Use cases

This chapter describes the business functions that can be performed by having a company balance in the Verestro system and using Payout via xPay card token. We also present end user default views presented during using the application.

Know your business

The first step to starting integration is to complete the KYB process. This process is required to identify and verify business clients. Automatic registration process ensures that all the information and documents provided by the clients gone properly through AML verification. Business client registration process may take around 10-15 minutes. At this link you can find out what exactly the KYB process is and what it looks like. KYB in Verestro is performed with the help of an external verification provider - Mobiltek.

Note: AML (Anti-Money Laundering) is a set of policies, procedures, and technologies that prevents money laundering.

Customer balance management

Description of methods in Antaca service to create and manage the balance.

| Method |

Description |

|

Method that allows you to create a balance for your company. |

|

|

Method that allows you to top up the created balance. |

|

|

Method that allows you to debit the created balance. |

Note: The balance for your corporation is created during its registration in our system.

You can create end-user balances from the Administration Panel created for your corporation or use the Create balance method mentioned above.

Initialize payment link

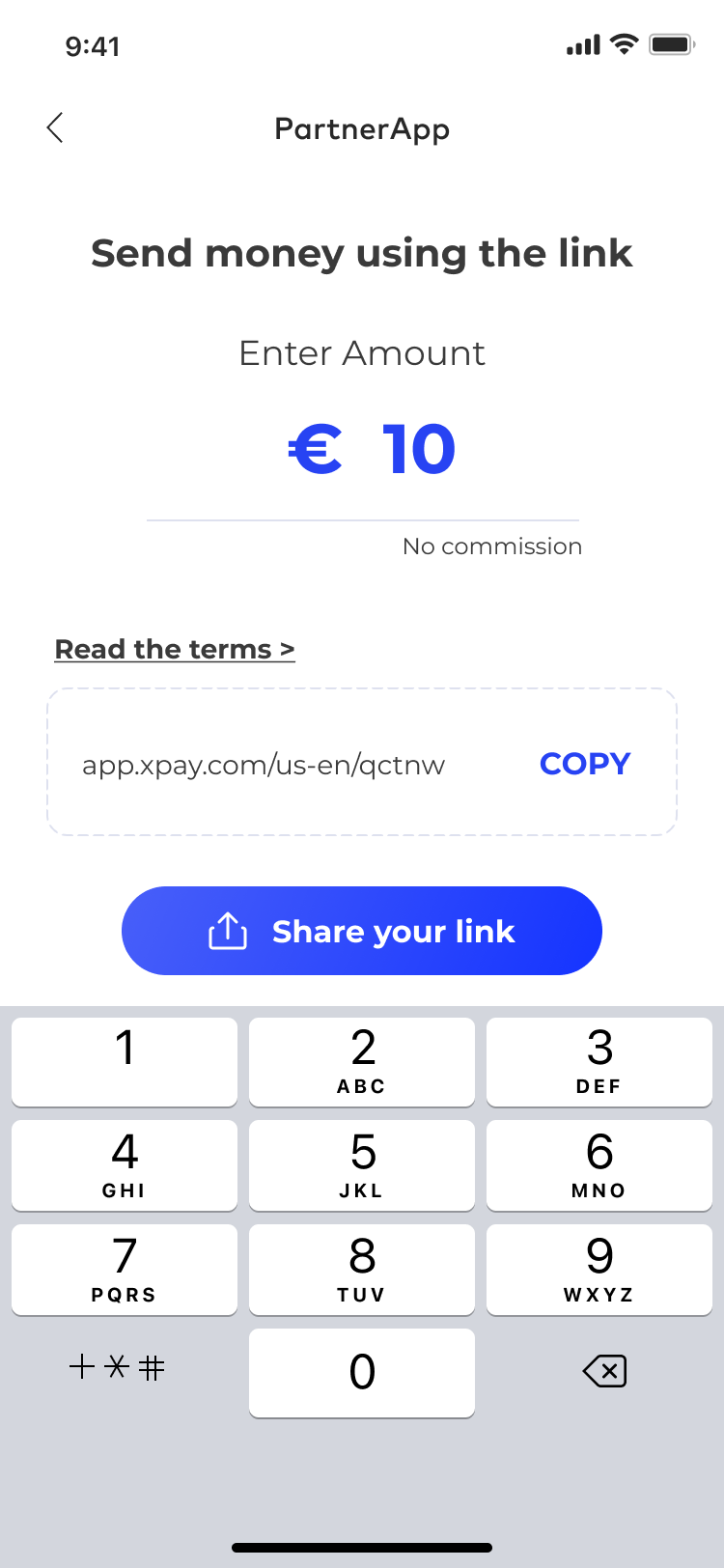

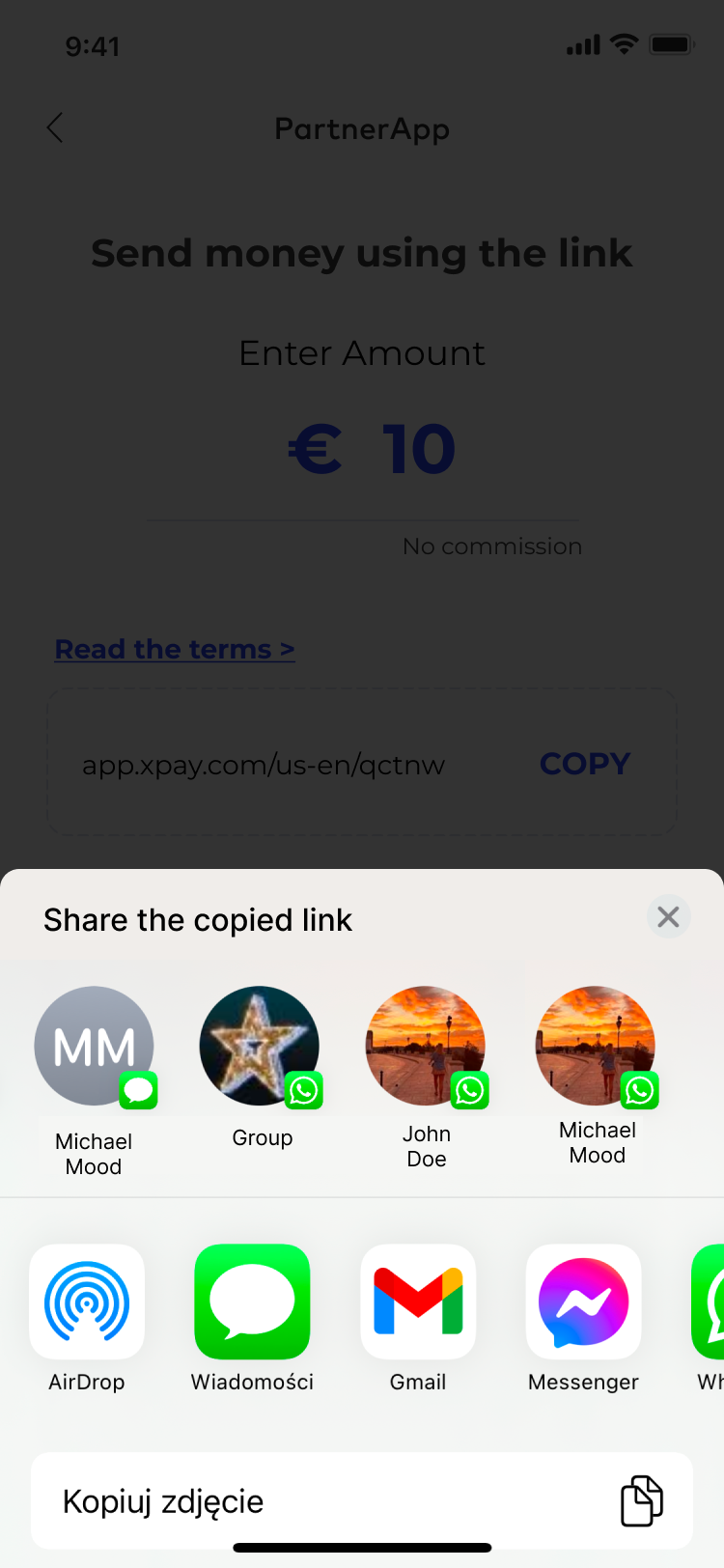

The card top-up process begins when the payment link is initialized. As a customer, you must provide transaction metadata such as the amount and currency in which the payout will be made. After confirming the entered data, a link is generated that you can send to the recipient.

Important! The first screen below (PartnerApp view) imitates the view from your application and you will be responsible for implementing this view.

UML presenting initialize payment link step by step

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

participant "Sender" as sender

participant "Customer" as cust

participant "Verestro" as oro

participant "Recipient" as user

sender->cust: Send money using payout

note right of sender: Money Sender has a balance in Antaca Verestro

cust->oro: Initialize payment link (provide transaction metadata)

oro->cust: Return generated payment link

cust->sender: Return generated payment link

sender->user: Send link to the receiver

@enduml

|

|

|

| 1. Sender provides transaction metadata and order payment link (this step takes place in Customer's application). | 2. Sender gets payment link and sends it to the recipient. |

Receiving funds

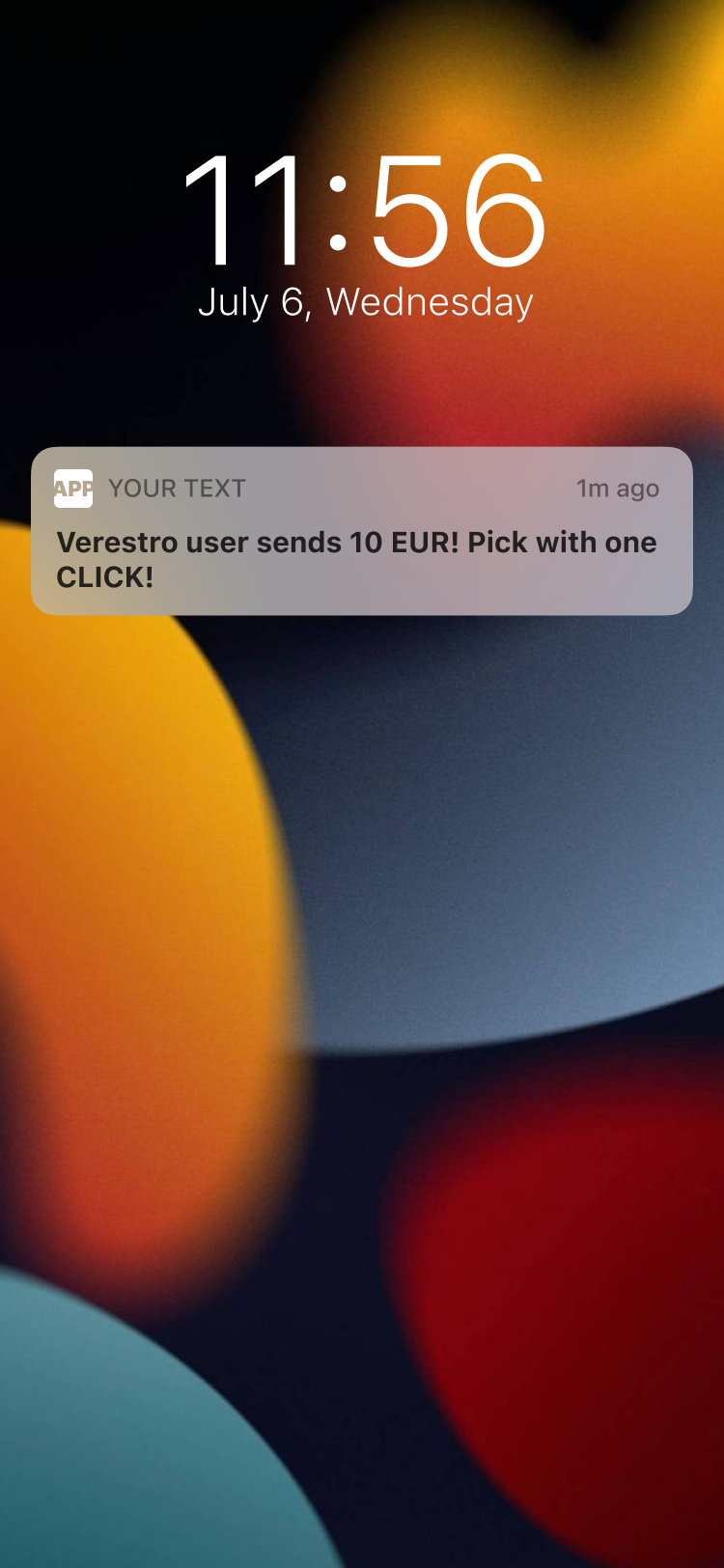

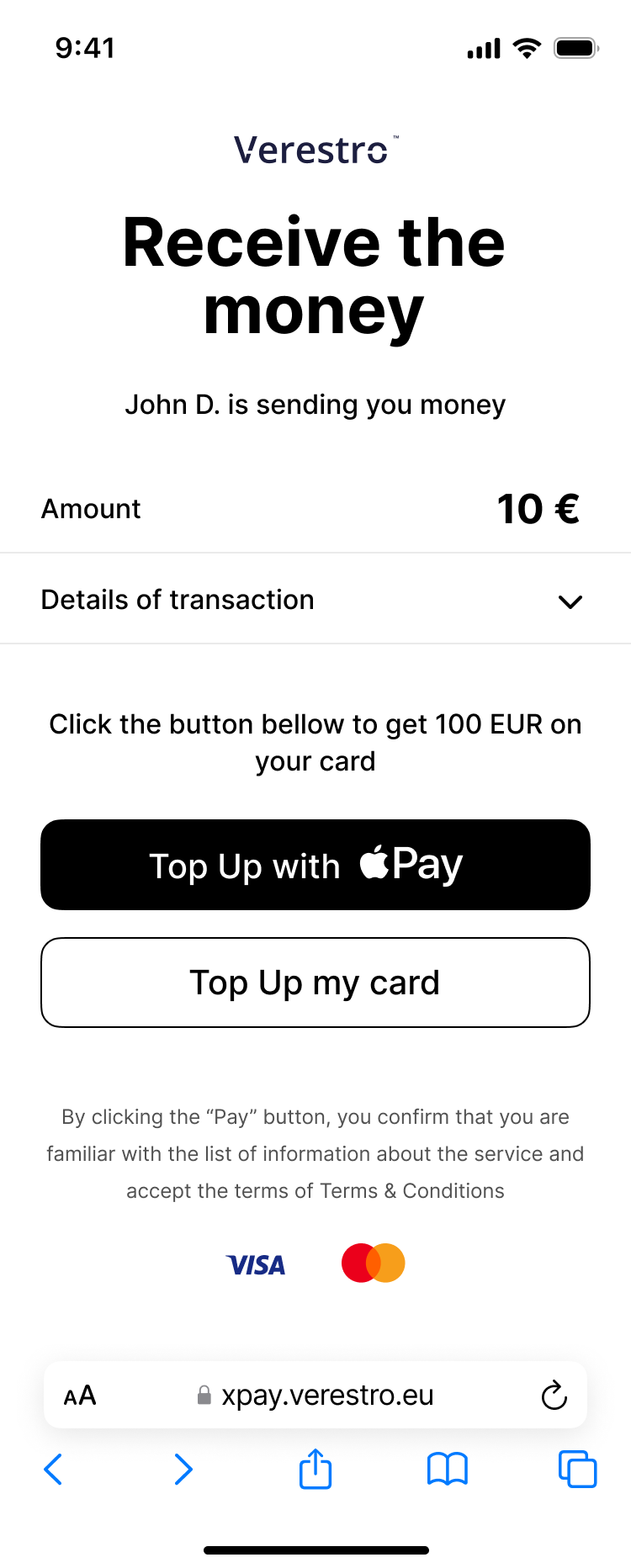

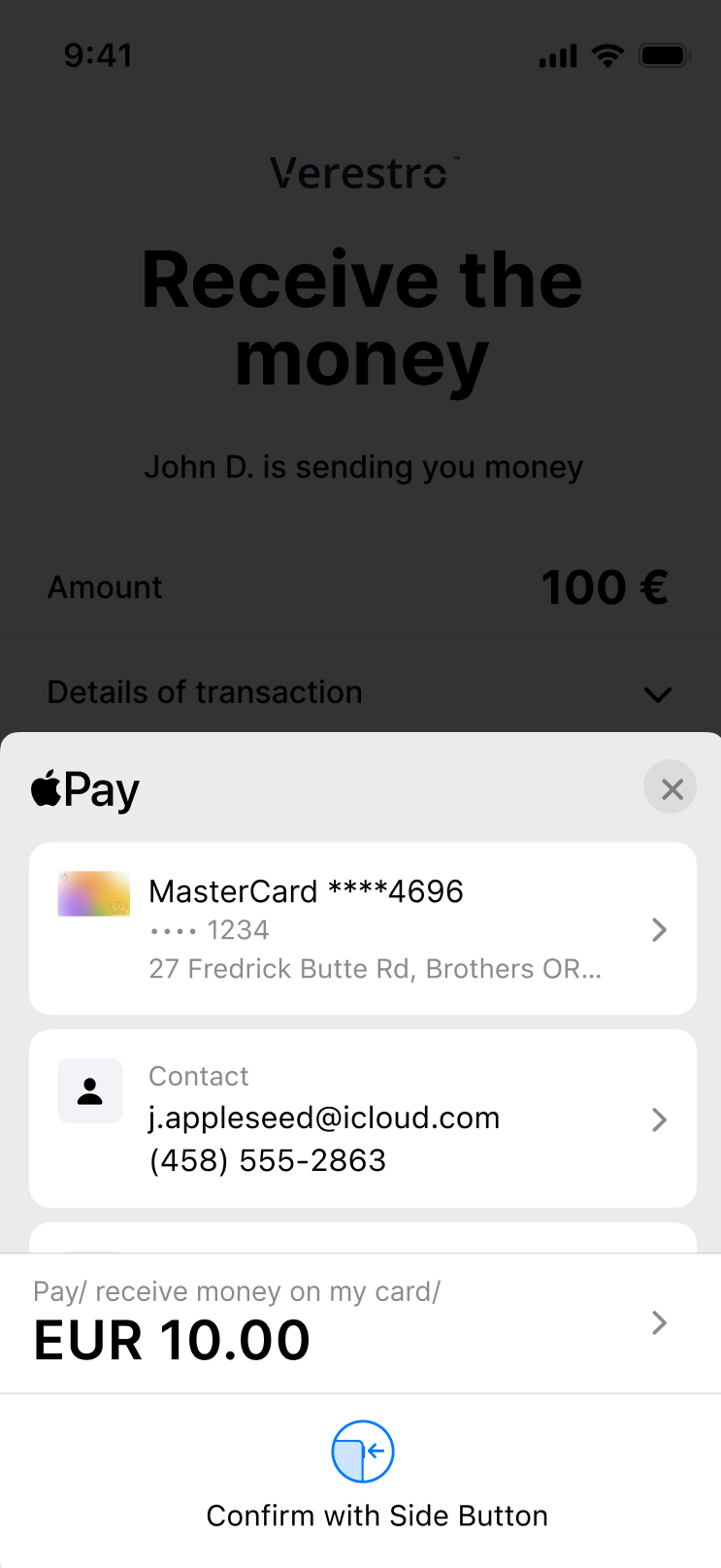

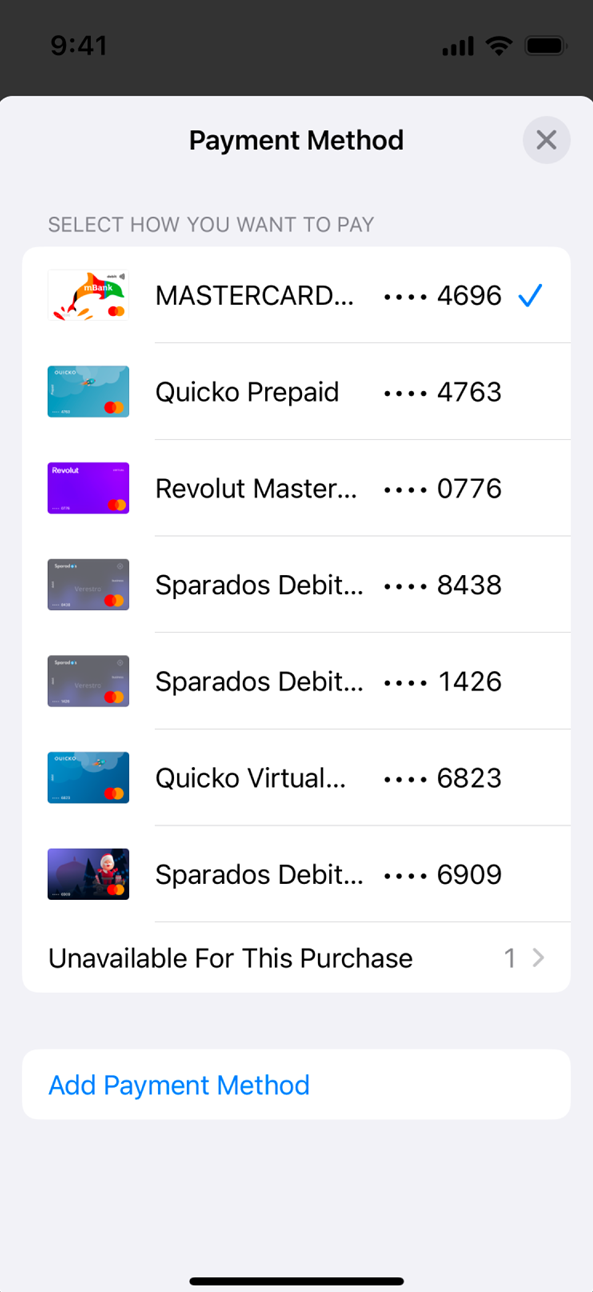

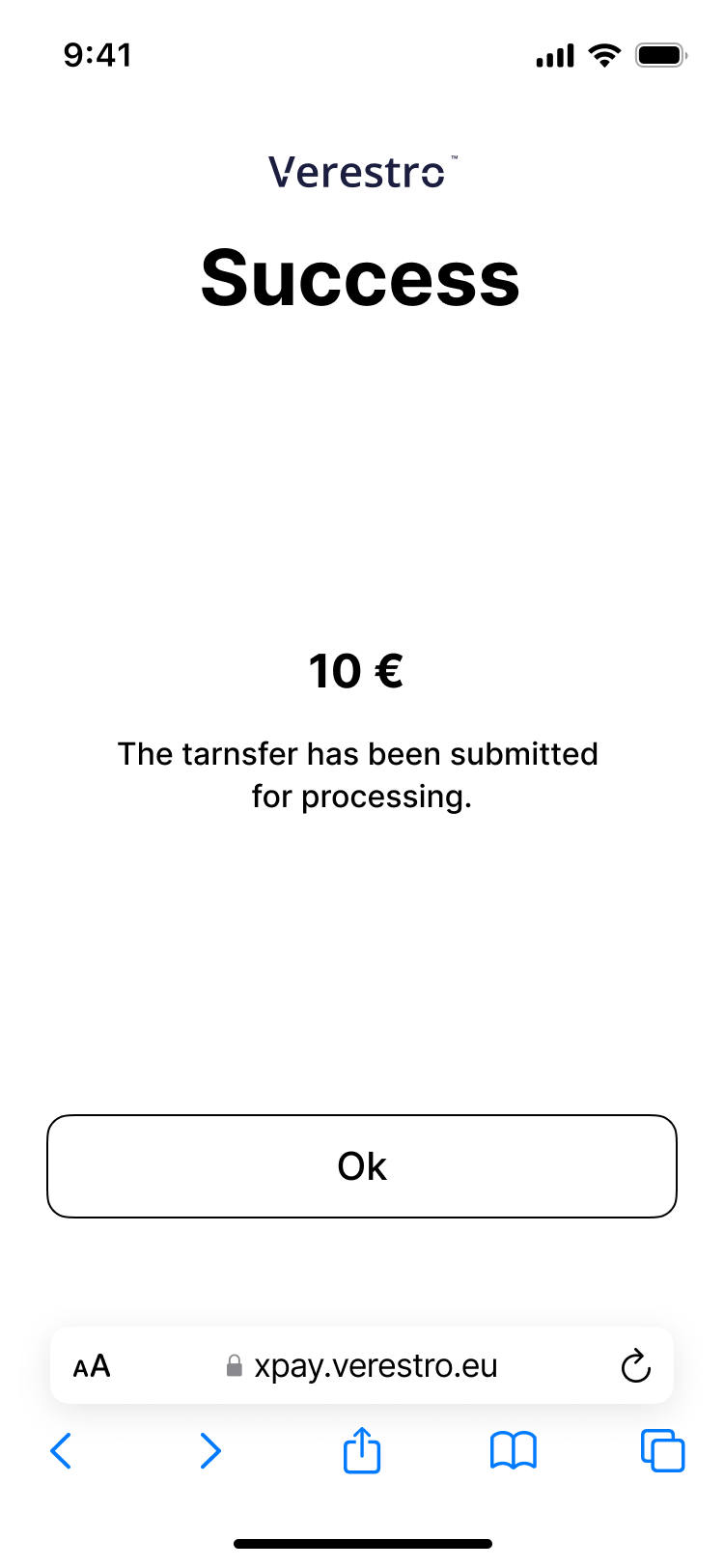

The recipient receives the link you sent. It is valid for a specified period of time - you can choose the link's lifetime yourself and provide us this information during the onboarding process. After opening the link, a payment template with transaction data is displayed to the recipient. Basicly, the recipient will see how much money he will receive and in what currency. However, to receive the money, the recipient must select the card to which the funds should to be transferred. Our application provides three sources of the card: Google Pay and Apple Pay wallet or providing card manually.

|

|

|

| 3. Recipient gets message with payment link from the Sender. Recipient clicks that link. | 4. Recipient is redirected to Payout to card and xPay view (this step takes place in Verestro Payout to card and xPay application). |

Top-up card by xPay card token

Depending on the browser the recipient uses, the template will display the option to use the Google Pay wallet (for most browsers) or the Apple Pay wallet (for the Safari browser). From the mentioned xPay wallet, the selected card will be topped up with the funds you declared step before. After making a Payout to the selected card from the xPay wallet, your company's balance is debited for this amount.

UML presenting top up card from xPay step by step

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

participant "Money Receiver" as user

participant "Verestro" as payt

participant "Google/Apple Pay" as xpay

participant "Acquirer" as acq

note right of user: Money Receiver gets payment link via SMS/Messenger/etc sent by Sender

user->user: Open payment link

note right of user: Link redirects Money Receiver to the web browser

user->payt: Choose xPay card

payt->xpay: Get xPay card token

xpay->payt: Return xPay card token

payt->payt: Debit Money Sender's balance (declared transaction amount)

payt->acq: Payout to card

acq->user: Top up card from xPay card token

@enduml

Get xPay card token

The xPay card token is returned automatically from xPay wallet after the recipient selects Top Up with xPay button and choose proper card. Verestro is a registered Payment Service Provider in Google Pay and Apple Pay, which frees you from the need to integrate with these entities. We call one of the xPays asking for a card token of the card that recipient choosed.

| 5. Recipient chooses to get money on card from xPay wallet (at this step Verestro Payout to card and xPay opens xPay wallet). | 6. Recipient chooses proper card from xPay wallet (at this step xPay wallet returns card token to Verestro Payout to card and xPay). | 7. Payout to card and xPay application tops up Receiver's card (this step takes place in Verestro Payout to card and xPay application). |

Tip: After the transaction is completed, a notification will be sent to you informing you of the completion of the transaction and whether it was a success or failure.

Top-up card by providing it's number manually

The recipient may also enter the card PAN manually into the designated input field provided on this page if he/she prefers not to select a card from their xPay wallet. The recipient then confirms hir/her intention to accept the transfer by clicking the “Confirm” button. Once confirmed, the funds are credited to his/her balance immediately. Detailed description of this feature is described here.

UML presenting top up card provided manually

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

participant "Money Receiver" as user

participant "Verestro" as payt

participant "Acquirer" as acq

note right of user: Money Receiver gets payment link via SMS/Messenger/etc sent by Sender

user->user: Open payment link

note right of user: Link redirects Money Receiver to the web browser

user->payt: Provide PAN manually into the input then confirm

payt->payt: Debit Money Sender's balance (declared transaction amount)

payt->acq: Payout to card

acq->user: Top up provided card

@enduml

Tip: After the transaction is completed, a notification will be sent to you informing you of the completion of the transaction and whether it was a success or failure.