Overview

This document provides high level description of functionalities offered by Token Payment Service. Token Payment Service supports e-commerce transactions by card payment token received from Google Pay™ thus eliminating the need to use real card details during transactions. As a registered PSP in Google Pay™, Verestro will decrypt the card payment token and perform the transaction on behalf of the Customer. The solution is very easy to integrate - Customer must integrate two API methods: tokenPayment and deposit. There is also a third method getTransacionDetails which is optional to integrate. The solution can be supported by various Acquirers.

Verestro recommends using the getTransacionDetails method. For example in situations when there were any problems with the connection between the Customer and Verestro. This method allow Customer to get current status of the ordered transaction.

If the Customer requires the settlement of the transaction by a new Acquirer – to which Verestro is not integrated – there will be required new integration between Verestro and the new Acquirer. The specification of the new Acquirer should be provided by the Customer.

Abbreviation

This section shortly describes abbreviations and acronyms used in the document.

|

Abbreviation |

Description |

|

ACQ |

Acquiring Institution / Acquirer |

|

ACS |

Access Control Server |

|

OS |

Operative System |

|

Mid |

Merchant Identifier identifying the Customer in the Acquirer system |

|

PCI DSS |

Payment Card Industry Data Security Standard |

|

PAN |

Permanent Account Number |

|

CVC |

Card Verification Code |

|

3DS |

3-D Secure |

|

PSP |

Payment Service Provider |

Terminology

This section explains a meaning of key terms and concepts used in this document.

|

Name |

Description |

|

Customer/Merchant |

Institution which uses Verestro products. This institution decides which solution should be used depending on the business requirements and how transaction should be processed. |

|

User |

End-User which uses Customer application and pays for Customer's goods using Google Pay™ solution. This is the root of the entity tree. User is an owner of the card stored in Google Pay™ system. |

|

Card Payment Token |

Card Payment Token is an entity created by Google Pay™ and returned to the Customer. This token is created when the Customera application user selects the card he wants to pay with Google Pay. Card Token Payment is encrypted and does not contain valid card details. This token is decrypted on the Verestro side and then Verestro orders the payment to the Customer's Acquirer. |

|

Authorization Method |

The way of the authentication of the card transaction. Verestro supports followed authorization methods: |

|

Gateway Id |

Phrase/value that identifies a given Payment Service Provider in the Google Pay™ system. The Merchant provides gateway Id to Google Pay™ to obtain a card payment token. By provided gateway Id, Google Pay™ encrypts the card payment token with the appropriate public key. Verestro is defined by a gateway Id with the value |

|

Gateway Merchant Id |

Unique Customer identifier assigned by Verestro during the onboarding process. This identifier is in the form of a |

|

Payment Service Provider |

Payment Service Provider is an entity that helps Merchants transfer sensitive data to Acquirer during the transaction. Payment Service Provider should be PCI DSS compilent. In the Token Payment Service solution, Verestro has the role of PSP. |

|

Acquirer |

External Institution resposible for processing transaction and 3ds requests ordered by the by Verestro Token Payment Service solution in Customer context. Acquirer connects with banks / card issuers and returns an information whether the ordered action on a given card payment token is possible. |

|

MID |

Merchant identifier. This entity is represending Customer / Merchant in Acquirer's system. Customer has to provide the mid information to enable mid configuration in the Verestro system. Required to process transactions and 3DS via Verestro system. |

|

Card Network |

This is the type of card that allows you to make payments using a card payment token. Verestro allows to use |

|

PAN |

It is 7-16 digits of the credit / debit card number. These digits contain the Permanent Account Number assigned by the bank to uniquely identify the account holder. It is necessary to provide it when User wants to pay with a card for purchases on the internet. |

|

CVC |

It is a type of security code protecting against fraud in remote payments. Card Verification Code is necessary to provide it when User wants to pay with a card for purchases on the internet. |

|

Expiration Date |

It is a date of the card validity ending and contains two values – month/year. Card will be valid to the last day of the month of the year showed on it. It is necessary to provide it when User wants to pay with a card for purchases on the internet. |

|

3DS |

3-D Secure is a method of authorization of transaction made without the physical use of a card, used by payment organization. The 3DS process in the Merchant Paytool solution is performed internally in the Verestro system. |

|

PCI DSS |

It is a security standard used in environments where the data of payment cardholders is processed. The standard covers meticulous data processing control and protection of users against violations. |

Token Payment Service key components

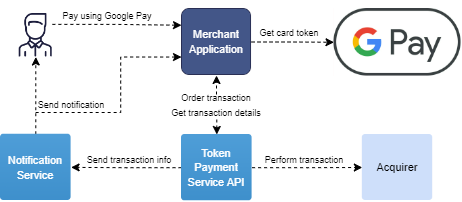

Token Payment Service is a solution that has been created to provide the functionality that allows Customer to process payments using Google Pay™. An additional assumption was that the payment process should be performed outside the Customer's system, which frees him from the need to handle with sensitive data or the transaction itself. The Customer only receives information that the transaction was successful or not. Customer can also follow the most actual transaction status. This section provides introduction to technologies which are supported by Token Payment Service. High level architecture diagram is presented to show the place and usage of the each entity in the solution.

|

Component |

Description |

|

Token Payment Service API |

Component stores the configuration data of a given Customer such Merchant Name or Merchant Id and also communicates with various Acquirers, collect transaction data and statuses. This component also triggers notifications to the Customer and the end user (depending on the Customer requirements) about successful or unsuccessful transaction. |

|

Notification Service |

Component responsible for sending information to the Customer about the transaction status. It is also responsible for sending email to the end user about the transaction. Notification Service is triggered by Token Payment Service API. |

The diagram below shows each step of the card payment token transaction process

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

participant "User" as user

participant "Customer Application" as app

participant "Google Pay" as gp

participant "Verestro Token Payment Service" as tps

participant "Acquirer" as acq

note right of user: User wants to pay with Google Pay

user->app: 1. Pay with Google Pay and choose card

app->gp: 2. Requests for card token

gp->gp: 3. Encrypts card token with Verestro pub key

app<-gp: 4. Returns encrypted card token

app->tps: 5. Requests token payment "/payment/token.google-pay"

tps->tps: 6. Decrypts card token

tps->acq: 7. Orders transaction

tps<-acq: 8. Transaction status

note left of acq: 3DSecure authentication may be required

app<-tps: 9. Transaction status

user<-app: 10. Transaction status

user<--tps: 11. Sends email notification - optional

@enduml

Allowed card networks

Listed below are the types of cards supported in transactions using the Token Payment Service and Google Pay™ solution:

|

Card type |

|

|

|

|

|

|

Implementation models

Verestro provides REST API implementation model in Token Payment Service Solution. In this model Customer has his own application which should be integrated with Token Payment Service API. Verestro provides all necessary backend methods. Customer is responsible for integrate provided methods with his own application. Technical information about the integration can be found here. Below diagram shows high level architecture of the solution: