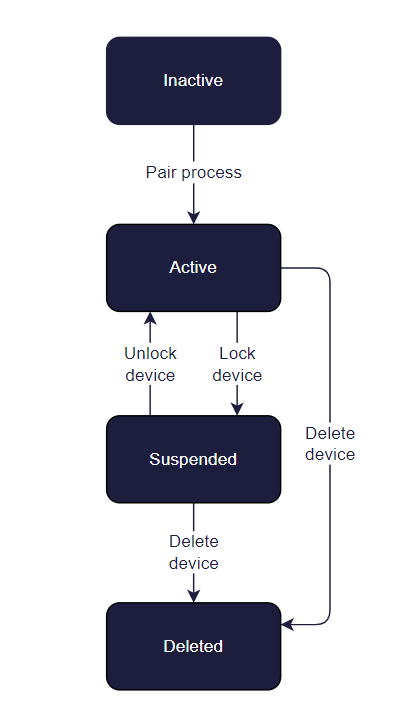

Referring to the above table, a diagram has been created showing the change of states of the device token. This allows for better visualization of actions and dependencies between them.

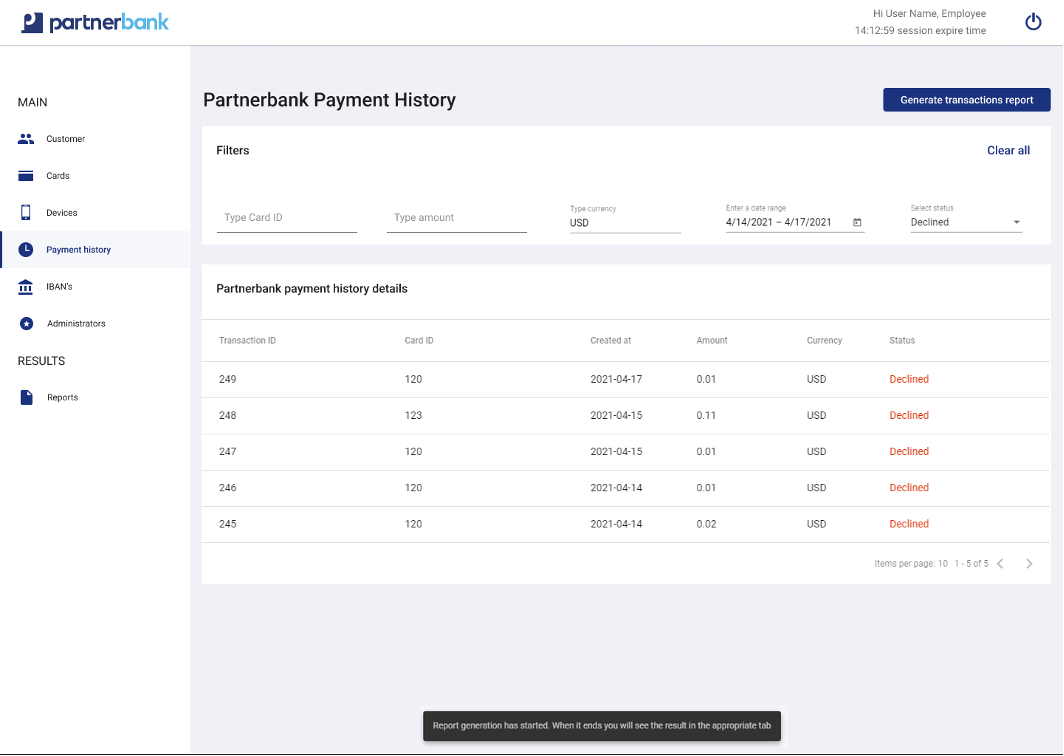

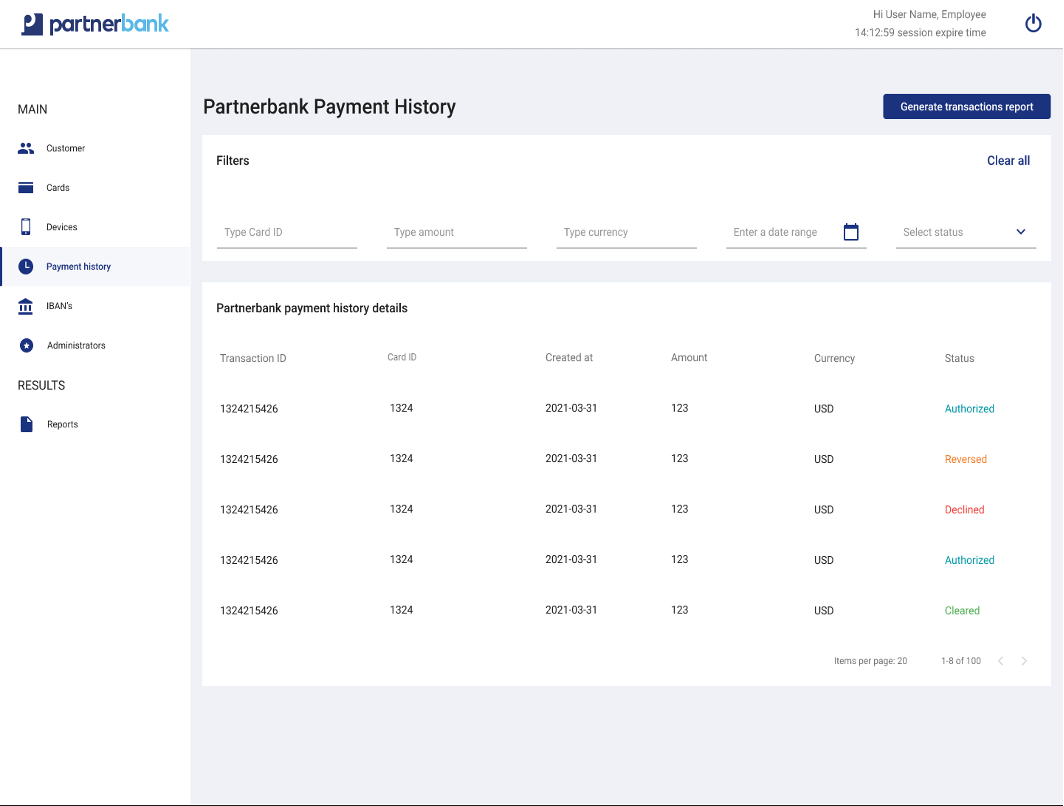

Payment history

Payment history list

Payment history list contains filters and columns with dates. In this section actions don’t occur. The filters are used for dynamic searching, such data as: Card ID, amount, currency, date of transaction, status (available: cleared, declined, authorized, reversed). The date displayed in both the transaction list and details is in UTC+0 and ISO8601 compliant. Also, the filters are selected by the user in UTC+0. At no time is there a conversion to the local time zone of the portal operator.

Basic list includes following information:

|

Parameter |

Description |

|

Transaction ID |

Internal Verestro transaction identifier. |

|

Card ID |

Internal Verestro Id of Card. |

|

Created at |

The date/time when the transaction was made. In ISO 8601 extended format. |

|

Amount |

The transaction monetary amount in terms of the minor units of the currency. |

|

Currency |

3-character ISO 4217 currency code of the transaction. |

|

Status |

Transaction status (described in transaction statuses part). |

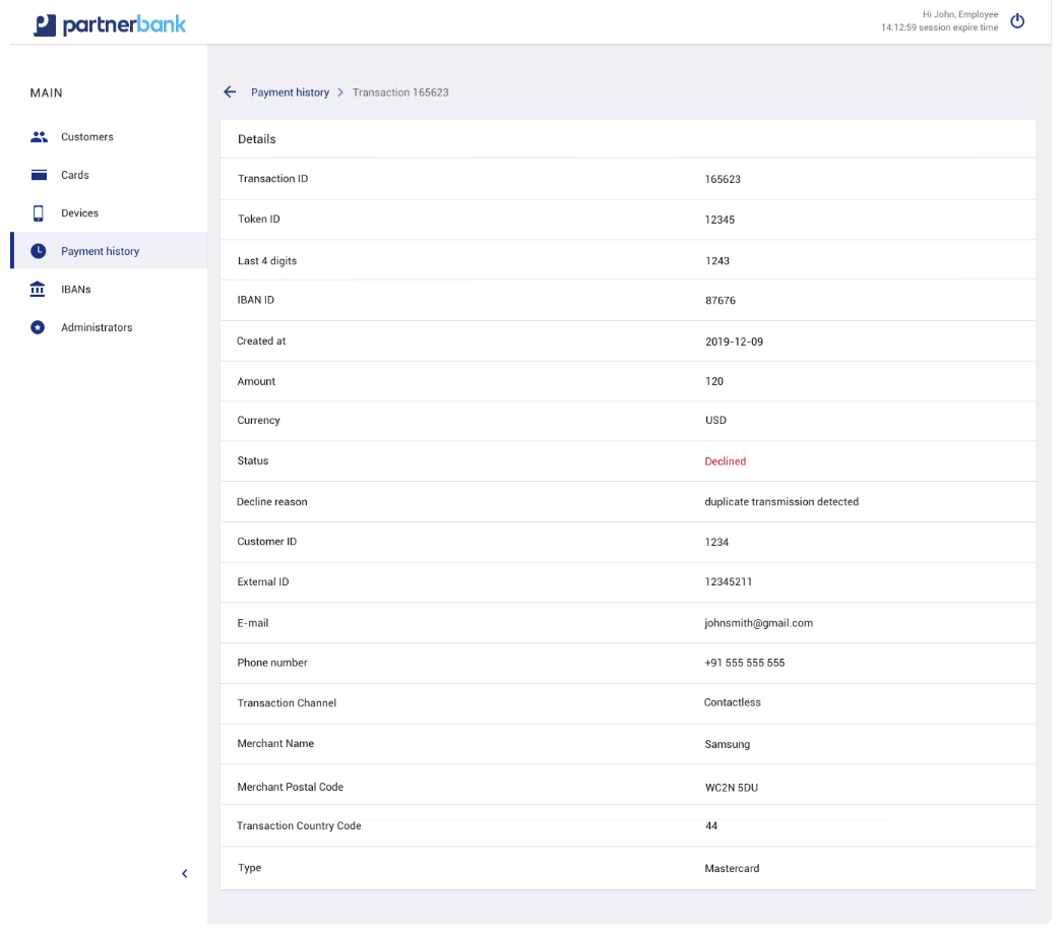

Payment history details

Selecting a specific payment history allows to see more detailed data.

Detailed list includes following information:

|

Parameter |

Description |

|

Transaction ID |

Internal Verestro transaction identifier. |

|

Token ID |

Internal Verestro Id of Token. |

|

Card ID |

Internal Verestro Id of Card. |

|

IBAN ID |

Internal Verestro Id of IBAN. |

|

Created at |

The date/time when the transaction was made. In ISO 8601 extended format. |

|

Amount |

The transaction monetary amount in terms of the minor units of the currency.. |

|

Currency |

3-character ISO 4217 currency code of the transaction. |

|

Status |

Transaction status. |

|

Decline reason |

Additional information provided by the issuer for a declined transaction.* |

|

Customer ID |

Internal Verestro customer identifier. |

|

External ID |

External customer identifier provided by client (for example: recordID). |

|

|

Customer e-mail address. |

|

Phone number |

Customer phone number. |

|

Transaction channel |

Information about transaction channel. One of: [CONTACTLESS, CLOUD, MONEYSEND]. |

|

Merchant name |

The merchant ("doing business as") name. |

|

Merchant postal code |

The postal code of the merchant. |

|

Transaction country code |

The country in which the transaction was performed. Expressed as a 3-letter (alpha-3) country code as defined in ISO 3166-1. |

|

Type |

Transaction type.** |

*Type of declined transactions:

a) invalid card number,

b) format error,

c) maximum amount exceeded,

d) expired card,

e) PIN authorization failed,

f) tranaction not permitted,

g) exceeds withdrawal amount limit,

h) restricted card,

i) exceeds withdrawal count limit,

j) allowable number of PIN tries exceeded,

k) incorrect pin,

l) duplicate transmission detected.

**Type of transactions:

a) purchase transaction,

b) refund transaction,

c) payment transaction,

d) ATM cash withdrawal,

e) cash disbursement,

f) ATM deposit,

g) ATM account transfer.

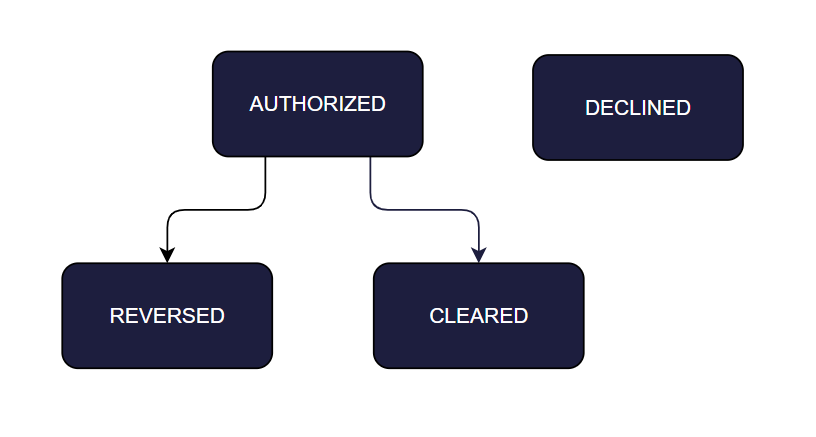

Transaction statuses

Each transaction has a transaction id given by the client, a type and a status. In payment systems, when a transaction is of type REFUND, it has the same id as a transaction of type PURCHASE. Therefore, the unique key is(the id given by the customer and the transaction type). Transaction amounts are stored in the system as a minor(1.25 to 125).

Each transaction has a type that can have different statuses. Immediately after a transaction is executed, it may receive one of the following statuses:

|

Parameter |

Description |

|

AUTHORIZED |

The transaction was authorized correctly. The funds in the Cardholder's account are blocked and an amount of the same value is "promised" to the Merchant. No transfer of funds is performed at this time. |

|

DECLINED |

The transaction was declined. No funds are blocked/transferred from Cardholder's account. |

For a transaction authorized correctly (AUTHORIZED), the following scenarios are possible. It may go into status:

|

Parameter |

Description |

|

REVERSED |

The transaction is reversed, e.g. due to an error reported by Merchant. The lock is lifted and the funds remain on the Cardholder's account. No transfer of funds is performed. |

|

CLEARED |

The transaction was settled correctly. The funds in the Cardholder's account are unblocked, and are then transferred to the Merchant's account. The block on the Cardholder's account becomes a debit, and the "promised" funds become a credit on the Merchant's account. |

Referring to the above tables, the possible transition of transaction states is presented in the diagram below.

Operator administration

Default privileges per role in the portal

Below are the default function settings for described product divided into areas.

|

Aggregate |

Action |

Admin |

Manager |

Employee |

| Customers - Cards | View | x | x | x |

| Delete | x | x | - | |

| Block | x | x | - | |

| Unblock | x | x | - | |

| Customers - Endusers | View | x | x | x |

| Edit | x | x | - | |

| Delete | x | x | - | |

| Lock | x | x | x | |

| Unlock | x | x | x | |

| Customers - Devices | View | x | x | x |

| Lock | x | x | x | |

| Unlock | x | x | x | |

| Delete | x | x | - | |

| Customer - Tokens on details of Endusers/Devices/Cards | View | x | x | x |

| Suspend | x | x | x | |

| Unsuspend | x | x | x | |

| Delete | x | x | - | |

| Customers - Payment history | View | x | x | x |

| Customers - Reports | View | x | x | - |

| Generate | x | x | - |

Reports

Payment history report

Payment history reports use the same filters that are used to select the payment history list. After applying the appropriate set of filters (Card ID, amount, currency, data range and status) it is possible to generate a report that will include the records displayed in the list.

Clicking the "Generate transactions report" button launches the generation mechanism. If the generation request was successful a popup is displayed at the bottom of the panel informing about the start of work (image below). In case of an error caused by missing data in the specified filter range the message "Cannot find transactions to generate the report" is displayed.

When user opens the "Reports" tab, a list of reports is displayed. It contains ready to download output files (.xlsx) in Ready status and information about reports currently being processed - In_Progress.

The report file contains the following columns:

|

Column |

Description |

|

Transaction ID |

Internal Verestro transaction identifier. |

|

Payment token ID |

Internal Verestro token identifier. |

|

IBAN ID |

Internal Verestro IBAN identifier. |

|

Card ID |

Internal Verestro Id of Card. |

|

Card last four digits |

Last four digits of card, which has been used to process transaction. |

|

Created at |

The date/time when the transaction was made. In ISO 8601 extended format. |

|

Amount |

The transaction monetary amount in terms of the minor units of the currency. |

|

Currency |

3-character ISO 4217 currency code of the transaction. |

|

Status |

Transaction status (described in transaction statuses part). |

|

Issuer response information |

Additional information received from Issuer in context of transaction. |

|

Customer ID |

Internal Verestro customer identifier. |

|

Customer external ID |

External system customer identifier. |

|

Customer email |

Customer email address in format alias@domain. |

|

Customer phone number |

Customer mobile phone number with prefix. |

|

Transaction channel |

Type of transaction channel used to perform the transaction. |

|

Merchant name |

The merchant ("doing business as") name. |

|

Transaction country code |

3-character ISO 3166-1 country code of the transaction. |

By default, both report generation and report retrieval are unlimited, meaning that any role can use this functionality in an unlimited way. If there are reasons to limit e.g. only Administrator to generate reports and allow everyone to view them - please let us know during project configuration stage.