Overview

Cashback is a financial incentive where cardholders receive a percentage of the money they spend back as a reward. This refund is typically credited to their account or card balance.

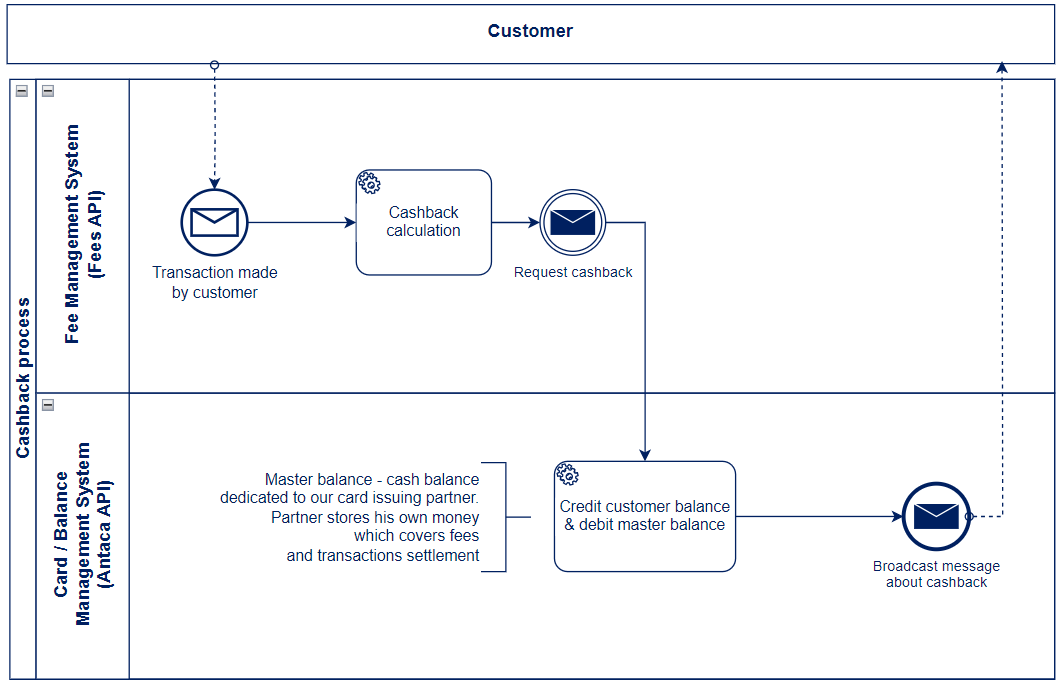

How cashback works?

When a cardholder makes a purchase using their payment card, a predetermined percentage of the transaction amount is refunded to them as cashback. For instance, if a cardholder spends $200 and the cashback rate is 2%, they will receive $4 as cashback.

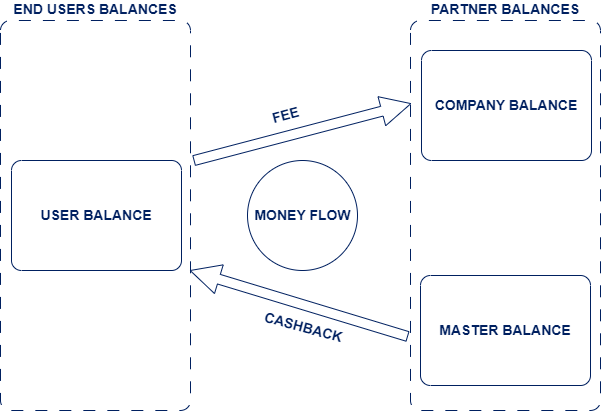

Cashback money flow

Cashback is an internal transaction for a partner who wants to top up the user's balance as part of the loyalty program.

Our card & balances management system (Antaca) automatically debits the masterbalance with this transaction.

Benefits of using cashback

- Customer Loyalty: Encourages repeat purchases and enhances customer loyalty.

- Increased Spending: Motivates customers to spend more to earn cashback.

- Competitive Edge: Offers an attractive benefit that can differentiate your product from competitors.

Key features of the cashback

- Customizable Rules: Create specific cashback rules such as minimum transaction amounts.

- Real-Time Processing: Immediate calculation and allocation of cashback after transactions.

- Secure and Scalable: Robust security measures and scalable architecture to handle large volumes of transactions.

Common scenarios for cashback usage

Online shopping

- Scenario: A customer makes a purchase on an e-commerce platform.

- Process: The transaction amount is checked against the cashback rules, and the applicable cashback is credited to the customer’s account.

In-store purchases

- Scenario: A customer uses their payment card at a physical retail store.

- Process: Similar to online shopping, the transaction is processed, and cashback is calculated and credited in real time.

Subscription services

- Scenario: A customer subscribes to a monthly service such as streaming or software.

- Process: Each recurring transaction is evaluated for cashback eligibility based on the defined rules.

Cashback Calculation Models

The cashback amount can be calculated in various ways as described below. We can distinguish between two fee calculation models: percentage and fixed.

Percentage price models

| Percentage Flat Rate | Percentage Tiered Rate | Decimal Fraction Flat Rate | |

| Description | "x" % of the transaction value |

"x" % of the transaction value for transactions > 100 USD "y" % of the transaction value for transactions <= 100 USD |

A fraction of the transaction value after the decimal point |

| Example cashback amount |

0,5% * 125 USD transaction = 0,62 USD |

0,5% * 125 USD transaction = 0,62 USD 0,2% * 95 USD transaction = 0,19 USD |

0,45 USD when transaction value was 125,45 USD |

| Status | Possible | Possible | Requires development |

Important! Decimal Fraction Flat Rate calculation model requires development.

Fixed price models

| Fixed Flat Rate | Fixed Tiered Rate | |

| Description | "x" USD per transaction |

"x" USD of the transaction value for transactions > 100 USD "y" USD of the transaction value for transactions <= 100 USD |

| Example cashback amount |

0,05 USD |

0,05 USD for 150 USD transaction 0,02 USD for 75 USD transaction |

| Status | Possible | Possible |

Cashback Trigger Models

This section describes the moment when cashback is executed.

| Instant | Periodic | Manual | |

| Description | Automatically after the transaction occurs | Once per specified period (daily, weekly, monthly, quarterly, yearly) | Triggered manually by the user in the app (or via API) |

| Status | Possible | Requires development | Requires development |

Important! Periodic and Manual triggering models require development.

Cashback Payout Conditions

This section describes the rules that define whether cashback should be issued for a given transaction. These rules allow you to specify the conditions that must be met for cashback to be paid out, taking into account transaction data (merchant ID, transaction category, transaction amount, etc.).

Transaction/cashback amount conditions

| Single transaction amount | Cashback amount | Sum of transactions amount in specified period | |

| Description | Cashback only if the transaction amount is greater/less than "x" USD | Cashback only if the cashback amount does not exceed/exceeds "x" USD | Cashback once per specified period if the total transaction amount within that period is greater/less than "x" USD |

| Status | Possible | Requires development | Requires development |

Important! Cashback amount and Sum of transactions amount in specified period require development.

Transaction data conditions

The product can calculate cashback based on specific transaction data. Below are the specific elements according to which we can define cashback rules.

| Merchant identifier | MCC Code | Capture mode | Wallet type | |

| Description | Cashback based on the specific merchant or set or merchants. | Cashback based on the transaction category or set of categories. | Cashback based on method of payment. | Cashback based on digital wallet used for the transaction. |

| Example cashback behavior | 0,5% cashback on transactions made at Ikea merchant | 0,2% cashback on transactions made at book stores (MCC: 5942) |

0,25% cashback on transactions made onsite | 0,01% cashback on transactions made with Samsung Pay |

| Transaction type | Country | Currency | |

| Description | Cashback based on the specific transaction type (POS, ATM, eCommerce) | Cashback based on the transaction country | Cashback based on the transaction currency |

| Example cashback behavior | 0,3% cashback on eCommerce transactions. | 0,02% cashback on transactions made inside the EU. | 0,04% cashback on transactions made in USD. |

If multiple cashback conditions are defined, each condition must be met for cashback to be awarded.

Example cashback definitions:

0,05% cashback on transactions made at Ikea merchant, which have value greater than 50 USD, and are made onsite with Samsung Pay wallet.