**Note:** It is required that you have an account in Acquirer's system which will settle your transactions. For more informations please contact our Sale Department. We are suggesting to use [Fenige](https://www.fenige.com/) as this is our partner acquiring institution and we are fully integrated with this Acquirer

# Overview This chapter describes the terminology used in the document as well as the components of the Verestro system that are part of the C2C Widget. ## Terminology| **Name** | **Description** |

| Client User | A user registered in the client service. Roles in the C2C Widget: - generating and sending links to the C2C Widget to users outside the client application, - is the recipient of a C2C transfer carried out using a widget, - is not a direct user of the widget. |

| C2C User | A user registered for a service hosted in the C2C Widget. Roles in the C2C Widget: - registration in the C2C Widget, - is the sender of a C2C transfer carried out using a C2C Widget |

| Client | Verestro partner, enabling its users to receive transfers made by C2C users. The client allows its users to generate a link to the widget to C2C users via its application. |

| App | A client application in which the client provides services to its users, e.g. a banking application. In the application, the client allows users to generate and send a link to a C2C Widget to a user outside the application. |

| Acquirer | An external institution that communicates with the card issuer, protects against fraud and taking responsible for executing the transaction and checking the correctness of 3D Secure authentication. |

| Card | It is a payment instrument issued by the issuer to a given user. Users can send funds using the card. |

| Issuer | Bank, card issuer. It determines whether a given transaction can be performed and whether 3D Secure authentication is needed. |

Client user ≠ C2C user. Application ≠ C2C Widget.

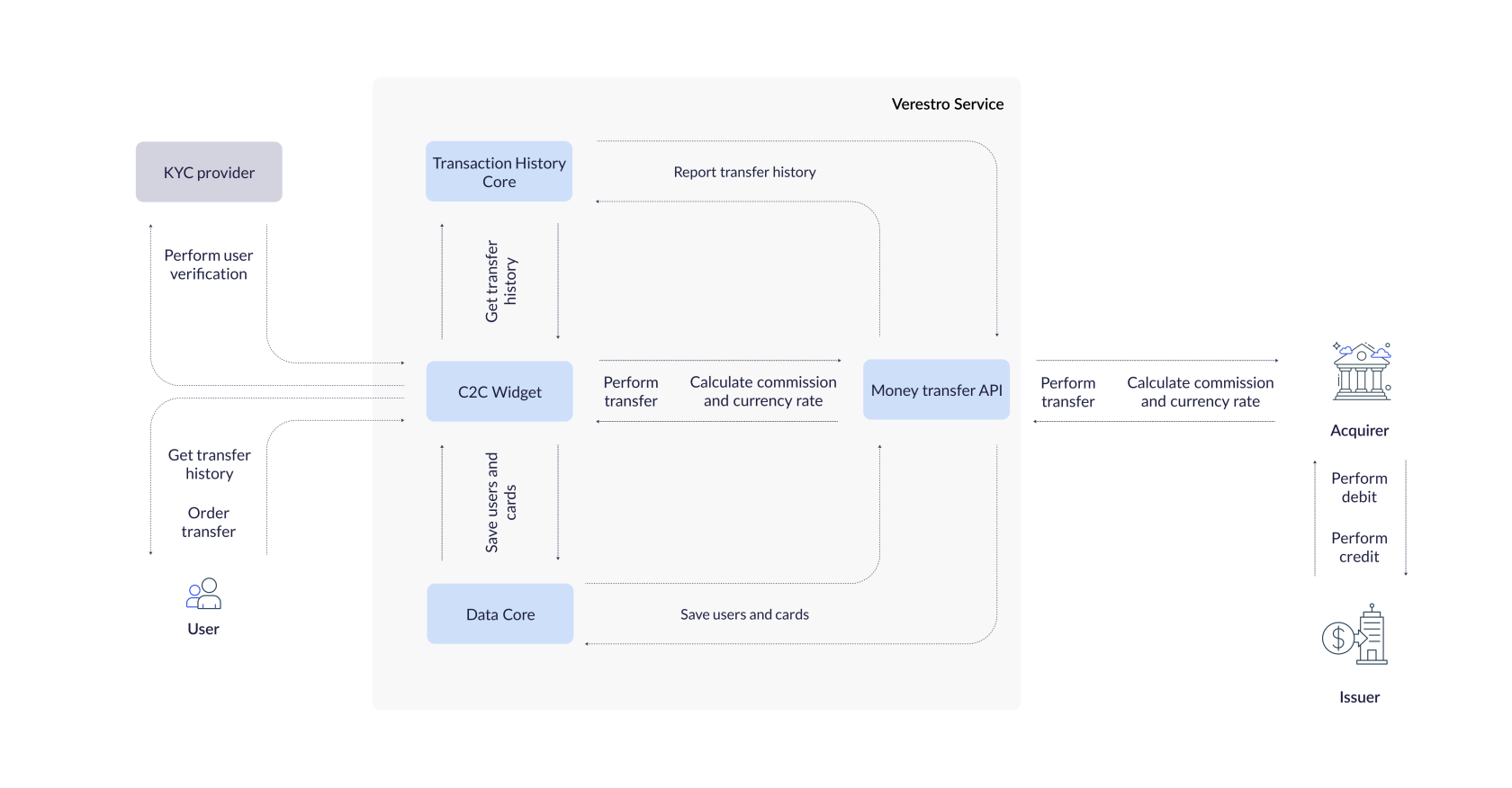

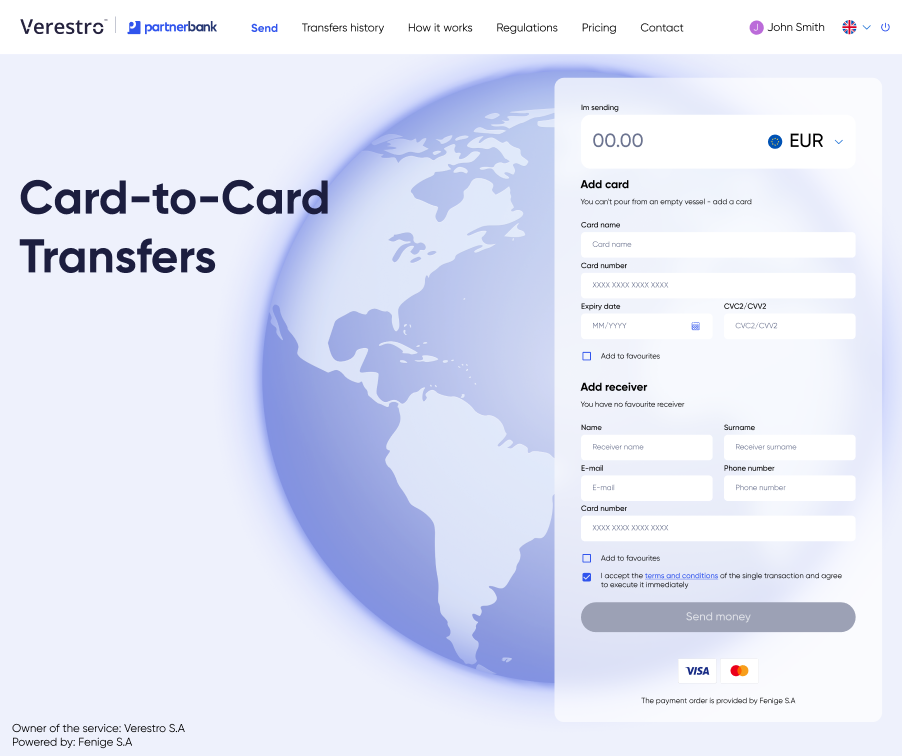

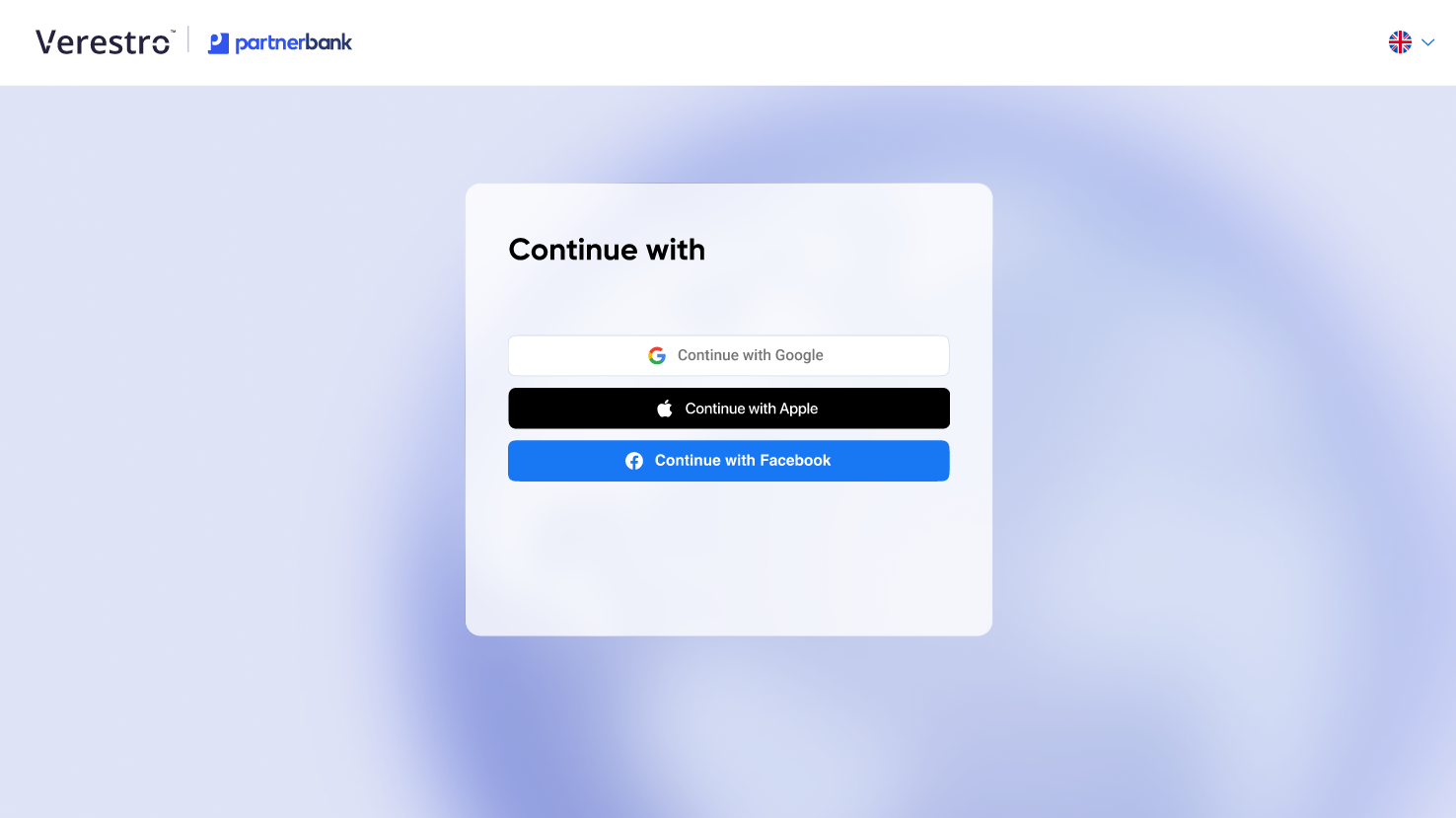

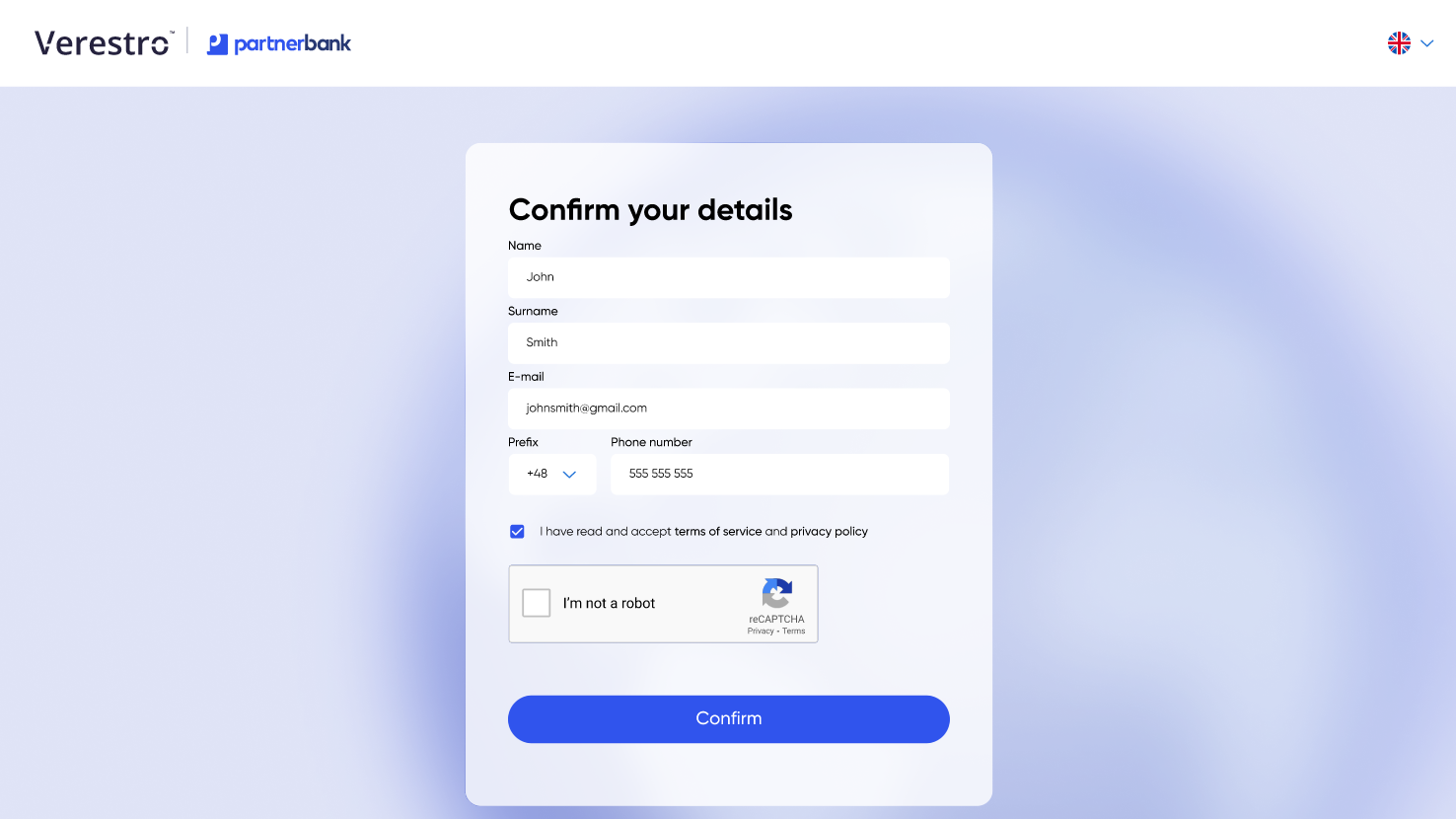

## Application components This chapter is describing all components involved in the processes included in the C2C Widget product. Each of the sections below describes one of the components. [](https://developer.verestro.com/uploads/images/gallery/2025-07/p4t10.png) #### LC API (Data Core) The main purpose of Verestro [Lifecycle API & SDK ](https://developer.verestro.com/books/user-lifecycle-card-management-api-sdk)web service is to add and manage user and payment cards in a safe way. All data are transfered to Verestro Data Core system which is placed in PCI compliant zone and is fully secure. LIfecycle API is an internal service secured by x509 certificate, which increases the safety of transported data. The API communicates with the data storehouse called DataCore. DataCore is internal service and one of crucial components of Verestro's product line-up. Its main responsibility is to provide secure, PCI-DSS compliant storage for cardholder data. DataCore manages the status of the user and their aggregates. All other product in implementation connect to DataCore which returns information about the user and his aggregates. #### Money Transfer API [Money transfers](https://developer.verestro.com/books/money-transfers) (P2P Service) enable users to initiate domestic and international transfers. The platform has several available configurations: sending and receiving funds, payments from and to cards, transactions from and to stored value account (SVA), ACH transfers. #### THC (Transaction History Core) Service is designed to work in cooperation with other services from Verestro product line. This API offers methods that allow managing information about transactions. [Transaction History Core](https://developer.verestro.com/books/transaction-history-api) allows on checking the history of transactions in the C2C Widget. #### KYC Provider After logging in, the user goes through an intuitive process KYC, which allows for instant identity verification in accordance with the AML (Anti-Money Laundering) regulations. The system automatically analyzes user data, ensuring the highest level of security and protection against financial fraud. In order to pass KYC, it is necessary to take a photo of an identity document and pass liveness. Liveness is a biometric verification that involves the user recording a short video of themselves showing their face and making gestures as instructed. # Use cases This chapter describes the processes taking place in C2C Widget from the point of view of your users. ### Transfers The user can perform the transfer based on one of the following paths: ##### Manual process The user independently enters the card and recipient's data, specifying the transaction amount. **** ##### Money request The user receives a special link with previously defined recipient data and amount. The users can modify the transfer amount and select the card from which they want to send funds, without having to manually enter the information.  ### Registration Users can choose one of the popular login methods – Facebook, Google or Apple. It is also possible to add other social media login methods, which makes the registration process quick and convenient. [](https://developer.verestro.com/uploads/images/gallery/2025-02/sAMimage.png) [](https://developer.verestro.com/uploads/images/gallery/2025-02/Iiaimage.png) ### KYC verification After logging in, the user goes through an intuitive process KYC, which allows for instant identity verification in accordance with the AML (Anti-Money Laundering) regulations. The system automatically analyzes user data, ensuring the highest level of security and protection against financial fraud. In order to pass KYC, it is necessary to take a photo of an identity document and pass liveness. Liveness is a biometric verification that involves the user recording a short video of themselves showing their face and making gestures as instructed. ### ThreeDs authentication Widget C2C supports the 3DS process and it is required when user is initiating a transaction. 3DS is a security protocol used in online payments to enhance the protection of payment card transactions. Its main purpose is to verify the identity of the user This is an authentication method based on the alleged cardholder data check, biometric authentication and improved customer experience. ## # Onboarding This chapter is intended to present you the requirements that will allow you to use C2C Widget in your business. We have presented here what information is necessary to provide so that you can join the C2C Widget program and so that we can properly create the required account for you in our system. ### Business onboarding| **To start using C2C Widget you need to go through a few onboarding steps:** |

| 1\. Please contact our sales - *salesteam@verestro.com* |

| 2\. Please respond to some introduction question that will let us prepare proposal for you. |

| 3\. You will receive offer. |

| 4\. If you accept the offer you will be asked to provide some company documents required for the AML verification process. |

| 5\. After succesful AML process you will receive contract with our [partnering acquiring institution](https://www.fenige.com/). |

| 6\. And finally you will enable C2C Widget to enable card to card transfers. |

**Important!** Implementation of the solution in progress...