User registration & card issuing

To meet the needs and expectations of its customers, Verestro has developed a flexible infrastructure, allowing it to issue cards to fintech, merchants, companies, payment institutions or banks. We can provide digital issuing services for licensed payment and banking institutions or using our partner network, BIN sponsors to companies without payment licenses.

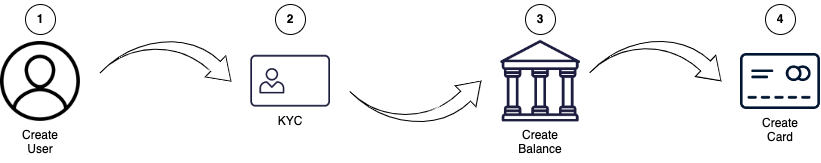

Verestro provides its customers with a range of services based on the applicable laws, directives and guidelines of card issuers such as Mastercard and Visa. Meeting these guidelines based on security standards including PCI DSS, 4 steps must be followed to deliver the card to the user:

Create User

The first step to be fulfilled is to register the user in Verestro infrastructure in order to maintain his data in accordance with PCI DSS guidelines and secure the subsequent communication. Depending on the customer's needs to fulfill this step, there is a possibility of delivering a dedicated mobile application or, in case of already existing system, implementing SDK in own application or server-server connection in cases when the application is not necessary. Regardless of the path chosen, Verestro provides its customers with a dedicated Administration Panel to facilitate the management and monitoring of its customers.

White Label Application

To meet the needs of the most demanding customers, Verestro has developed a mobile application for iOS and android. The application has a modular design which, in the shortest possible time, can be personalized to the required functionalities, branded according to the guidelines and published in production. More about this solution can be found in White Label Application.

Mobile SDKs

Customers with their own infrastructure and well-established products who want to provide their users with new mobile functionalities in a fast and easy way, including secure payment instruments, may use dedicated SDKs. Verestro team actively supports their implementation and leads through necessary certification processes. More on SDK based implementation can be found in User Lifecycle & Card Management API & SDK.

Life Cycle API

Customers who, similarly to the above case, want to expand their offer with competitive functionalities, where mobile application is not applicable, can use dedicated backend solution in server-server connection. LC API created for this purpose in a safe and easy to implement way allows to meet this requirement. More about LC API can be found in User Lifecycle & Card Management API & SDK.

KYC

In order to meet the requirements of card issuers, legal regulations and international directives Verestro supports the KYC (Known Your User) process aimed at verification of the customer to whom the services and payment instruments will be offered. As in the case of user registration, here, too, there is the flexibility of adjusting this solution both from the user's side in the mobile application and the processing of the application itself.

Manual KYC Process

The standard Verestro solution makes it possible to collect the necessary data and photos of documents and persons in the mobile application and send the thus prepared request via a secure channel to the Verestro infrastructure. This process is supported both in the implementation of the White Label Application and/or implementation of SDK in the customer application. All KYC data are available through a dedicated Administration Panel, through which the client at a specific access level verifies the data submitted by users.

Automatic eKYC

As KYC process requires customisations and flexibility, Verestro platform enables integration of external entities supporting this process. With the implementation of which it is possible to achieve full automation and thus reduce user verification time to a minimum. With KYC verification automation, the user can have a working payment device within 3-5 minutes of installing the application on their phone.

External KYC

For institutions that are expanding their offerings to include card issuance and already have a KYC process in place, LC API is a dedicated channel from setting KYC status with the user more about it in User Lifecycle & Card Management API & SDK.

Create Balance

The third step that brings the user closer to obtaining the card is the creation of a balance / account for the user, which is a dedicated place that maintains the current balance of available funds in a specific currency. Depending on the customer's needs, the user can have a virtually unlimited number of balances.

Automatic

The most commonly used solution is to automatically create the balance as soon as the user gets a positive KYC verification status. With this approach, the user receives the balance in the currency defined within the project.

Manual

A client can create a balance for a user on demand or enable the user to do so themselves. Regardless of the implementation method, the process of creating balances is available in a dedicated mobile application, the provided SDK, from the server-to-server connection and through a dedicated admin panel. More on balance management can be found in Card Management System.

Create Card

The final step is to create a card linked to the previously created balance. Verestro provides its customers with the ability to generate virtual and physical cards for its users. With the implementation of the application in the minimum configuration specified by Mastercard, Verestro enables joining the Digital First program, where the user has a modern e-banking system along with a stylistically attractive physical representation of a virtual card. Processes related to issuing and managing cards are available in Card Management System.