Overview

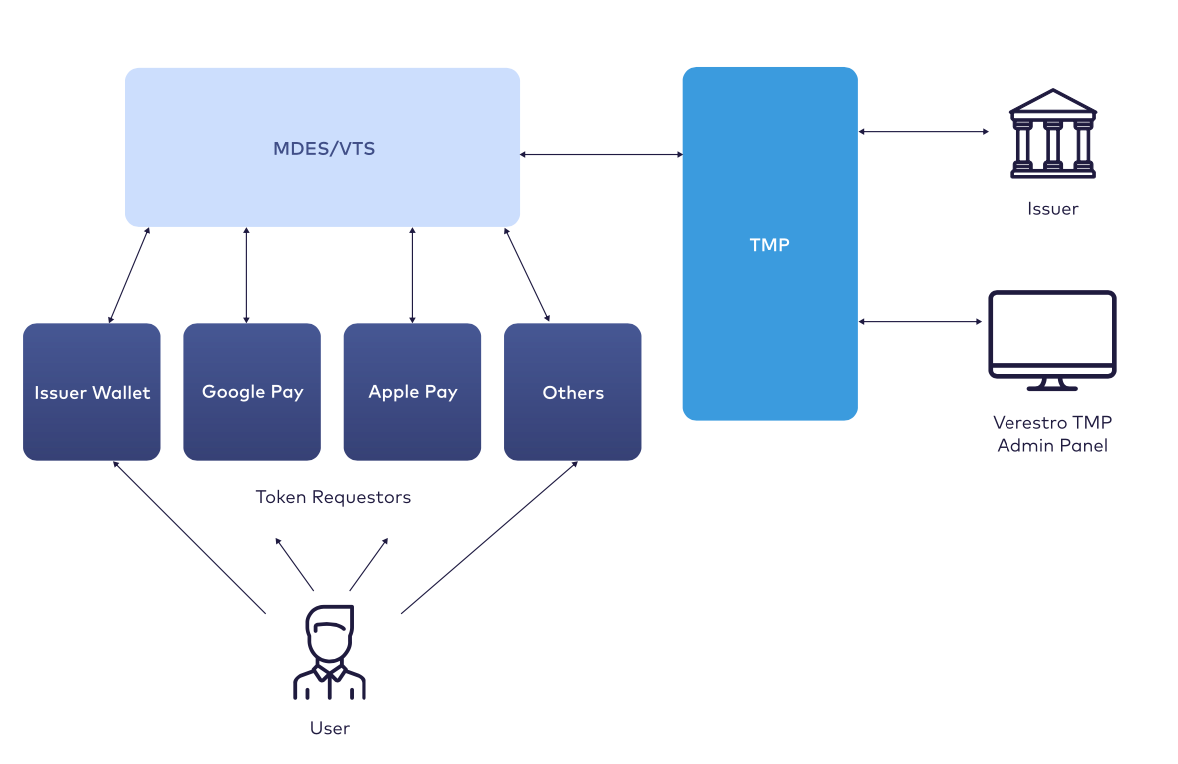

Verestro Token Management Platform is a solution created in order to allow much easier connection to Token Service Providers (TSP) - MDES, VTS. That can be used for card „pre-digitization” from all Token requestors with minimum development on the issuer side. It consists of the following parts:

- Predigitization API - set of processes and requirements that must happen before the payment token becomes ready for use - it will be possible to make payments.

- Token LifeCycle API - Mastercard or Visa API that TMP connects to in order to manage token life cycle.

- Admin Panel - Administration Panel for creating/fetching reports and managing token life cycle - can be used by Issuer's Customer Service.

- PushProvisioning API - allow card issuers the ability to initiate the card provisioning process for Apple/Google Wallet/Click2Pay directly from app.

Benefits for issuing bank or fintech partner

- TMP is created to connect to TSP(MDES/VTS) and enable much easier integration for the Issuer.

- TMP integrates with Token Service Providers (Mastercard MDES, Visa VTS) and provides a single interface for the issuers, so issuers don't have to integrate with both TSP.

- TMP supports various Token Requestors.

- TMP supports different requirements and implementations recommended by Token Requestors.

- TMP has audit and reporting capabilities for the Issuer including Apple Pay reports.

- TMP provides the Token and (optionally) Card Lifecycle Management API.

- TMP provides Admin Panel.

- TMP provides customizable Rule Engine, with risk rules kept in line with Token Requestors and Payment Networks recommendations, allowing issuer to make easier and more reliable tokenization authorizations decisions.

- TMP supports notifications including reminders for the users.

- TMP supports token requestor based velocity controls.

- TMP supports automated token lifecycle management.

- TMP supports In App Push Provisioning and supports In App token activation method.

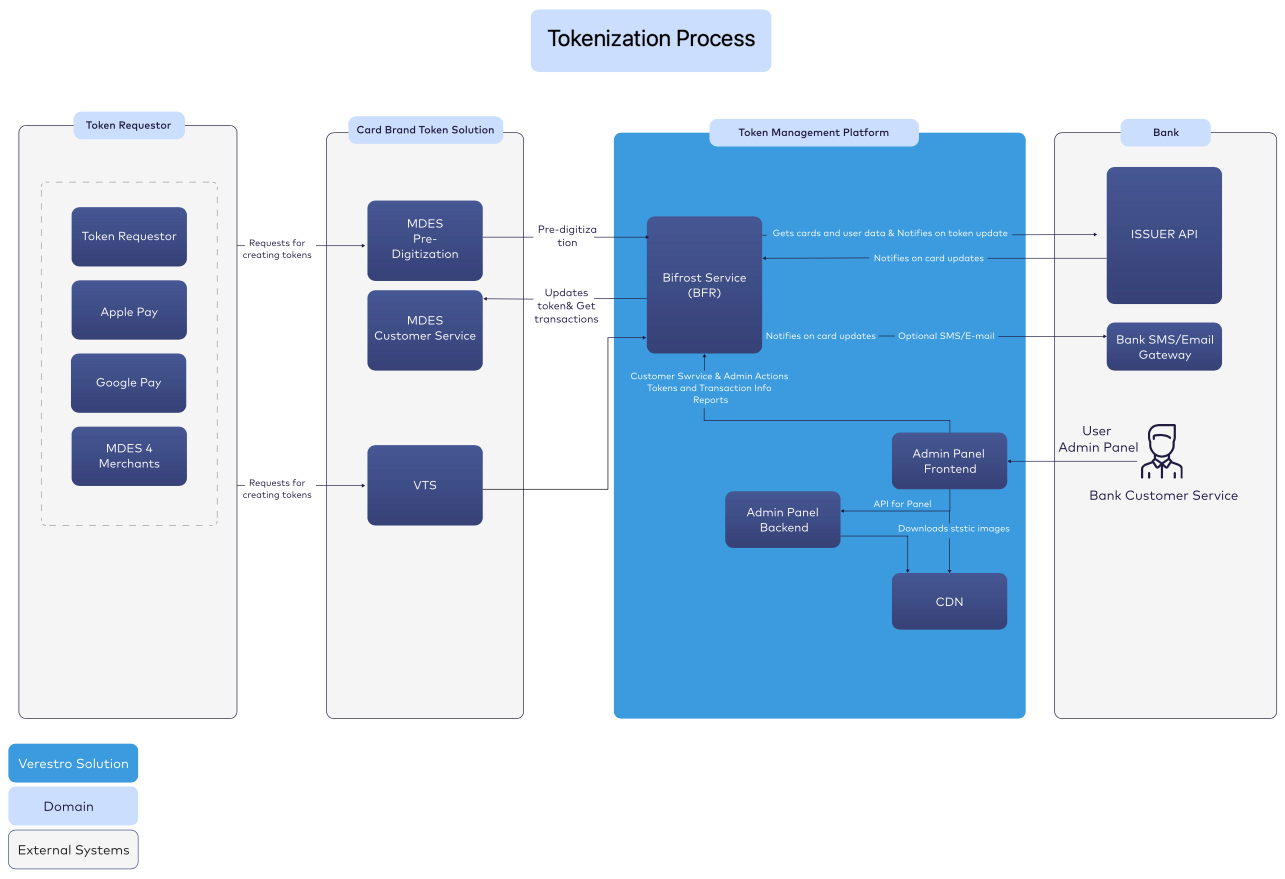

High Level Overview

Key components

| Component | Description |

| Bank Customer Service |

Service that allows direct one-on-one interaction between a consumer using a card and a representative of the bank. |

| Bank SMS/Email Gateway | Bank Service to send OTP via SMS or email to users. Used only when Issuer wants to send sms/email by themselves. |

| Verestro SMS/Email Gateway | Verestro TMP gateway to send OTP via SMS or email to users. |

| Bifrost Service (Verestro TMP backend) | Component responsible for the pre-digitization, token/card lifecycle, reports and push provisioning. |

| Push Provisioning ApplePay/GooglePay | Allows a mobile application to push a card to a token requestor. |

| Issuer | The bank or institution responsible for issuing the cardholder their card (debit, credit, prepaid). |

| MDES/VTS | Token Service Provider which supports digitization (transforming the card into payment token) and is responsible for management, generation and provisioning of transaction credentials to Token Requestor to enable simpler and more secure digital payment experience. |

| MDES Pre-digitization | MasterCard Digital Enablement Service API with methods to perform pre-digitization process. |

| Verestro TMP Admin Panel | Panel that can be used by bank for token LifeCycle management, administration and viewing reports. |

| Token Requestor |

Is an entity that requests payment tokens for end-users. Some examples of TRs include digital wallet providers, payment enablers, merchants and IoT manufacturers. |

Features overview

Verestro Token Management Platform supports below functionalities:

| Area |

Functionalities |

| Interface (Payment network APIs) |

Mastercard Pre-Digitization API Mastercard Customer Service API Visa Token Service Inbound API Visa Token Service Outbound API |

| Apple Pay |

Manual provisioning Push provisioning Apple Pay payload encryption Apple Pay card list |

| Google Pay |

Manual provisioning Push provisioning Google Pay payload encryption Google Pay card list |

| XPays (Samsung Pay, Fitbit Pay, etc.) |

Manual provisioning Push provisioning Payload encryption Card list |

| Token Management Portal |

Web UI All tokens available at the same time through the same interface Rules & tokenization decisions overview |

| Identity Verification |

SMS OTP Email OTP InApp Verification |

| Reports |

Apple mandatory report Standard report (includes user, device, token, payment history data) |

| Card Lifecycle Management |

Automated Card Lifecycle Management |

| Decision Paths & Fraud Prevention |

Wallet Provider recommendation |

Verestro TMP solution

Verestro Token Management Platform is solution which has been developed to facilitate the process of pre-digitizing cards for the Issuer.

Solution consists of:

- Token Management Platform (Server solution) - backend component.

- TMP Admin Panel - frontend component, dedicated to issuer's customer service teams.

Architecture

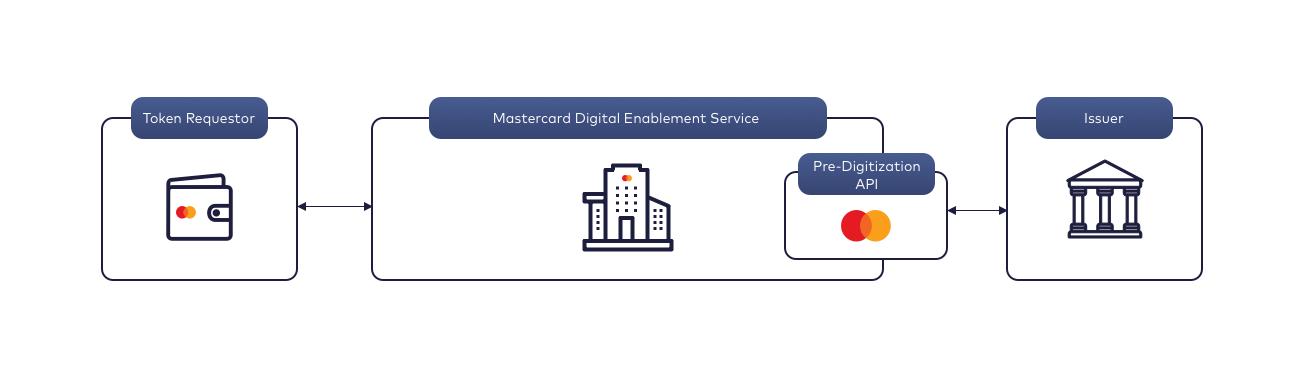

Pre-digitization

Pre-digitization is a set of processes that allows to a generation of digital payment tokens to enable simpler and secure digital payment experiences. Simply it turns a payment card into a digital token. In this process, Verestro TMP is taking care of all the requirements from Token Requestors.

For this process, the Issuer needs to expose one API method, which will return card verification result or security code verification result.

Tokenization process

1. User enters the card into Apple Pay/Google Pay or another Token Requestor wallet.

2. TMP receives Authorize Service request from TSP(MDES/VTS) on Pre-digitization API with Card Number, CVC, Exp Date, Device Score, and other tokenization data provided by Token Requestor.

3. TMP checks device score, number of already active tokens, velocity controls and other risk rules, relevant for the case.

4. TMP sends a request to Issuer Card Verification API with a Card Number and receives the Card Status, Card ID, User Phone Number, CVC validation Result, Product Category.

5. TMP returns the decision to TSP (APPROVED/REQUIRE_ADDITIONAL_AUTHENTICATION/DECLINED).

Token activation

If the decision is APPROVED - token activated instantly after Authorize Service response. Verestro TMP can also notify the issuer if required.

If the decision is REQUIRE_ADDITIONAL_AUTHENTICATION - The message will be displayed to the user with activation options (ex. SMS OTP). After the user selects the activation type, TSP will send a DeliverActivationCode to Verestro TMP. Verestro TMP will send the OTP activation code to the user. After the user enters the OTP, TSP activates the token. The token can also be activated manually via the Administration Panel.

If the decision is DECLINE - a token becomes INACTIVE and cannot be activated again.

When a token is activated, Verestro TMP will receive a notifyServiceActivated call from TSP.

User authentication

There are 4 authentication paths for the user:

- Green Path - Path without user confirmation (authentication) during the token activation process. The payment token is automatically activated.

- Yellow Path - Path with user confirmation (authentication) during the token activation process. Payment token is activated after correct OTP is provided.

- Orange Path - Path with user confirmation (authentication) during the token activation process. Payment token is activated by the Bank after the user's request via call.

- Red Path - Path when the Issuer rejected activation payment token during the token activation process.

Pre-digitization API Sequence Diagram

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

title Green Path

actor User

'comment: actor boundary control entity

User -> "Token Requestor": 1. Tokenize Card

activate "Token Requestor"

"Token Requestor" -> "MDES": 2. AuthorizeService request

activate "MDES"

"MDES" -> "TMP": 3. AuthorizeService request

activate "TMP"

"MDES" <-- "TMP": 4. AuthorizeService response (APPROVED)

"Token Requestor" <-- "MDES": 5. AuthorizeService response (APPROVED)

User <-- "Token Requestor": 6. APPROVED

"MDES" --> "TMP": 7. NotifyServiceActivated

deactivate "TMP"

"MDES" --> "Token Requestor": 8. Service Activated

deactivate "MDES"

"Token Requestor" --> User: 9. Service Activated

deactivate "Token Requestor"

@enduml

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

title Yellow Path

actor User

'comment: actor boundary control entity

User -> "Token Requestor": 1. Tokenize Card

activate "Token Requestor"

"Token Requestor" -> "MDES": 2. AuthorizeService request

activate "MDES"

"MDES" -> "TMP": 3. AuthorizeService request

activate "TMP"

"MDES" <-- "TMP": 4. AuthorizeService response (RAA)

"Token Requestor" <-- "MDES": 5. AuthorizeService response (RAA)

User <-- "Token Requestor": 6. Activation Methods

User -> "Token Requestor": 7. Choose Activation Method

"Token Requestor" -> "MDES": 8. Choose Activation Method

"MDES" -> "TMP": 9. DeliverActivationCode

"TMP" --> User: 10. DeliverActivationCode (SMS, EMAIL)

deactivate "TMP"

User -> "Token Requestor": 11. Enter activation code

"Token Requestor" -> "MDES": 12. Validate activation code

"MDES" --> "Token Requestor": 13. Service Activated

deactivate "MDES"

"Token Requestor" --> User: 14. Service Activated

deactivate "Token Requestor"

@enduml

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

title Red Path

actor User

'comment: actor boundary control entity

User -> "Token Requestor": 1. Tokenize Card

activate "Token Requestor"

"Token Requestor" -> "MDES": 2. AuthorizeService request

activate "MDES"

"MDES" -> "TMP": 3. AuthorizeService request

activate "TMP"

"MDES" <-- "TMP": 4. AuthorizeService response (DECLINE)

deactivate "TMP"

"Token Requestor" <-- "MDES": 5. AuthorizeService response (DECLINE)

deactivate "MDES"

User <-- "Token Requestor": 6. Decline

deactivate "Token Requestor"

@enduml

Deliver activation code.

This method is called when authorize service returned decision: REQUIRE_ADDITIONAL_AUTHNETICATION(Yellow Path). Account Holder needs to verify himself with one of the available activation methods (e.g. OTP code or call to call center). OTP code can be generated by Verestro TMP or TSP(preferred option).

Verification steps:

- Verestro TMP sends OTP code via SMS or email (configurable option) to the Account Holder, but there is also possibility to do that by the Issuer, in that case Verestro TMP will notify the Issuer and then Issuer sends it to the Account Holder,

- Account Holder is entering received OTP and TSP or Verestro TMP(configurable) is validating it,

- When OTP code is correct, notifyServiceActivated method is called which means that token is activated and ready to use.

MDES Pre-digitization API technical

The process of predigitization presents a set of methods by which Issuer can easily digitize his card. The process of predigitization presents a set of methods by which Issuer can easily digitize his card. The diagram below shows the flow from the moment the User starts digitizing his card, through its authentication with the activation code (Deliver Activation Code) to the activation of the payment token.

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

actor User

participant "Token Requestor" as TR

participant "Mastercard Digital Enablement Service" as MDES

participant "Token Management Platform" as TMP

participant Issuer as Issuer

User -> TR: 1. Digitize

activate TR

TR -> MDES: 2. Digitize

activate MDES

MDES -> TMP: 3. AuthorizeService

activate TMP

TMP -> Issuer: 4. CardValidation

activate Issuer

Issuer --> TMP: 5. Card Validation Response

deactivate Issuer

TMP --> MDES: 6. Decision and List of Activation Methods

deactivate TMP

MDES --> TR: 7. List of Activation Methods

deactivate MDES

TR --> User: 8. List of Activation Methods

deactivate TR

deactivate User

note left: Activation method selected

User -> TR: 9. Deliver Activation Code

activate TR

TR -> MDES: 10. Deliver Activation Code

activate MDES

MDES -> TMP: 11. Deliver Activation Code

activate TMP

TMP -> Issuer: 12. Deliver Activation Code

activate Issuer

Issuer --> User: 13. Send activation code using preferred channel

Issuer --> TMP: 14. Activation Code Delivered

deactivate Issuer

TMP --> MDES: 15. Activation Code Delivered

deactivate TMP

MDES --> TR: 16. Activation Code Delivered

deactivate MDES

TR --> User: 17. Activation Code Delivered

deactivate TR

User -> TR: 18. Enter activation code

activate TR

TR-> MDES: 19. Activate

activate MDES

MDES -> MDES: 20. Token

MDES -> MDES: 21. Token activated (TUR)

MDES -> TMP: 22. NotifyTokenUpdated (TUR, Active)

activate TMP

MDES -> TMP: 23. NotifyServiceActivated

TMP -> Issuer: 24. NotifyServiceActivated

deactivate TMP

MDES -> TR: 25. NotifyServiceActivated

deactivate MDES

TR --> User: 26. Token Activated

deactivate TR

@enduml

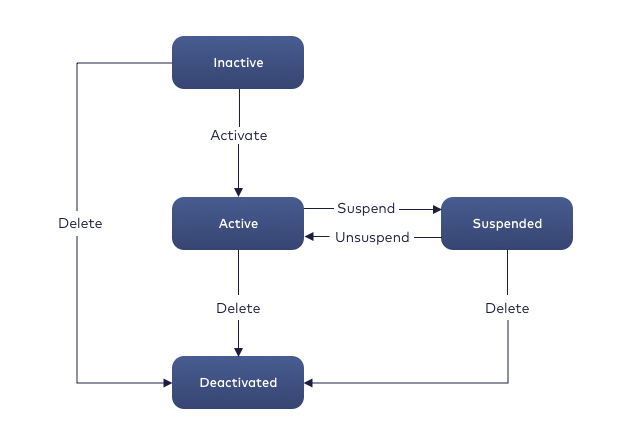

Lifecycle

Token lifecycle support token management which can be use directly by user, issuer or customer service using Admin Panel. This feature provides action on token to change token status. Actions what can happened are:

Acivate token → change token status to Active,

Suspend token → change token status to Suspended,

Unsuspend token → change token status to Active,

Delete token → change token status to Deactivated,

The diagram below shows the transitions between payment token statuses.

Automatic lifecycle management is supported via Verestro TMP API. Issuer can call Verestro TMP API to perform any lifecycle actions on card with will result on lifecycle action on all tokens assigned for the card.

Example: User looses his card and calls bank customer services to block the card, bank blocks user's card and automatically calls Verestro TMP to blocks all the tokens for the same card. This solution is compliant with apple automated lifecycle management requirements

Payment Token Lifecycle Management

These diagrams show what the 4 authentication paths look like for a user:

This section describes payment token lifecycle management performed via Issuer or Admin Panel.

Token lifecycle options:

– Token can be suspended/deleted from the consumer app (Apple Pay/ Google Pay). Verestro TMP will receive a TokenUpdate notification from TSP.

– Token can be activated/suspended/unsuspended/deactivated from Administration Panel UI by the Issuer Customer Service Support team.

– Token can be activated/suspended/unsuspended/deactivated via Verestro TMP API.

– All card tokens can be suspended/unsuspended/deactivated via Verestro TMP API. Card renew and replace is also supported.

Thera are a possibility to turn on an automatic notifications depends on any actions on token e. g token was activated or customer didn't finalize token activation.

Suspend, Unsuspend, Deactivate the token

Payment token can be suspended by the Issuer or the Admin Panel.

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

actor User

participant "Token Requestor" as TR

participant "Mastercard Digital Enablement Service" as MDES

participant "Token Management Platform" as TMP

participant "Admin Panel" as AP

AP -> TMP: 1. suspend/unsuspend/deactivate token

activate AP

activate TMP

TMP -> TMP: 2. check the permissions

alt if permissions are compatible

TMP -> MDES: 3. suspend/unsuspend/deactivate token

activate MDES

else if permissions disagree

TMP --> AP: 4. response

end

MDES -> MDES: 5. suspend/unsuspend/deactivate token

MDES --> TMP: 6. response

TMP --> AP: 7. response

deactivate AP

deactivate TMP

MDES -> TR: 8. token suspend/unsuspend/deactivate

deactivate MDES

activate TR

TR -> TR: 9. suspend/unsuspend/deactivate token

TR --> User: 10. notification

deactivate TR

@enduml

Payment token can be suspended by the Issuer.

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

actor User

participant "Token Requestor" as TR

participant "Mastercard Digital Enablement Service" as MDES

participant "Token Management Platform" as TMP

participant Issuer as Issuer

Issuer -> TMP: 1. suspend/unsuspend/deactivate token

activate Issuer

activate TMP

TMP -> TMP: 2. check the permissions

TMP -> MDES: 3. suspend/unsuspend/deactivate token

activate MDES

MDES -> MDES: 4. suspend/unsuspend/deactivate token

MDES --> TMP: 5. response

TMP --> Issuer: 6. token suspended/unsuspended/deactivated

deactivate Issuer

deactivate TMP

MDES -> TR: 7. token suspend/unsuspend/deactivate

deactivate MDES

activate TR

TR -> TR: 8. suspend token

TR --> User: 9. notification

deactivate TR

@enduml

Replace and renew the token

Replace/renew payment token is the process with consists of updating payment token data. Every payment token has an expiry date and linked PAN. When the token is expiring, the Issuer can change the token expiration date.

When a cardholder has a new card (new PAN) and wants to keep the digital token active, it can be achieved by doing "PAN swap" for a token. The issuer can do it for one or all payment tokens associated with one PAN set to the new data. A new product configuration ID can also be associated with one or all tokens associated with a PAN.

The same situation may occur when the cardholder receives a new card (PAN) due to fraud / theft. The issuer changes the payment token data in the same way.

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

actor User

participant "Token Requestor" as TR

participant "Mastercard Digital Enablement Service" as MDES

participant "Token Management Platform" as TMP

participant Issuer as Issuer

Issuer -> TMP: 1. replace/renew token

activate Issuer

activate TMP

TMP -> TMP: 2. check the permissions

TMP -> MDES: 3. replace/renew token

activate MDES

MDES -> MDES: 4. replace/renew token

MDES --> TMP: 5. response

deactivate MDES

TMP --> Issuer: 6. token replaced/renewed

deactivate Issuer

TMP -> TR: 7. replace/renew token

deactivate TMP

activate TR

TR -> TR: 8. replace/renew token

TR --> User: 9. notification

deactivate TR

@enduml

Payment Card Lifecycle Management

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

participant "Issuer" as Issuer

participant "Verestro Token Management Platform" as TMP

participant "Customer Service API" as CSAPI

Issuer -> TMP: 1. Suspend card (CardId)

activate Issuer

activate TMP

TMP -> TMP: 2. Find all tokens for card

TMP --> CSAPI: 3. Suspend tokens

activate CSAPI

TMP --> Issuer: 4. Token Suspended

@enduml

Push Provisioning

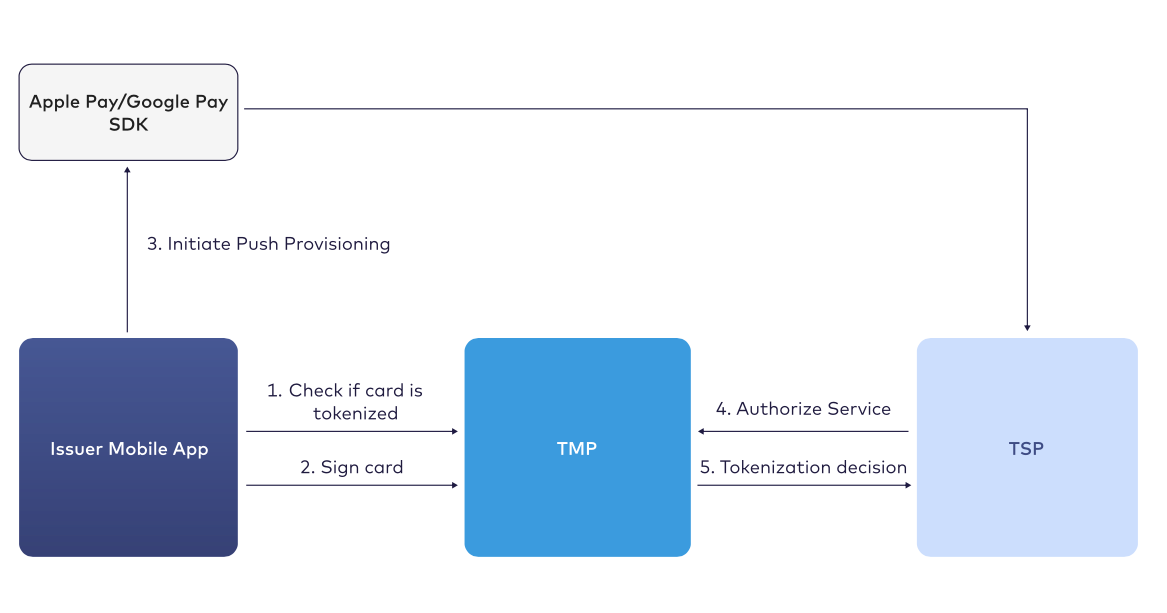

Push Provisioning provides the ability to initiate the card provisioning process for Apple/Google Wallet directly from the issuer’s app.

Users will find the Push Provisioning feature an extremely convenient method to provision their cards or passes into their devices by avoiding the need to input those details manually.

Verestro TMP Push Provisioning module API:

- Check if card is tokenized.

- Sign card .

Verestro TMP Push Provisioning module allows the following flow:

- Check if card is tokenized - Return information if a card is tokenized on the device, so the Issuer's mobile application can show "Add to Apple/Google pay" button.

- Sign card - Prepare encrypted and signed payload which can be used by the Issuer's mobile application.

- Initiate Push Provisioning with Apple Pay/Google Pay SDK.

- Authorize Service to Verestro TMP.

- Tokenization Decision returned to TSP (APPROVE/DECLINE).

Admin Panel

Admin Panel for Verestro Token Management Platform is an user interface thanks to we can manage and view tokens and transaction data.

Due to admin panel operators can:

- browse tokens list and see token details,

- change/manage tokens statuses,

- browse transactions list and see transaction details (including statuses).

- generate reports.

Can be used by Issuer Customer Service.

More information we can find in the Verestro TMP Admin Panel Product Overview documentation.

Additional Features

Reports.

Verestro TMP can generate various types of reports: ApplePay, Tokens, Transactions, Activity audit. Reports can be downloaded or generated from Admin Panel. Some of the reports can be generated automatically by Verestro TMP.

User notifications.

Verestro TMP can send custom notifications to Issuer, like:

- OTP code for additional authentication.

- Notifications when a token is activated or deleted.

- Notifications to inactive customers, which didn't perform any transactions after token activation.

- Notifications on abandoned provisioning, when a user didn't finish the full process of token activation.

Jobs.

Verestro TMP can generate/notify or do some other custom task automatically, like:

- Delete inactive tokens after a configured time.

- Generate reports.

- Send notifications.

- Fetch transactions from Customer Service, which can be used for reporting and accessible from administration panel.

Monitoring and Alerting:

- Grafana dashboard with tokenization activity and performance metrics.

- Statistics.

- Error and warning alerting.

Security:

- IP whitelist for API communication.

- Role based access to lifecycle and reporting features.

- x.509 mTLS authentication.

- VPN tunnel support.

- OAuth when connecting to Issuer API.