Use cases

The tool dedicated to performing KYB verification consists of Administration Panel, KYB Form, and Customer Panel.

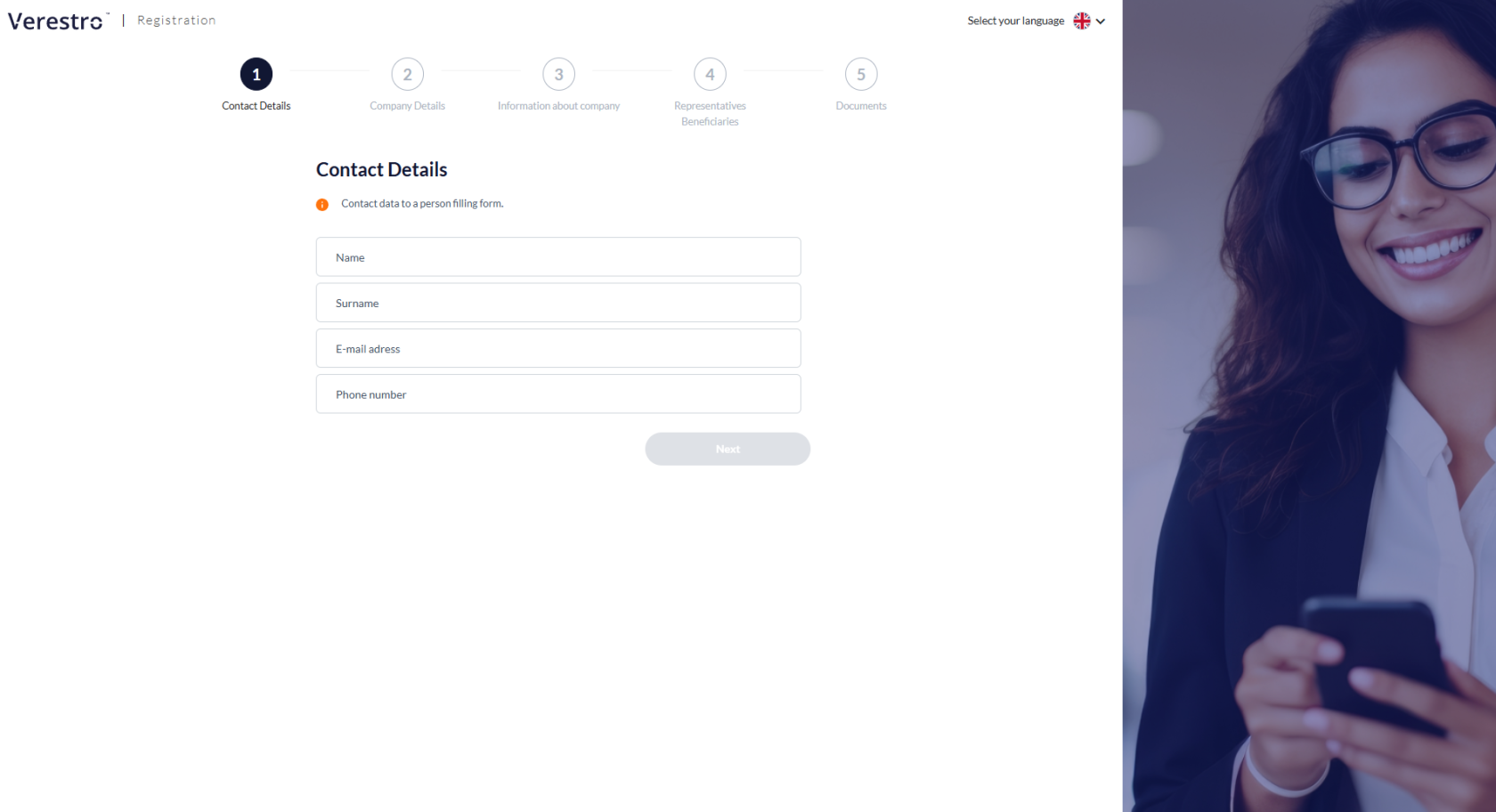

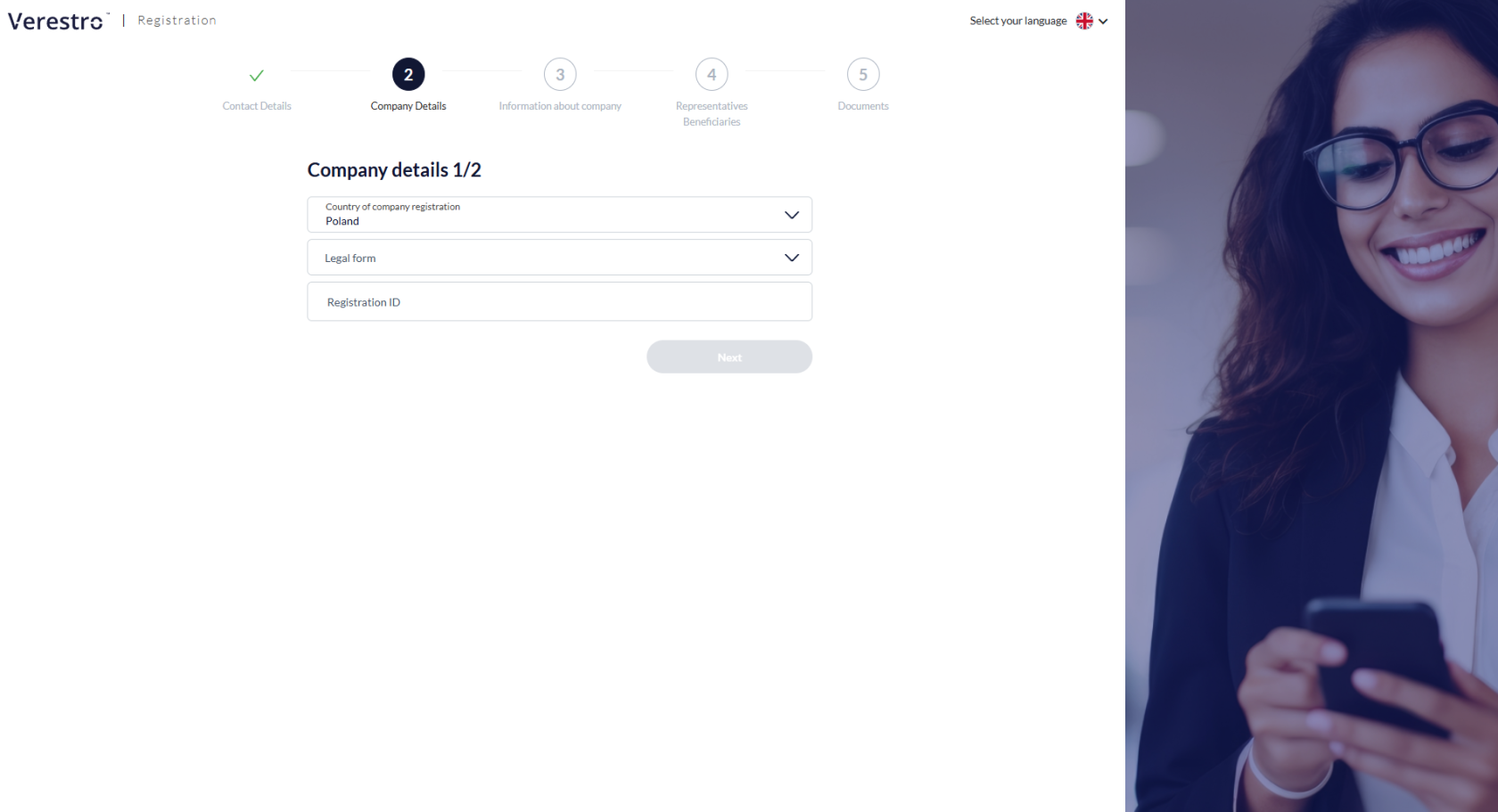

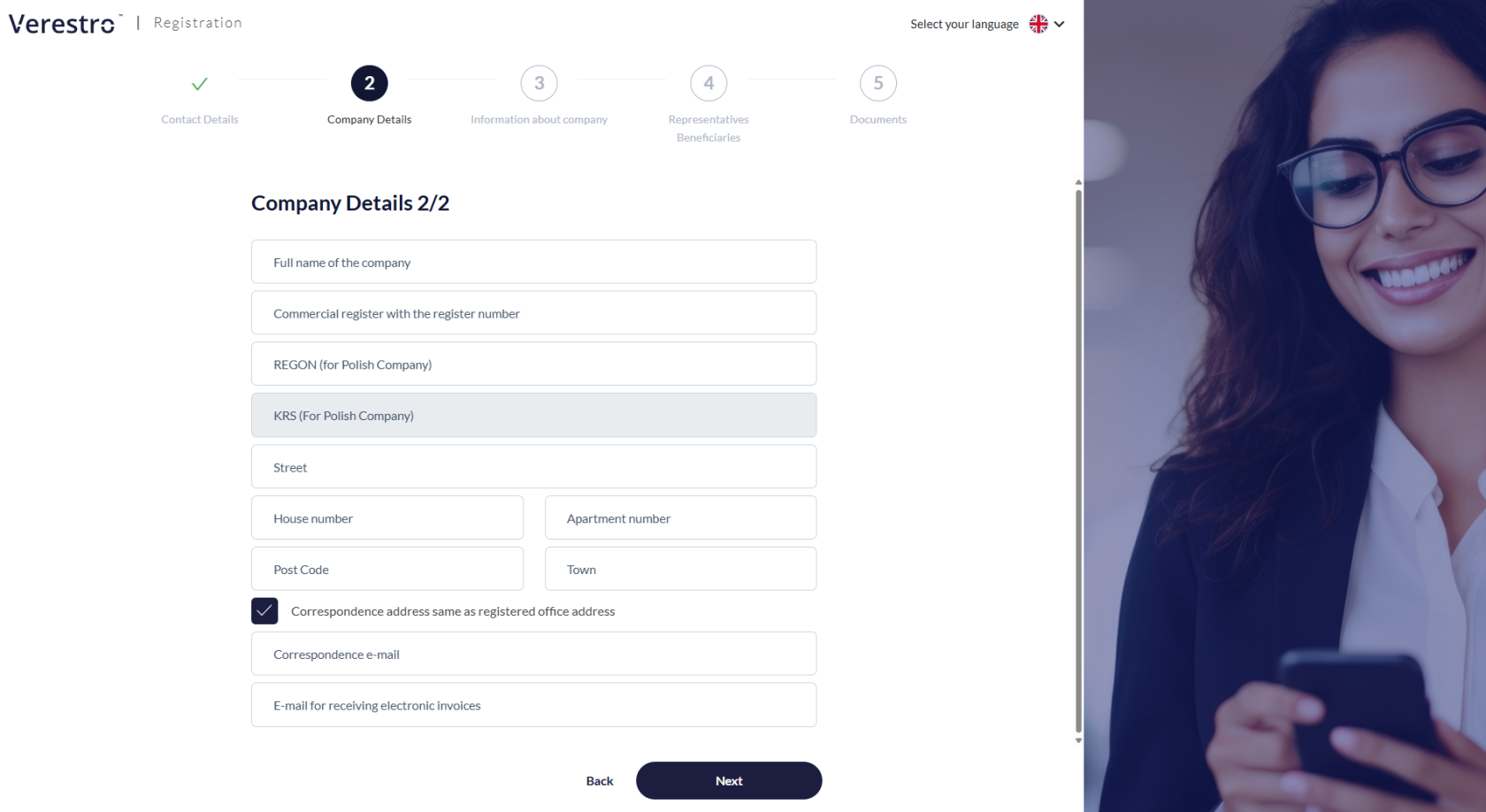

Registration process

Step 1: User provides his contact data (name, surname, email address and phone number).

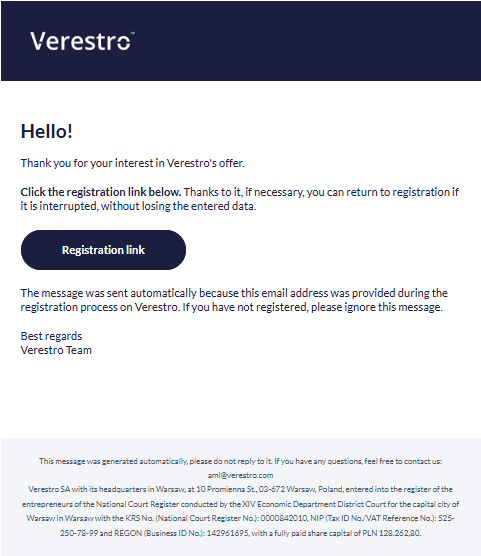

After step 1, user receives email with the link to the registration process to not lose the entered data. By clicking the link, user can rejoin the KYB process.

Step 2: User provides company’s details (NIP/Tax ID, full name of the company, legal form, REGON, KRS, company’s address and other).

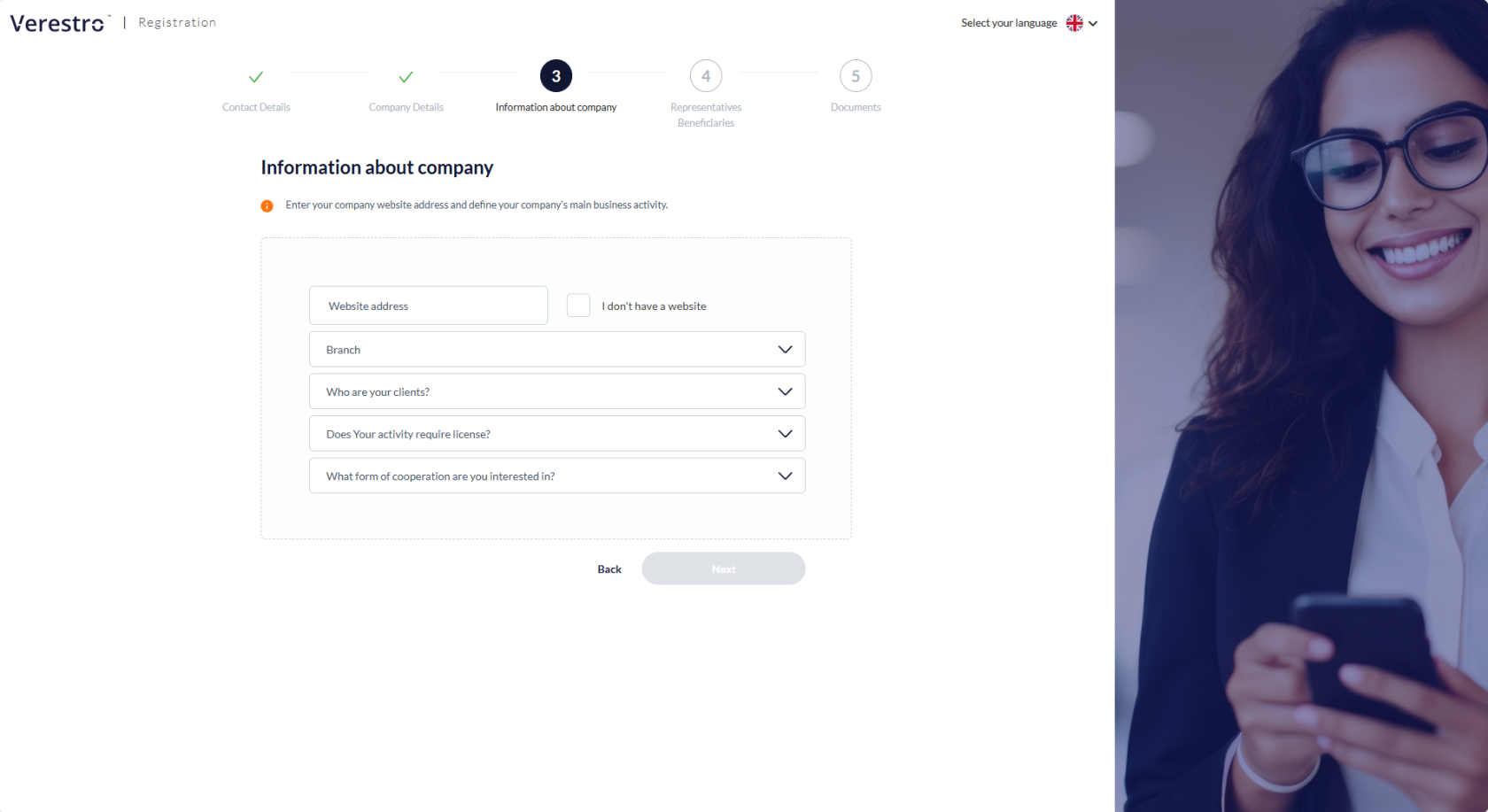

Step 3: User provides all information about company – website address, branch, type of company’s customers and provides information if company’s activity requires any license (what’s the license number).

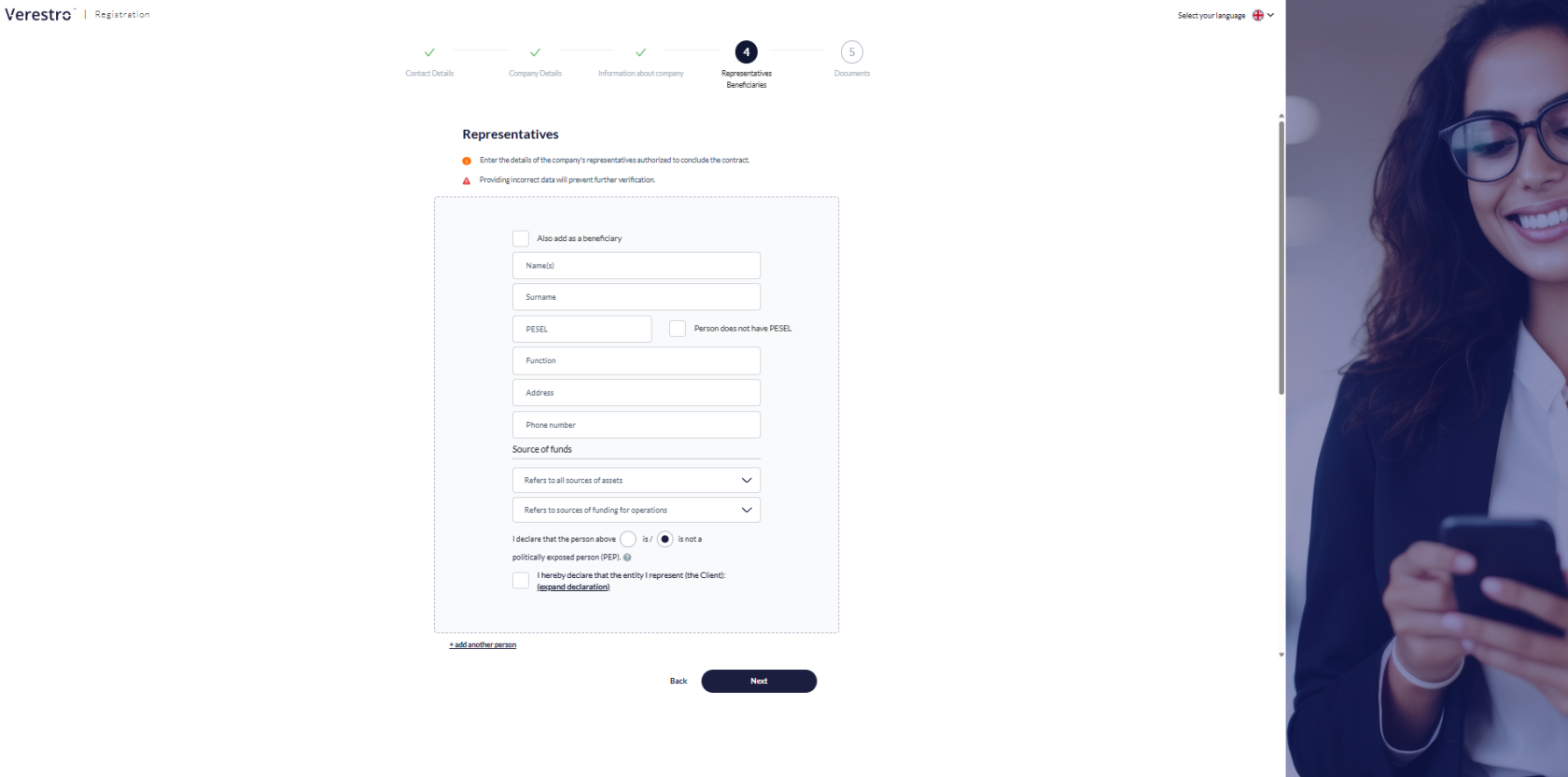

Step 4: User provides information about company’s representatives that are authorized to conclude the contract. For each representative, user needs to enter representative’s name, surname, PESEL (if applicable), date of birth, address, phone number, source of funds, declaration if the representative is a/is not a politically exposed person and sanctions declaration.

Step 4: User provides information about company’s representatives that are authorized to conclude the contract. For each representative, user needs to enter representative’s name, surname, PESEL (if applicable), date of birth, address, phone number, source of funds, declaration if the representative is a/is not a politically exposed person and sanctions declaration.

User can add more than one representative.

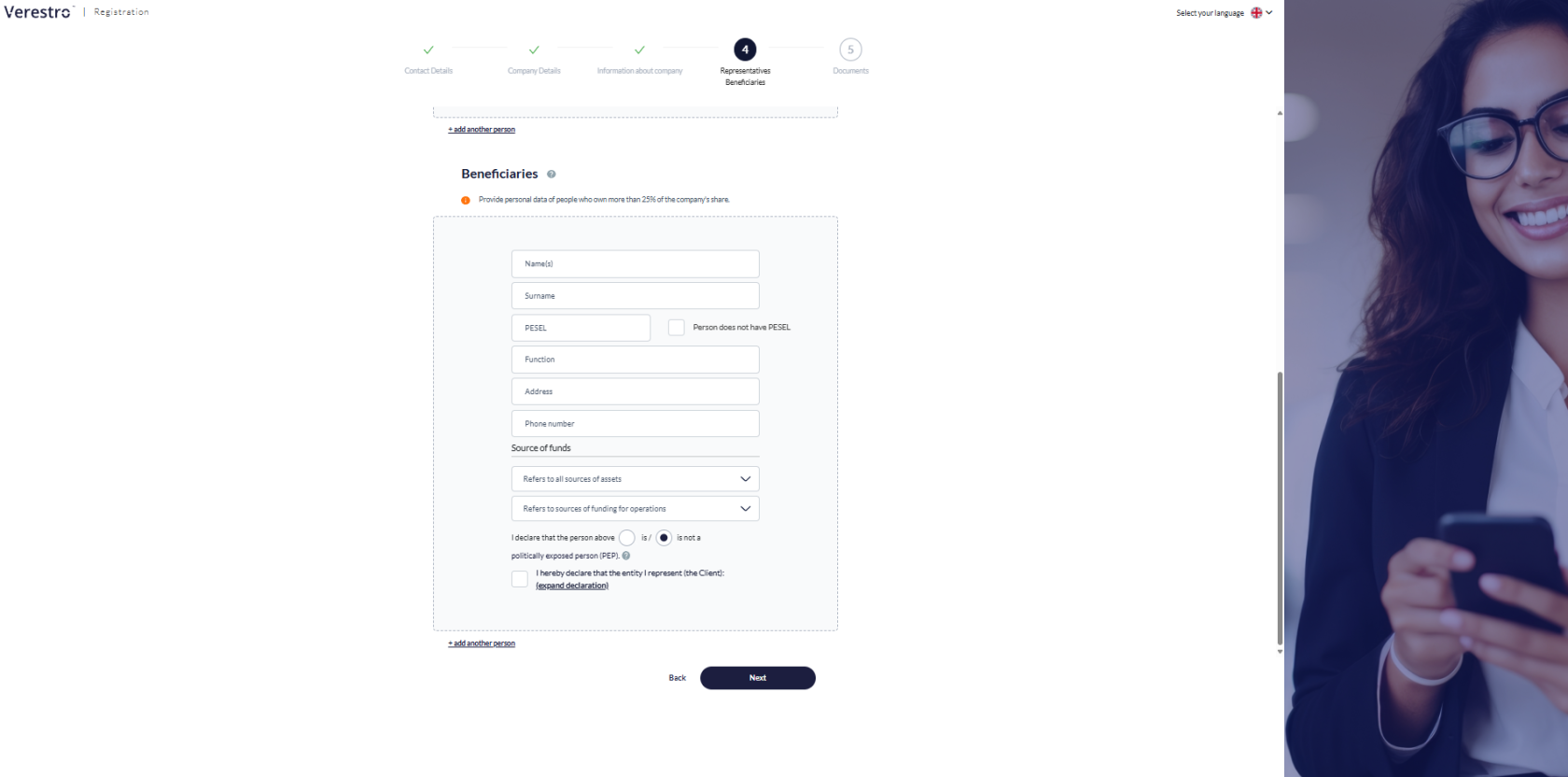

User needs to enter company’s beneficiaries and provide same personal data as for the representatives. User can provide more than one beneficiary.

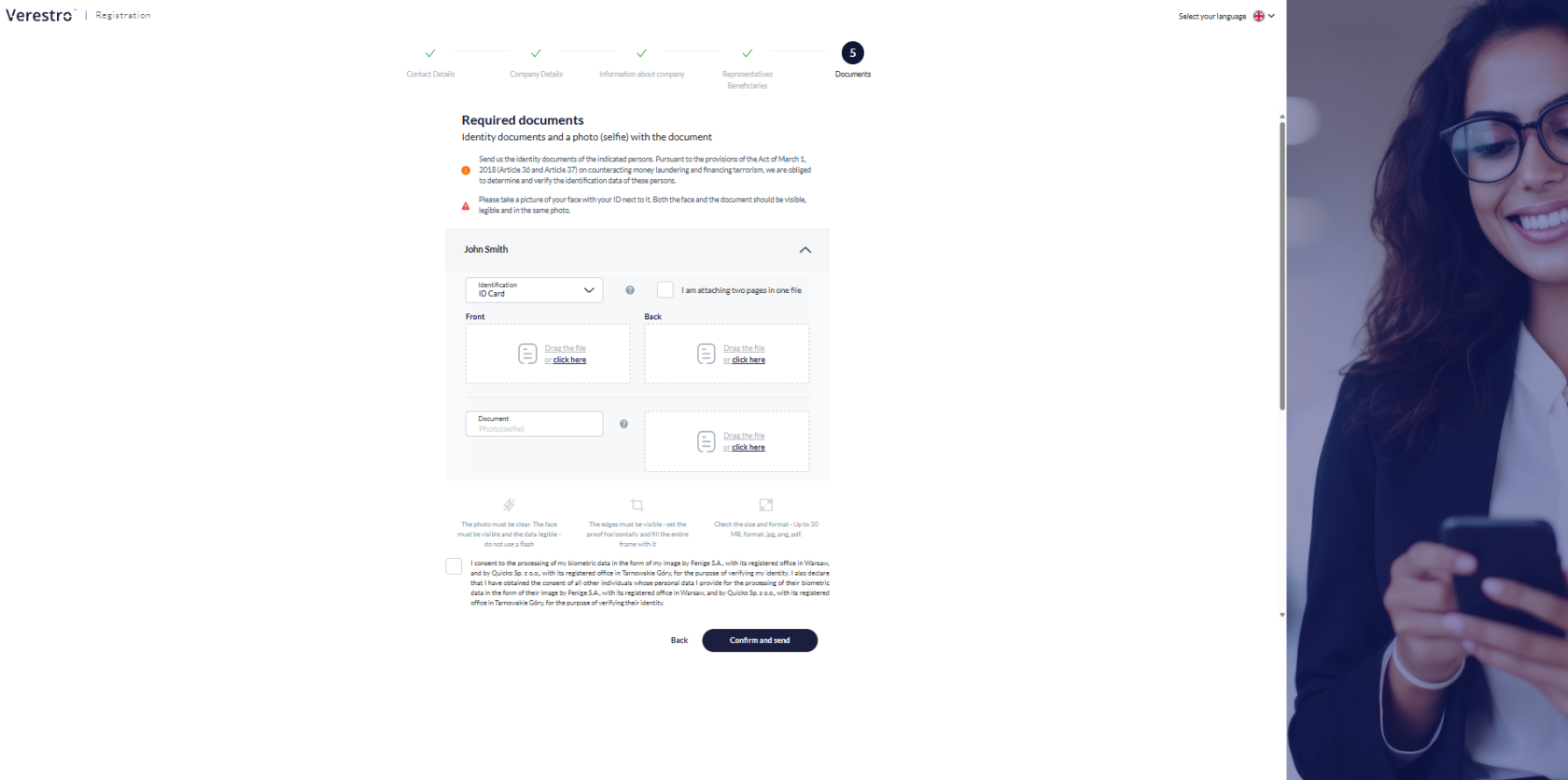

Step 5: User identifies type of document, then user needs to attach photo of identity documents (front and back) and selfie of the indicated persons.

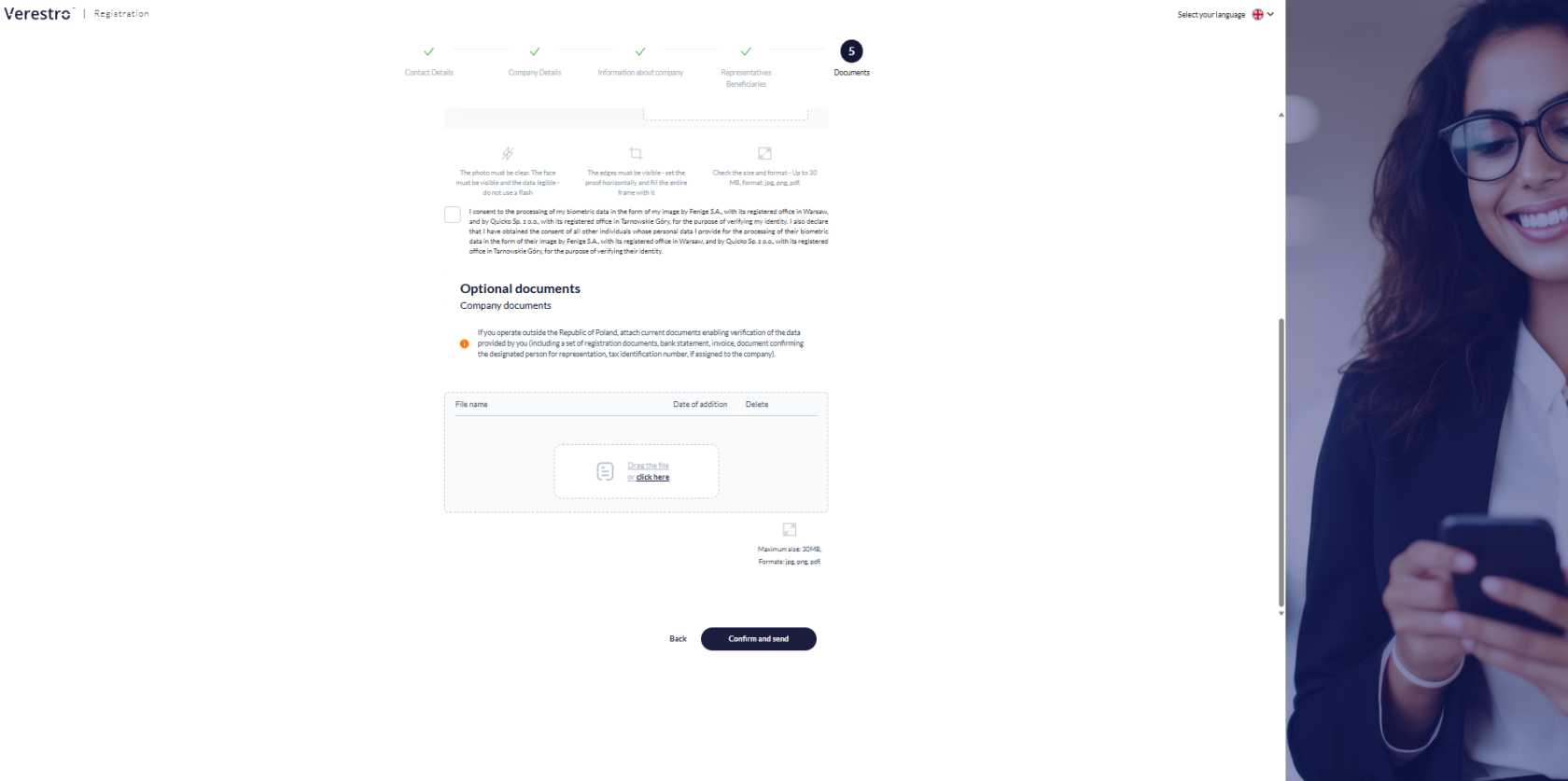

User can enter additional documents or wait to be contacted by an AML employee who will indicate which documents will be needed for your company's KYB verification.

The process of completing the form is complete.

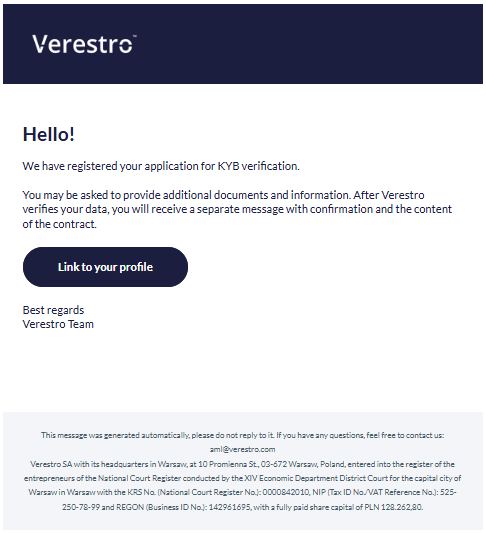

User receives an email confirming the application. An AML employee will start the verification. An AML employee will contact you to verify, confirm the information you have entered or ask for additional data.

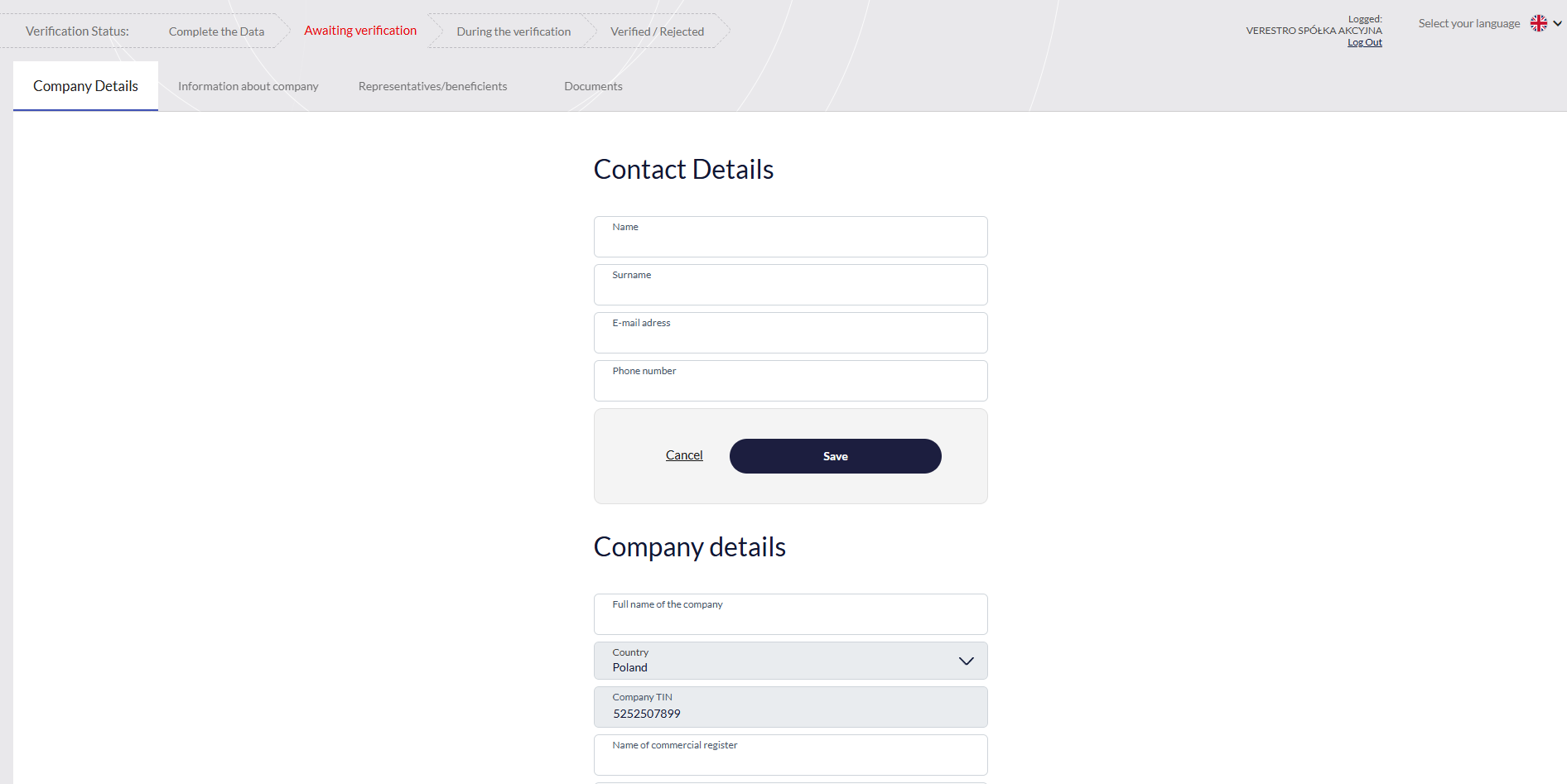

In the link from the email above, you will be given access to the Administration Panel, where you can check the data you have entered, attach documents and check comments from the AML officer.

The verification process can take up to 7 days.

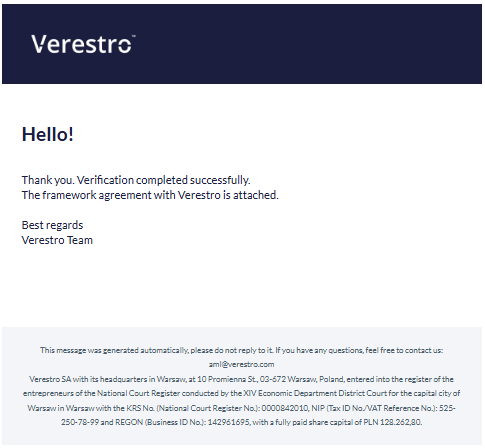

Once accepted, you will receive an email with a template of the framework agreement.

Administration Panel

The Administration Panel offers many sections and functionalities that enable efficient and transparent customer onboarding.

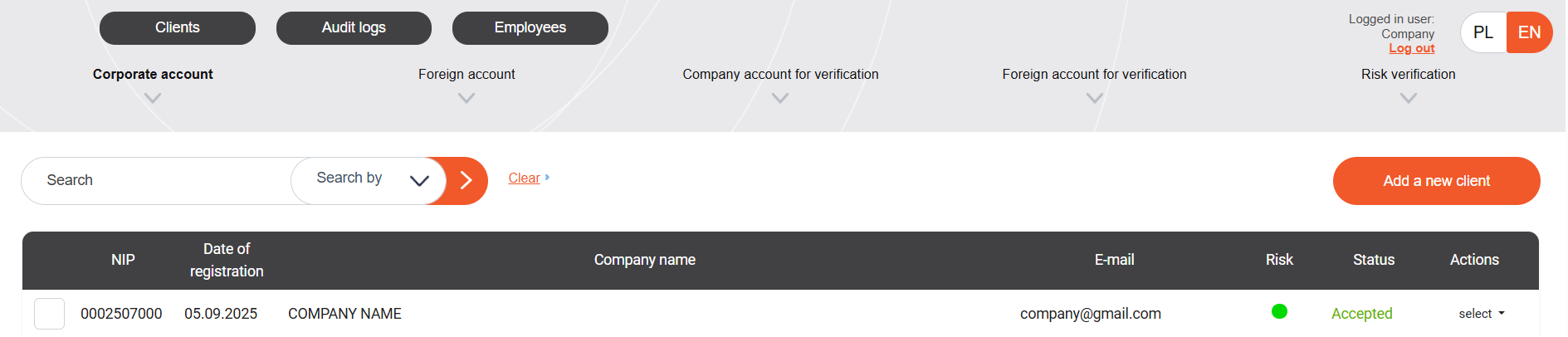

Clients

This section lists all clients who have started completing the KYB form. Verification can begin after the client completes the form- until then, they can access their Client Card or reject the form.

Available filters allow you to search for a specific entity by email, TAX ID (NIP), or company name. The main view displays the onboarded entity's details, such as: TAX ID (NIP), Date of Registration, Company Name, Email, Risk, Status, and available Actions.

Automatically changing statuses are available throughout the client registration and onboarding process:

| Status | Description |

| Accepted | Merchant accepted |

| During verification | Merchant is currently under verification |

| New | Merchant newly added with accepted terms and conditions, but missing some data |

|

New without regulations |

Merchant newly added without accepted terms and conditions, missing some data |

| Rejected | Merchant rejected from the system by an employee |

| Verification risk |

Merchant has all sections reviewed and accepted by an Employee and is awaiting risk assessment by a higher-authority Employee |

| Waiting for data correction | Merchant needs to correct the data entered during registration |

| To verify | Merchant has completed registration, provided all necessary data, accepted the terms and is awaiting verification |

| Waiting for acceptance |

Merchant has been verified by an Employee and is waiting for approval by an Employee with the appropriate role |

| During period verification |

Merchant has already been verified and accepted, but a re-verification is being opened. |

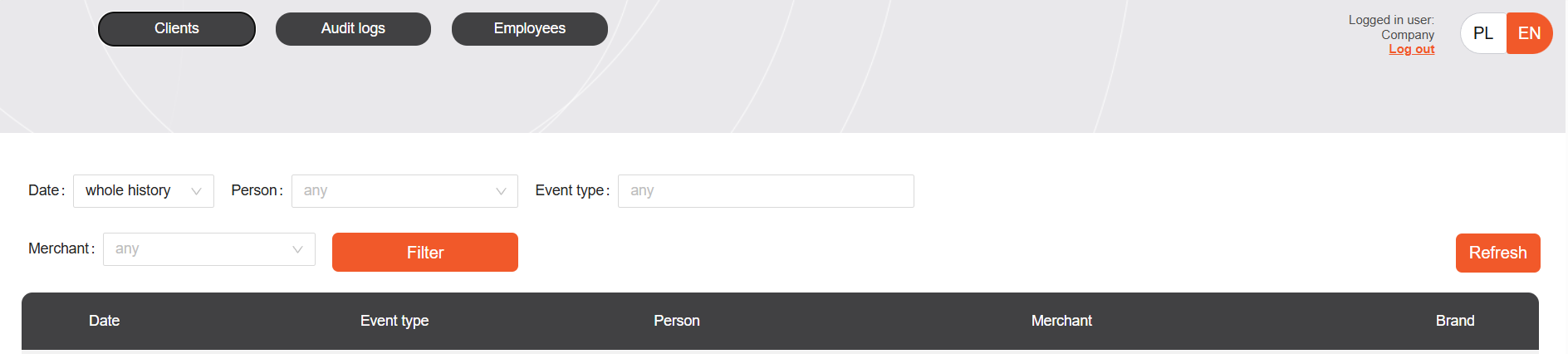

Audit logs

Audit logs tab provides all system, merchant, and operator actions globally. These include details about onboarding changes for each merchant, with filtering and drill-down options.

This allows you to monitor merchant and operator activity, as well as automatic status changes and email sending.

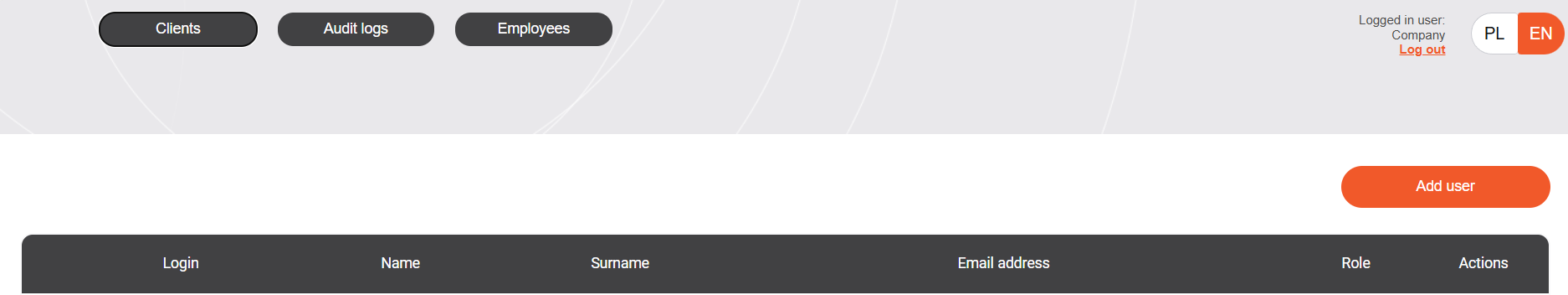

Employees

Here you can add employees with the permissions most appropriate for their role in your organization. These are broken down into:

- Administrator

- Administration

- Trade

- Customer Service

- Customer Service Tech

- ESEC

- Legal

- Final Approval

It is possible to select more than one role for a specific employee, as well as to define notifications about the appearance of a new client in the system (i.e. after completing the form).

Each added employee can be edited and deleted.

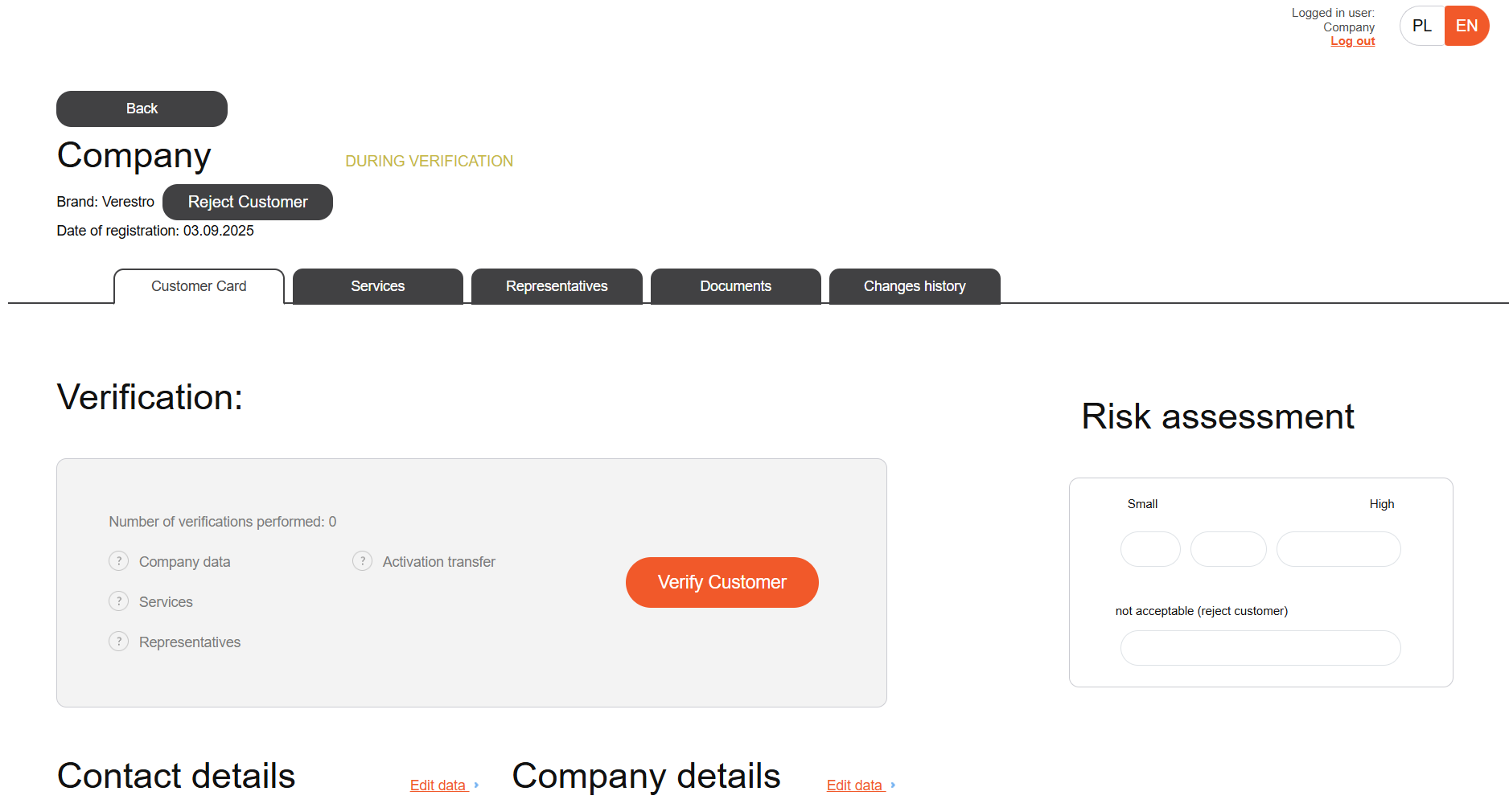

Verification

In the verification section, you can not only check the data entered by the customer, but also take many actions.

Company data

You have access to all the data entered by the customer in the KYB form, you will find it in the section describing the registration process.

Comments

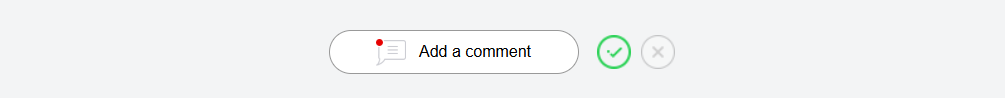

You can add a comment to each section, which, after saving changes, will send an email to the client informing them that the entered data needs to be corrected. The comment will also be displayed in the Client Panel in the format you entered.

Internal memo

This is a note that will not result in any action for the customer, but is intended to leave internal information regarding onboarding or the merchant.

Documents

Here you can review, download, and add a label to a document attached by the client. You can also attach a document, form, or template that the client should download and complete. You can do this by opening the 'Add a comment' section in the Documents section and then adding the file. Once uploaded, click "Add."

Sanction lists

In the Administration Panel, you can check for presence on sanctions lists both in the context of the onboarded entity and its Representatives and Beneficiaries. The check can be performed manually during verification, but it is also performed automatically every day, which you can verify in the Audit logs. The check is performed on the OFAC, UN, MSWiA (Polish list) and FSL lists.

Risk assessment

It is possible to assign risk to a merchant without finishing the verification process, which can be done later or by another operator. In order for risk assignment to be possible, each section must be marked as completed:

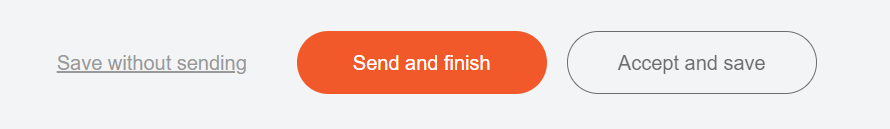

Finish Verification

Once the verification process is complete, all sections are filled in, and the risk is assigned, you can finish the process. The merchant will then receive an email notification about the verification result- rejection or acceptance. A framework agreement template will also be sent. Once the verification is complete, you cannot edit the data, but you can open a periodic verification and then make the necessary corrections or ask the merchant to do so. Periodic verification also requires risk assignment and customer acceptance, which will be communicated in the same way as in the original process.

Client card

Client card is a place where operators who don't have access to the verification section can monitor the process and view the necessary information about the merchant. It offers selected editing and display options. The client card also allows you to check the detailed history of a given merchant, i.e., actions taken by the operator, merchant, and system changes.