# Use cases

This chapter is mainly dedicated to the appearance of the application and a description of the individual paths that the end user will follow depending on the payment method he choosed. Each of the payment method available in Paytool application is described in a separate section. Additionally, every chapter contains diagrams depicting the entire transaction process per payment method.

**Tip:** Check it now. Verestro Paytool demo application is available [here.](https://paytool.verestro.dev/demo/)

## Transaction initialization

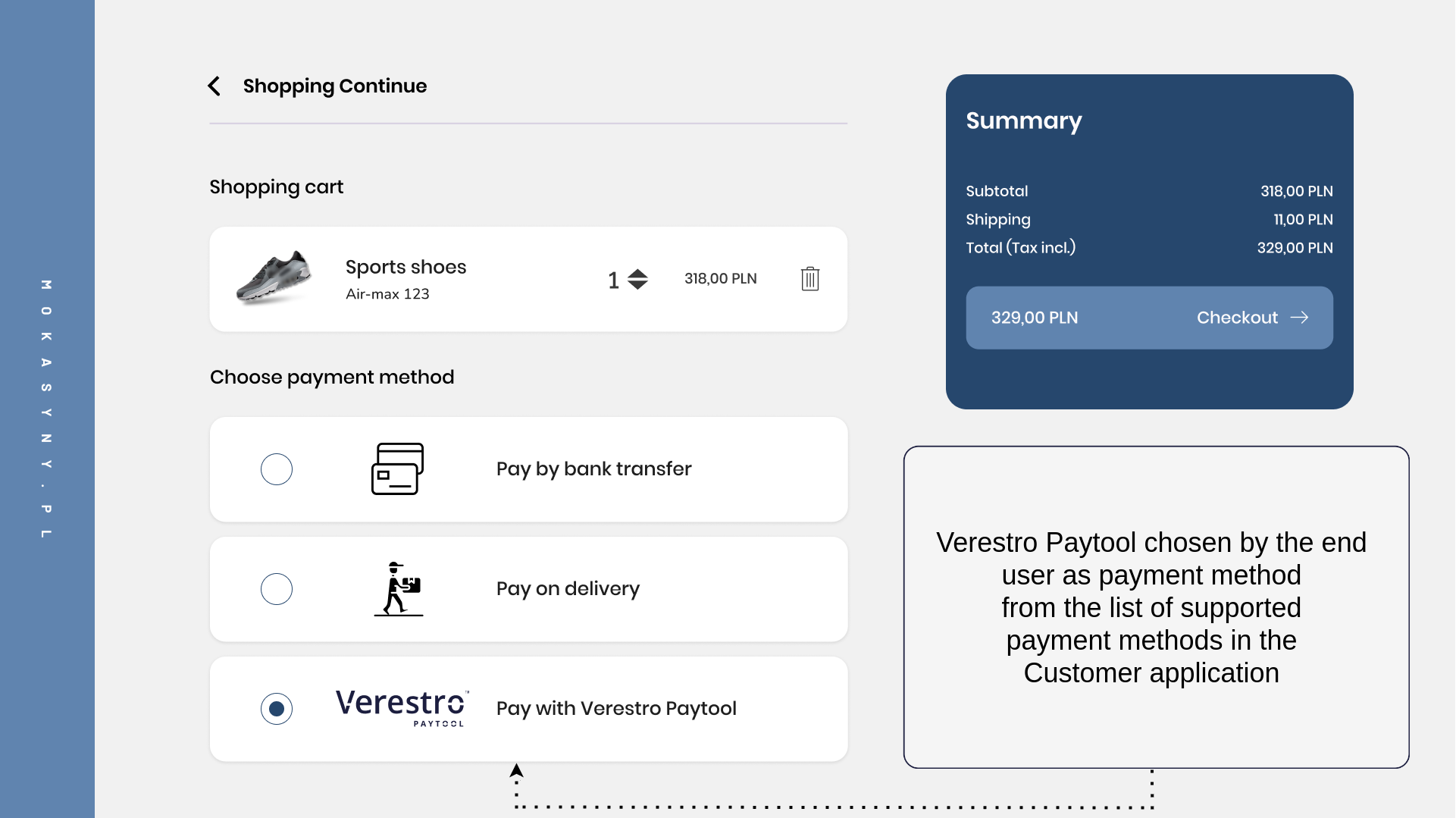

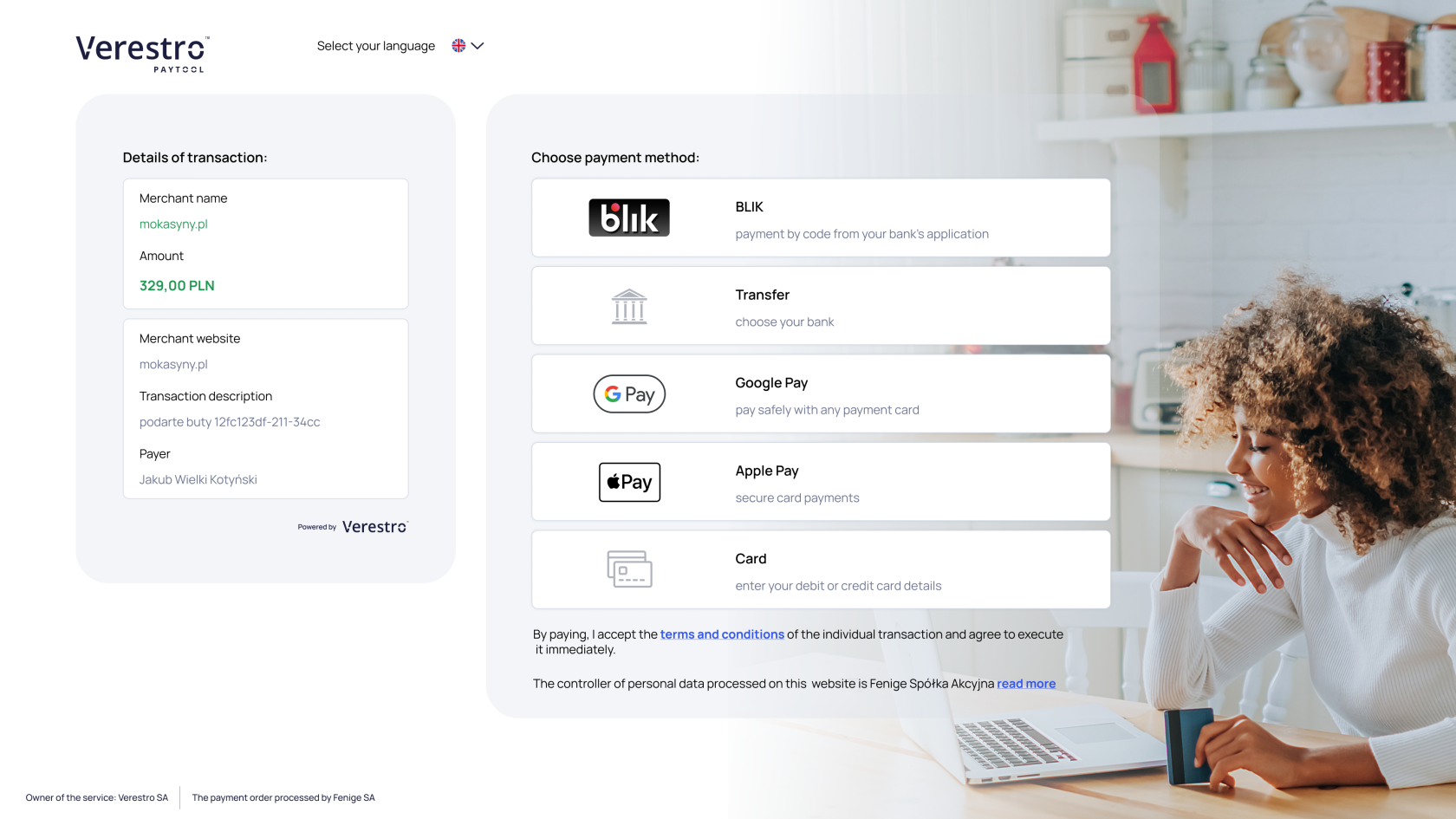

The first step of the each transaction always takes place in your application. Your application integrated with the Verestro Paytool solution should have exposed option allowing to pay using Paytool available in your application. Your backend should deliver the initial transaction data to the Paytool API to open new transaction session when your payer selects the Paytool as payment option. Our API will return you the transaction identifier and the payer's redirection address. The view of transaction initiatialization from the end user's perspective has been shown below. This view refers to the [Redirect your payer](https://developer.verestro.com/books/paytool/page/overview#bkmrk-redirect-your-payer) integration path:

| [](https://developer.verestro.com/uploads/images/gallery/2023-06/image-1687851731553.png)

| [](https://developer.verestro.com/uploads/images/gallery/2024-04/image-1713956541731.png)

|

**Tip:** In this implementation model your application makes a request to the [`transactionInitialization`](https://developer.verestro.com/books/paytool/page/paytool-external-api) method to create a payment session and then redirect your payer to the Paytool application. From this point on, are fully responsible for all other steps in the process such as execution of the transaction and [threeDs authentication](https://developer.verestro.com/books/paytool/page/use-cases#bkmrk-threeds).

The sequence diagram below illustrates the transaction initialization process step by step

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

actor payer

participant "Customer front" as cfront

participant "Customer backend" as cback

participant "Paytool front" as pfront

participant "Paytool backend" as pback

payer->cfront: 1. Pay with Paytool

cfront->cback: 2. Payer choosed Paytool

cback->pback: 3. Customer authorization + transaction metadata

pback->pback: 4. Store transaction metadata + open payment session

cback<-pback: 5. OK + transaction id + redirect url

cfront<-cback: 6. OK + transaction id + redirect url

cfront->pfront: 7. Redirect + transaction id

pfront->pback: 8. Get transaction data + merchant payment methods

pfront<-pback: 9. OK response

payer<-pfront: 10. Display transaction + payment methods

@enduml

1. Payer being in the Customer's application has selected Paytool as the payment method.

2. Customer's application accepts payer's decision on payment method.

3. Customer's API communicates with Paytool API to initiate a payment session and transmitting data about that payment.

4. Paytool API stores payment data and opens payment session for this transaction.

5. Paytool API returns status of the payment session initialization to Customer's API. If the status is success then the transaction ID and the URL to which the payer should be redirected are returned.

6. Customer's API passes received data to it's application to redirect payer.

7. The Customer's application redirects the payer to the Paytool application.

8. Paytool application gets transaction data stored by Paytool API in point 4.

9. Paytool API returns all stored data to Paytool application.

10. Paytool application shows to the payer every available payment method (Card, Google Pay, Apple Pay, BLIK) and all stored transaction data (Customer's name, amount of the transaction, currency, etc.).

The sequence diagram below illustrates the transaction initialization process step by step

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

actor payer

participant "Customer front" as cfront

participant "Customer backend" as cback

participant "Paytool backend" as pback

payer->cfront: 1. Pay with Paytool

cfront->cback: 2. Payer choosed Paytool

cback->pback: 3. Customer authorization + transaction metadata

pback->pback: 4. Store transaction metadata + open payment session

cback<-pback: 5. OK + transaction id

note right of cfront: At this point, the Customer decides how to present the transaction to the payer

cback->pback: 6. Request proper payment method / executing 3D Secure

cback<-pback: 7. Transaction result

note right of cfront: At this point, the Customer decides how to present the transaction result to the payer

@enduml

1. Payer being in the Customer's application has selected Paytool as the payment method.

2. Customer's application accepts payer's decision on payment method.

3. Customer's API communicates with Paytool API to initiate a payment session and transmitting data about that payment.

4. Paytool API stores payment data and opens payment session for this transaction.

5. Paytool API returns status of the payment session initialization to Customer's API. If the status is success then the transaction ID along with a list of every available payment method.

6. Customer's API executes proper Paytool API method (specified payment method or 3D Secure).

7. Paytool API returns result of the executed payment method and/or 3D Secure.

**Important!** This part of the documentation is work in progress...

## Payment methods

Verestro as a PSP provides several different payment methods in Paytool solution. You decide which payment method should be available in Paytool payment form. You decide this during the [onboarding](https://developer.verestro.com/books/merchant-paytool/page/onboarding) process but it is editable whenever necessary. The end user, seeing the available payment methods, can choose the option that is most convenient for him. This chapter describes all payment methods supported by our application.

**Note:** Some of the payment methods available in the Paytool frontend may not be available with an API to API connection.

| **Payment methods in Paytool**

| **Redirect your payer (open Paytool in webview)**

| **Payment in iframe (open Paytool iframe embed in your app)**

| **Payment via API (call Paytool API methods)**

|

| Google Pay™

| Available

| Not yet available

| Available

|

| Apple Pay

| Available

| Not yet available

| Not yet available

|

| Blik

| Available

| Not yet available

| Not yet available

|

| Card & Card on file

| Available

| Available

| Available

|

**Note:** It is required that you have created account in the Acquirer's system which will settle your transactions. Verestro Paytool solution has been implemented so that it is possible to process transactions with the participation of various Acquirers. If you require the settlement of the transaction by a new Acquirer – to which we are not yet integrated – there will be required new integration between Verestro and the new Acquirer. You should provide a specification of the Acquirer API.

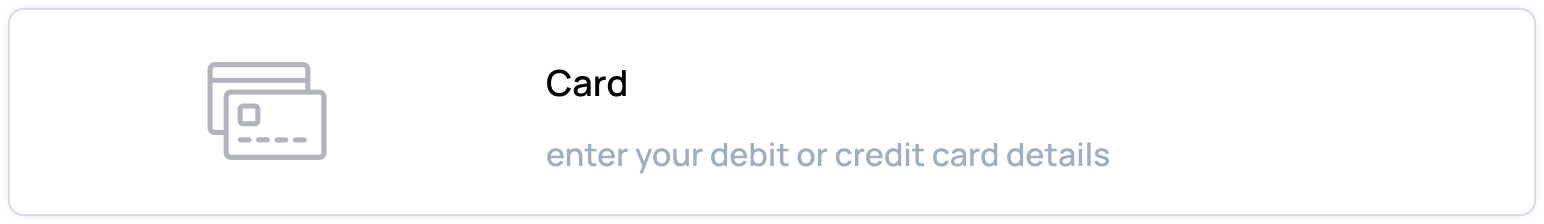

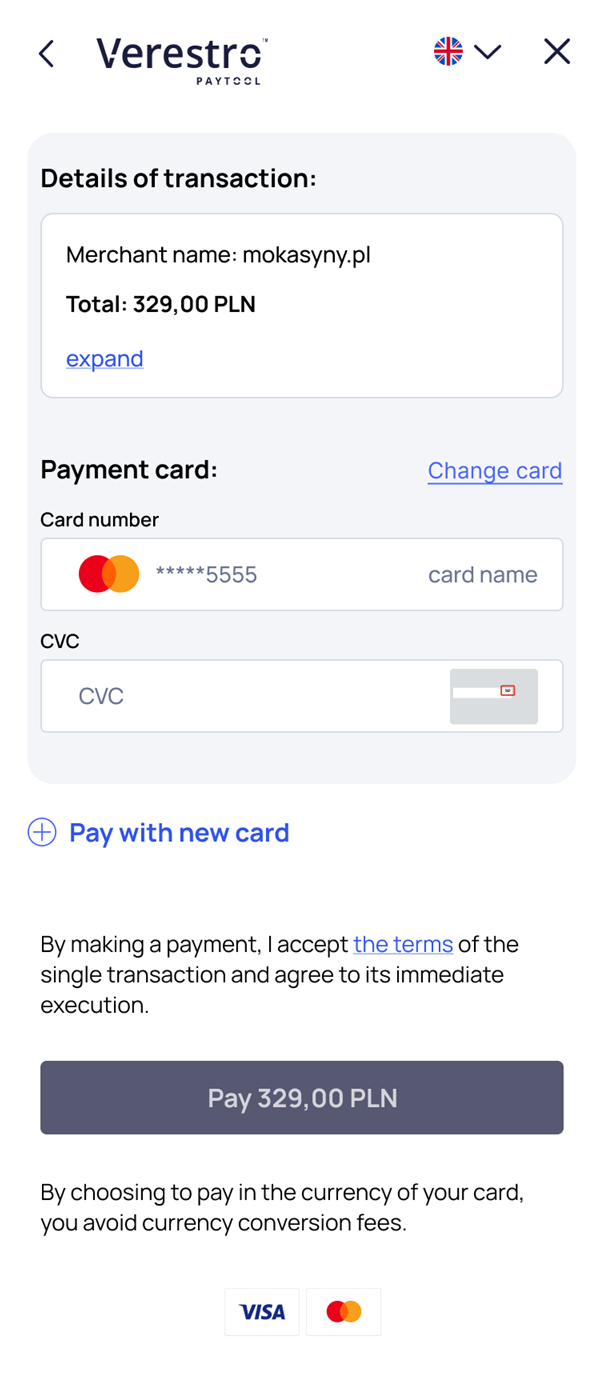

### Card

The most common payment method available in our application is payment using plain card details. This payment method consists in providing a payment form in which the end user can enter his payment card details. The option to pay with plain card details is available at the button shown below:

[](https://developer.verestro.com/uploads/images/gallery/2023-05/image-1685428055821.png)

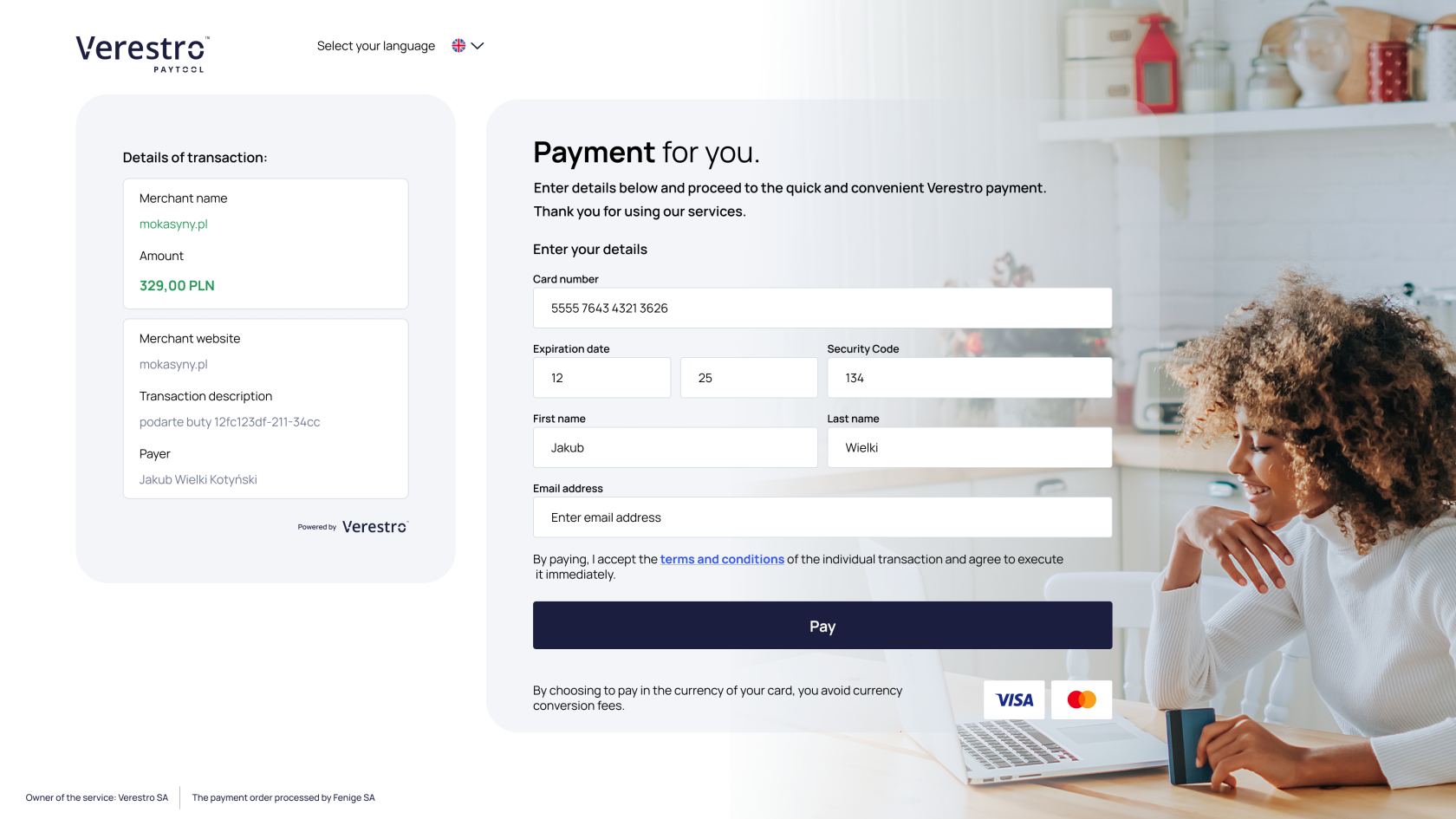

After clicking on the payment option using plain card details, the end user is redirected to the specially prepared payment form. Now he is able to provide the appropriate card details and clicks the **Pay** button at the bottom of the screen. At this point, the card details are encrypted and sent to the Paytool backend which requests Acquirer to process transaction. At this moment [threeDs authentication](https://developer.verestro.com/books/paytool/page/use-cases#bkmrk-threeds) process may be required. The payment process using plain card details from the end user's perpective has been shown below:

[](https://developer.verestro.com/uploads/images/gallery/2024-04/image-1713956617464.png)

The sequence diagram below illustrates the transaction with plain card details process step by step

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

actor "End User" as user

participant "Paytool Frontend" as pfront

participant "Paytool Backend" as pback

participant "Customer Server" as custback

participant "Acquirer" as acq

user->pfront: User chooses payment by plain card details

user<-pfront: Redirect end user to the payment form

user->pfront: User filling data (CN, CVC, EXP)

pfront->pfront: Encrypt data

pfront->pback: Perform transaction providing encrypted payment request body

pback->pback: Decrypt encrypted payment request body

pback->acq: Order transaction

note left of acq: At this point 3D Secure process may occur

acq->pback: Response

pback->pfront: Transaction Result

pback-->pback: Store transaction result

pfront->pfront: Redirect end user (success/failure)

pback->custback: Send transaction postback to provided URL (optional - configurable)

note right of pback: Verestro can also send the notification after transaction to the end user(optional)

custback->pback: Get transaction status (optional)

pback->custback: Return transaction status

@enduml

| **Payer has no saved cards**

| **Payer has saved cards**

| **Payer has saved cards and provides new card**

|

| In this scenario, the payer selects the card on file payment option without having any previously saved card. A form is immediately displayed, allowing them to enter the details of the card they wish to use.

To save the card, the user must check the "**Save card**" checkbox.

In this case, if the "**Save card**" option is selected, the card is automatically set as the default one, since it is the first card saved by this payer.

After confirming the payment request, 3D Secure authentication is performed.

To see more details of the current transaction, the user can click "**Expand**" button.

| In this flow, the payer selects the *card on file* payment option while already having a previously saved card in our system.

Two options are displayed: pay with the saved card or use a new card.

When choosing to pay with the saved card, 3D Secure authentication will be skipped.

When selecting the option to use a new card (by clicking the **"Pay with new card"** button), a form for entering the new card details is displayed.

To save the card, the **"Save card"** checkbox must be selected.

Additionally, in this case, a **"Set as default"** checkbox is shown, allowing the user to set the new card as the default one. After confirming the payment request with newly added card, 3D Secure authentication is performed.

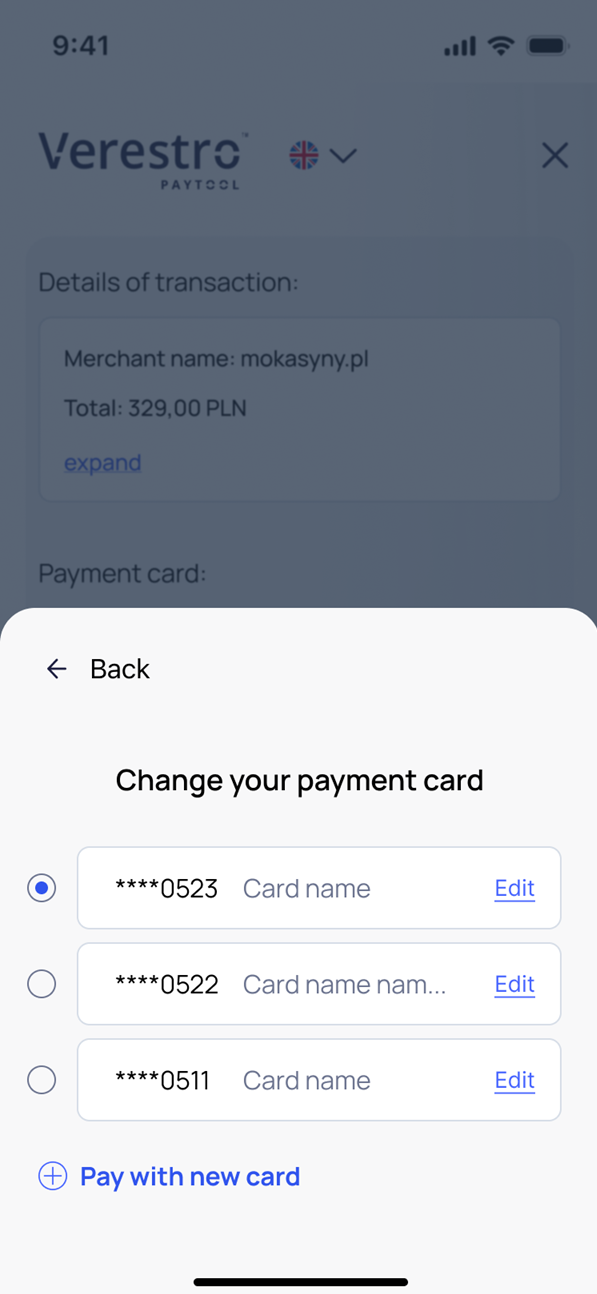

| If the payer has more than one saved card, they can open the list of all their saved cards to choose a card other than the default one for the transaction.

From the card selection view, it is also possible to:

- add a new card,

- edit existing cards.

In the edit mode, the user can:

- set a different card as the default,

- remove a card from the wallet.

It is not possible to edit sensitive data such as the card number or expiration date.

|

| [](https://developer.verestro.com/uploads/images/gallery/2025-08/new-card1.png)

| [](https://developer.verestro.com/uploads/images/gallery/2025-08/uIoexisting-card1.png)

| [](https://developer.verestro.com/uploads/images/gallery/2025-08/edit-card11.png) |

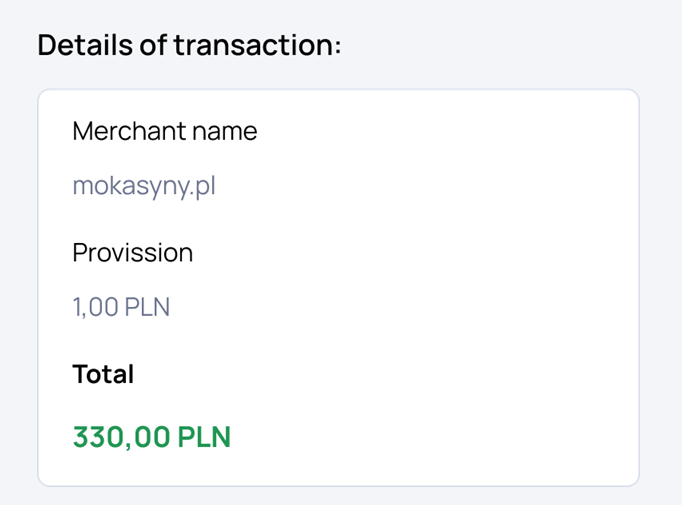

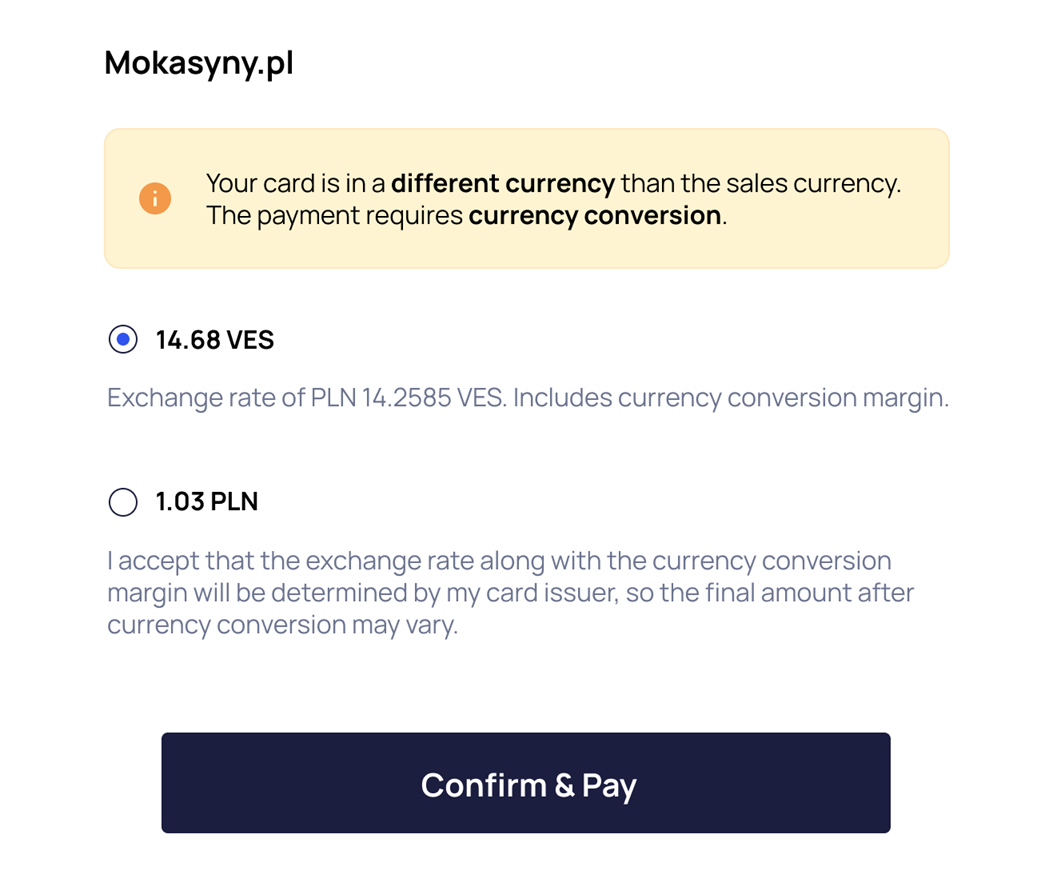

#### Dynamic currency conversion

The DCC functionality is to determine the currency of the payer's card, compare it with the currency used by the merchant selling the goods, and provide the payer with the option of converting currency at our rate or ordering payment leaving the currency conversion to the bank that issued the card. The DCC mechanism is triggered when the currency of the payer's card is different from the sales currency then.

**Note:** Currently, DCC functionality is only available for transactions made with Fenige's terminal.

*Fenige is our partner acquiring institution.*

After entering the card data in the correct field, the currency of the card is determined. If the dynamic currency conversion has been triggered, the following popup will be displayed to the payer and the total amount in the transaction details will be updated:

| [](https://developer.verestro.com/uploads/images/gallery/2025-02/dcc-caluculate-2-cutted.png)

| [](https://developer.verestro.com/uploads/images/gallery/2025-02/lFRdcc-screen.png) |

### Google Pay

Paytool as a registered hosted checkout in the Google Pay™ allows to perform a payment with the card from the Google Pay™ Wallet. Using our application your payer can choose the Google Pay™ as the payment method from the Verestro Paytool payment methods list. The option to pay with Google Pay™ card token is available at the button shown below:

[](https://developer.verestro.com/uploads/images/gallery/2023-05/image-1685428002241.png)

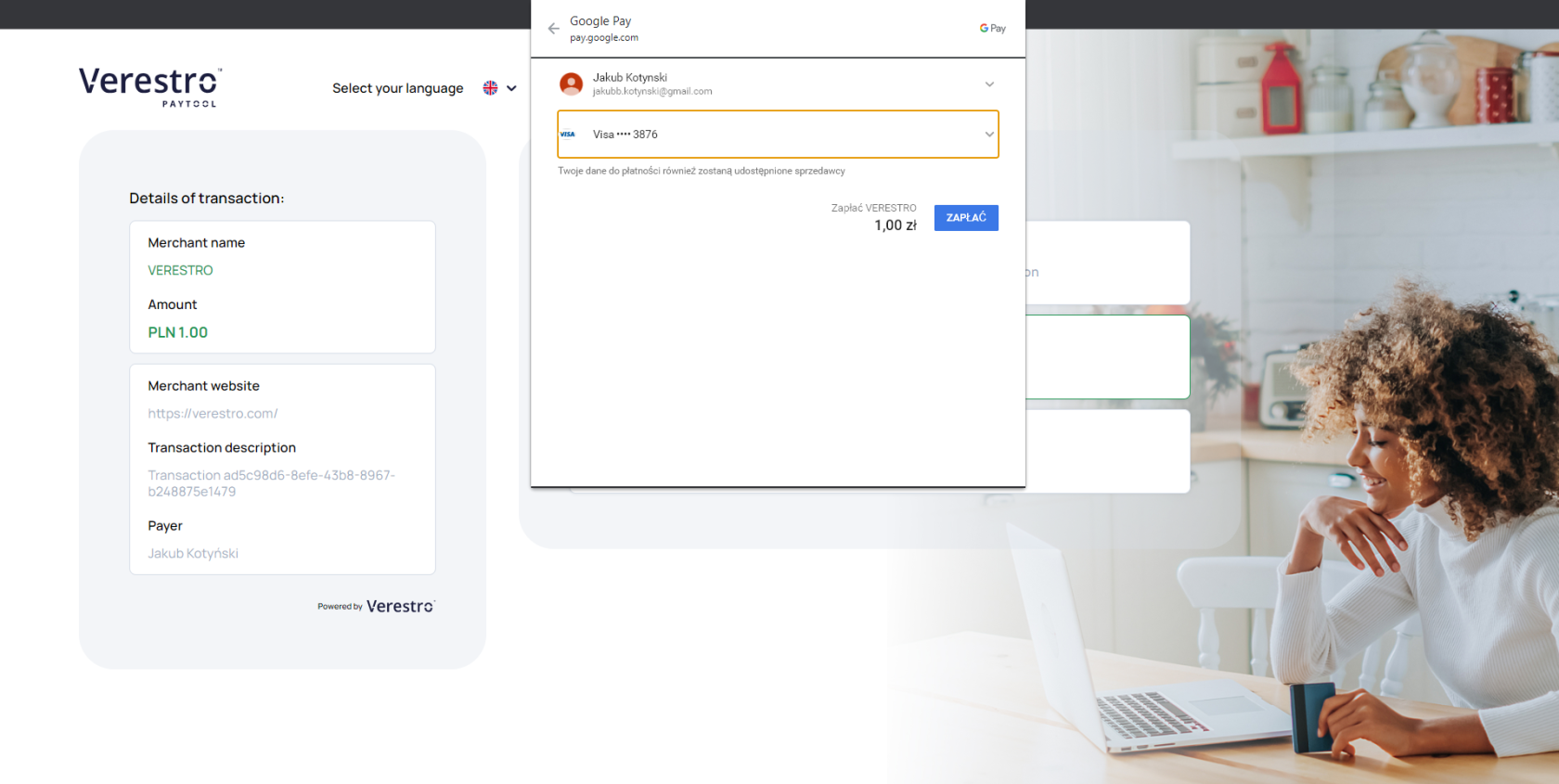

After clicking on the Google Pay™ payment option, the Google Pay™ Wallet popup is displayed. The payer should select the appropriate card from the Google Pay™ Wallet which is then encrypted on the Google Pay™ side and transferred to our application. We will decrypt obtained data and transfer them to the Acquirer in the transaction request. At this moment [threeDs authentication](https://developer.verestro.com/books/paytool/page/use-cases#bkmrk-threeds) process may be required but it will be handled on our side. The payment process using Google Pay™ card payment token from the end user's perpective has been shown below:

[](https://developer.verestro.com/uploads/images/gallery/2023-07/image-1689246683126.png)

The sequence diagram below illustrates the payment process using Google Pay™ card payment token step by step

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

actor "End User" as user

participant "Paytool Frontend" as pfront

participant "Paytool Backend" as pback

participant "Google Pay" as gpay

participant "Customer Server" as custback

participant "Acquirer" as acq

user->pfront: End user chooses payment by Google Pay

pfront->gpay: Open end user Google Wallet

user<--gpay: Opens end user's Google Wallet

user-->gpay: Choose card from Google Wallet

gpay->gpay: Encrypt chosen card token data

pfront<-gpay: Provide encrypted card token data

pfront->pback: Order transaction

pfront-->pback: Provide encrypted card token data

pback->pback: Decrypt encrypted card token data

pback->acq: Order transaction

note left of acq: At this point 3D Secure process may occur

acq->pback: Response

pback->pfront: Transaction Result

pback-->pback: Store transaction result

pfront->pfront: Redirect end user (success/failure)

pback->custback: Send transaction postback to provided URL (optional - configurable)

note right of pback: Verestro can also send the notification after transaction to the end user (optional)

custback->pback: Get transaction status (optional)

pback->custback: Return transaction status

@enduml

The sequence diagram below illustrates the payment process using Google Pay™ card payment token API to API step by step

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

participant "End user" as user

participant "Customer Application" as app

participant "Google Pay" as gp

participant "Paytool Backend" as tps

participant "Acquirer" as acq

note right of user: User wants to pay with Google Pay

user->app: Pay with Google Pay and choose card

app->gp: Requests for card token

gp->gp: Encrypts card token with Verestro pub key

app<-gp: Returns encrypted card token

app->tps: Requests token payment

tps->tps: Decrypts card token

tps->acq: Orders transaction

tps<-acq: Transaction status

note left of acq: At this point 3D Secure process may occur

app<-tps: Transaction status

user<-app: Transaction status

user<--tps: Sends email notification - optional

@enduml

**Important:** If you use Paytool with [Payment process via API](https://developer.verestro.com/books/paytool/page/overview#bkmrk-payment-process-via-) integration path, make sure you are a registered merchant in the Google Pay™ system. This does not apply to Customers using the [Redirect your payer](https://developer.verestro.com/books/paytool/page/overview#bkmrk-redirect-your-payer) route.

**Note:** Google Pay™ provides a [Google Pay Web integration checklist](https://developers.google.com/pay/api/web/guides/test-and-deploy/integration-checklist) that will help you with the integration step by step. The documentation is available after whitelisting in Google Pay™ system. The whitelisting process is performed by Google Pay™ during the Customer's merchant account registration process.

**Note:** Google Pay™ provides [Google Pay Web Brand Guidelines](https://developers.google.com/pay/api/web/guides/brand-guidelines) that presents branding requirements for web merchants registered in Google Pay™. You must meet these requirements so that you can allow his payers to pay via the Google Pay™ solution.

### Apple Pay

Verestro as a PSP registered in the Apple Pay™ allows to perform a payment with card token generated by Apple. Using our application your payer can choose the Apple Pay™ as the payment method from the Paytool payment methods list.

**Tip:** Please note that as a third-party iOS application, you are allowed to use Apple Pay only for the sale of physical goods. The sale of digital goods with external payment system providers such as Paytool is prohibited by Apple. To enable the sale of digital goods using Apple Pay, you must follow Apple requirements listed [here](https://developer.verestro.com/books/enabling-apple-pay-for-selling-digital-products).

The option to pay with Apple Pay™ card token is available at the button shown below:

[](https://developer.verestro.com/uploads/images/gallery/2023-11/image-1699524383207.png)

**Warning!** Apple Pay payment method is available in Safari web browser only.

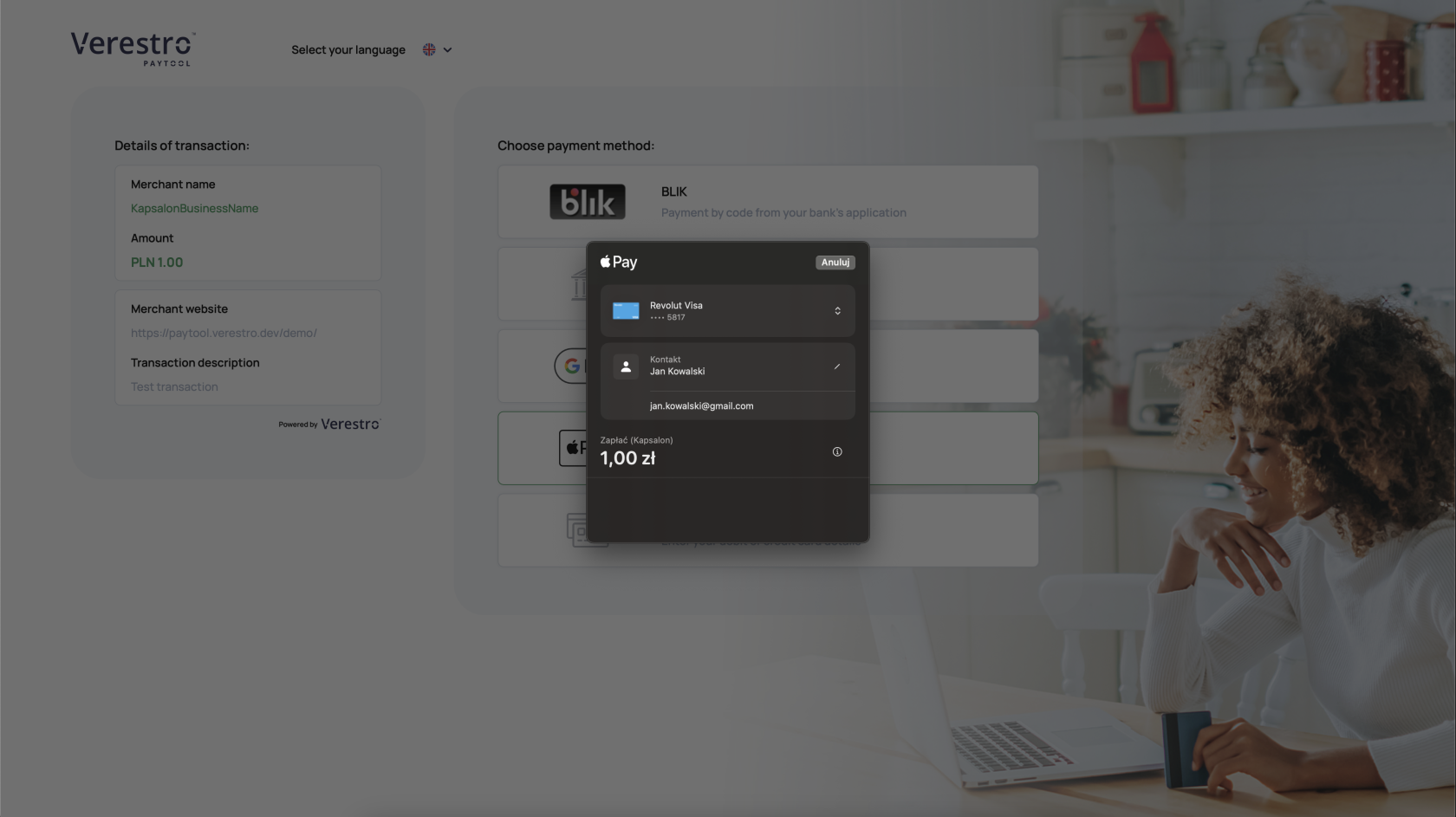

After clicking on the Apple Pay™ payment option, the Apple Pay™ Wallet popup is displayed. End user should select the appropriate card from the Apple Pay™ Wallet popup which is then encrypted on the Apple Pay™ side and transferred to our application. We decrypt obtained data and transfer them to the Acquirer in the transaction request. At this moment [threeDs authentication](https://developer.verestro.com/books/paytool/page/use-cases#bkmrk-threeds) process may be required. The payment process using Apple Pay™ card payment token from the end user's perpective has been shown below:

[](https://developer.verestro.com/uploads/images/gallery/2023-11/image-1699526152020-18-03.png)

The sequence diagram below illustrates the payment process using Apple Pay™ card payment token step by step

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

actor "End User" as user

participant "Paytool Frontend" as pfront

participant "Paytool Backend" as pback

participant "Apple Pay" as gpay

participant "Customer Server" as custback

participant "Acquirer" as acq

user->pfront: End user chooses payment by Apple Pay

pfront->gpay: Open end user's Apple Pay Wallet

user<--gpay: Opens end user's Apple Pay Wallet

user-->gpay: Choose card from Apple Pay Wallet

note left of user: At this point Apple Pay may require user authorization

gpay->gpay: Encrypt chosen card token data

pfront<-gpay: Provide encrypted card token data

pfront->pback: Order transaction

pfront-->pback: Provide encrypted card token data

pback->pback: Decrypt encrypted card token data

pback->acq: Order transaction

note left of acq: At this point 3D Secure process may occur

acq->pback: Response

pback->pfront: Transaction Result

pback-->pback: Store transaction result

pfront->pfront: Redirect end user (success/failure)

pback->custback: Send transaction postback to provided URL (optional - configurable)

note right of pback: Verestro can also send the notification after transaction to the end user (optional)

custback->pback: Get transaction status (optional)

pback->custback: Return transaction status

@enduml

**Note:** At this moment Apple Pay biometric authorization may be required.

**Note:** Payment using the Apple Pay Wallet is only possible if the payer uses MacOS.

#### Apple Pay payment via API

**Warning!** Implementation of Apple Pay backend to backend oriented is work in progress...

Alternatively Verestro allows you to perform a payment with Apple Pay card token by calling directly our API method. This is a backend to backend oriented solution. In this payment model you must be registered merchant in Apple Pay™ to be able to get a card payment token from Apple Pay™.

**Important:** If you use Paytool with [Payment process via API](https://developer.verestro.com/books/paytool/page/overview#bkmrk-payment-process-via-) integration path, make sure you are a registered merchant in the Apple Pay™ system. This does not apply to Customers using the [Redirect your payer](https://developer.verestro.com/books/paytool/page/overview#bkmrk-redirect-your-payer) route.

**Note:** Apple Pay provides a complete integration guide that outlines all the steps required to register as a merchant in its system. This registration enables the merchant to launch the Apple Pay wallet directly within your own application. To do so check [Apple Pay Merchant Registration Guide](https://developer.apple.com/apple-pay/Apple-Pay-Merchant-Integration-Guide.pdf).

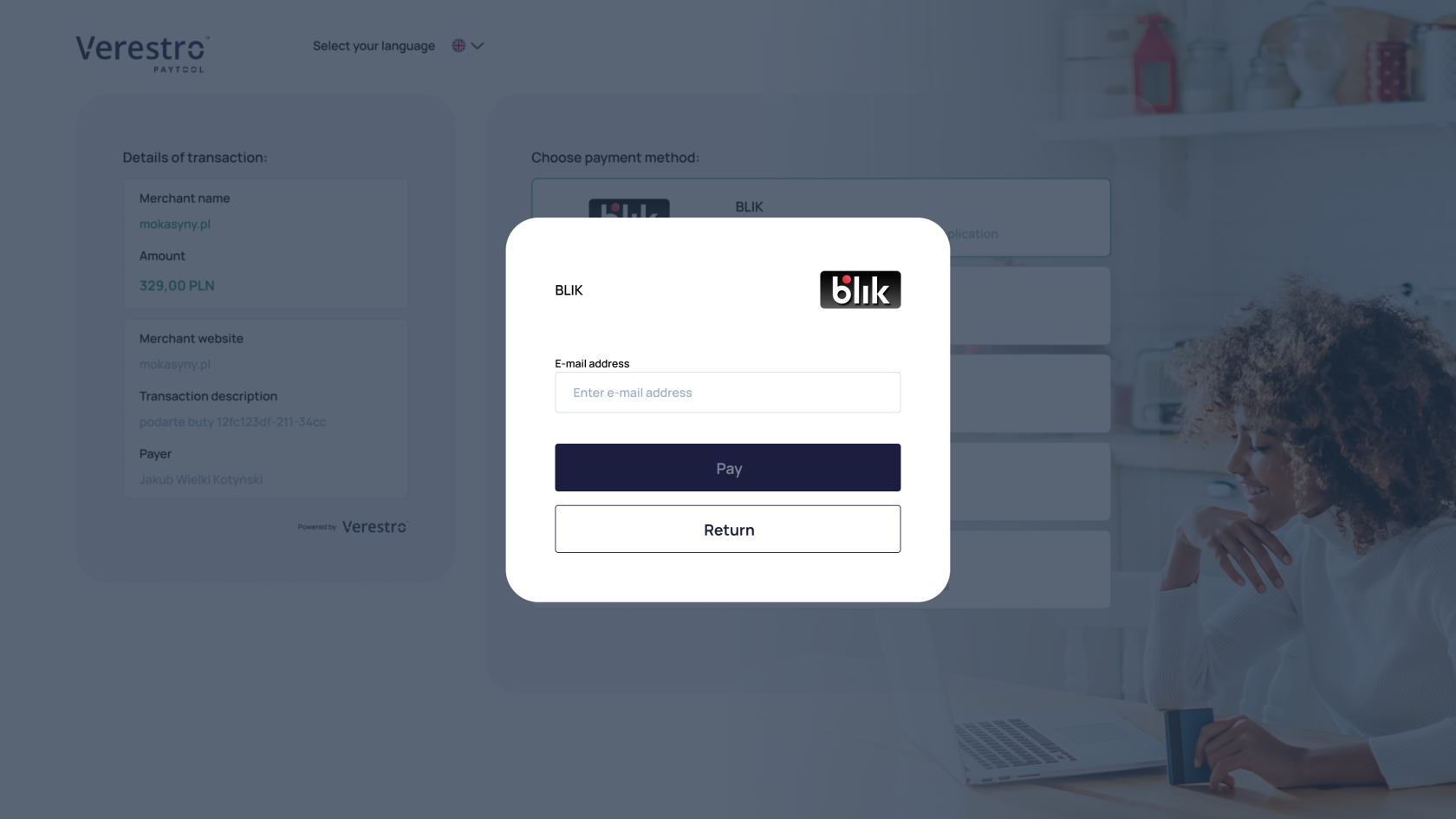

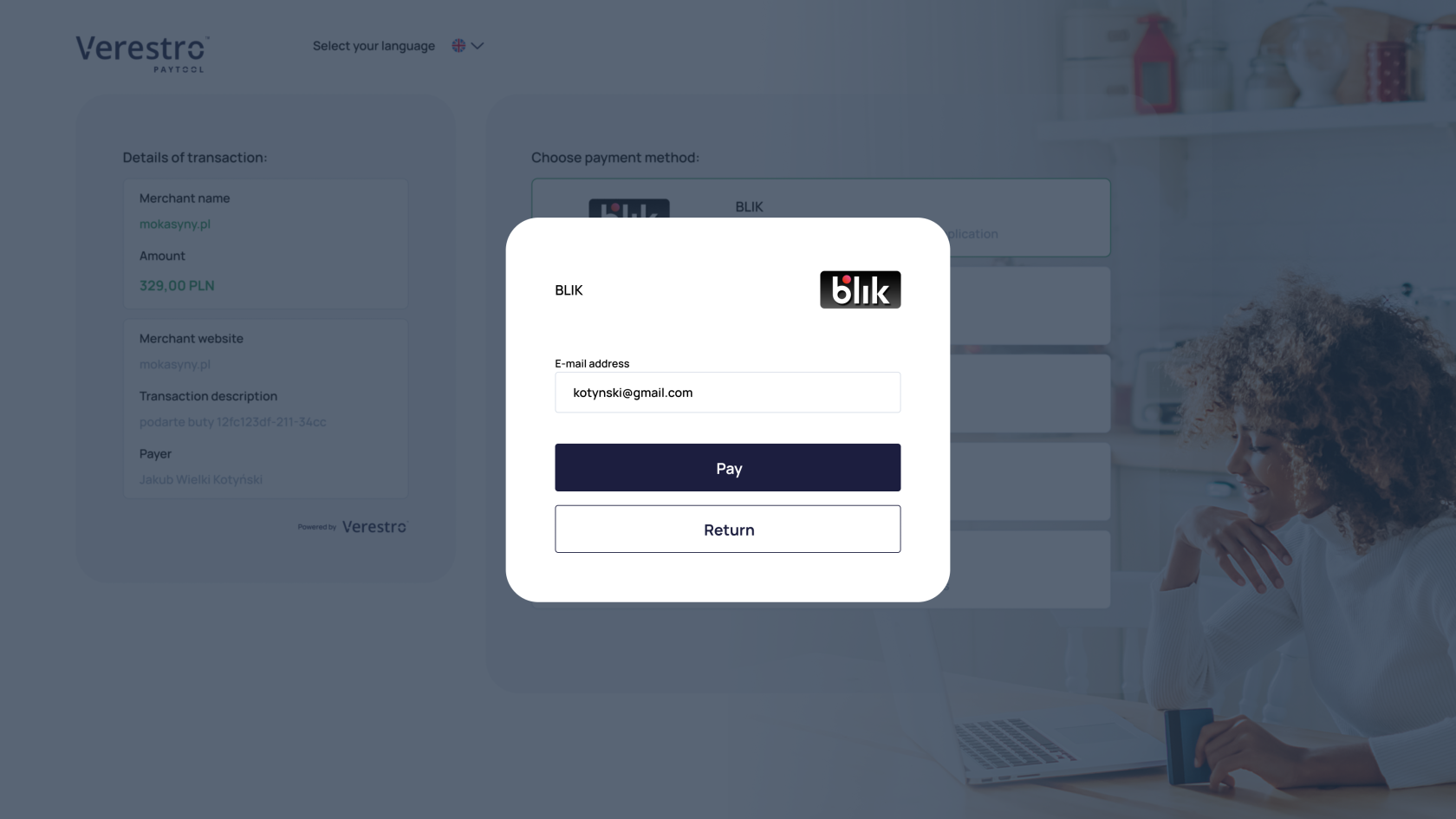

### Blik

Our solution supports cardless payments using the Blik code. The end user can choose the Blik as the payment method from the Verestro Paytool payment methods list. The option to pay with Blik code is available at the button shown below:

[](https://developer.verestro.com/uploads/images/gallery/2023-05/image-1685523665104.png)After selecting this payment method, the end user must provide his e-mail address in the proper field in displayed popup and then confirm the willingness to make the transaction. Blik as an external service, in response opens a view that allows end user to enter the 6 digits code. This step of the process takes place outside the Verestro. The 6 digits Blik code is generated in the end user's bank application. The payment process using Blik code from the end user's perpective has been shown below:

| [](https://developer.verestro.com/uploads/images/gallery/2023-06/image-1687851945379.png)

| [](https://developer.verestro.com/uploads/images/gallery/2023-06/image-1687852047098.png)

|

The sequence diagram below illustrates the payment process using Blik step by step

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

actor "End User" as user

participant "Paytool Frontend" as pfront

participant "Paytool Backend" as pback

participant "Acquirer" as acq

participant "Blik" as blik

participant "Customer Server" as custback

user->pfront: End user chooses payment by Blik (1)

pfront->pback: Requests for payment by Blik (2)

pback->acq: Orders Blik transaction (3)

acq->blik: Internal request to Blik system (4)

acq<-blik: Response from Blik system with HTML payment Base64 encoded form (5)

pback<-acq: Provides Blik's response (5.1)

pfront<-pback: Provides Blik's response (5.2)

pfront->pfront: Decode Blik HTML form (6)

user<-pfront: Displays Blik HTML form (7)

user->user: Enters Blik's 6 digits code (8)

user-->blik: After form submitting request to Blik system is triggered (9)

pfront<--blik: Redirects to Paytool Frontend (10)

user<--pfront: Shows progress bar because the user has to wait for transaction status (11)

acq<--blik: Webhook with information about Blik's transaction status (12)

pback<--acq: Webhook with information about Blik's transaction status (12.1)

pfront->pback: Get status of the Blik transaction (13)

pfront<-pback: Provides Blik transaction status (14)

user<-pfront: Displays transaction status (15)

custback<--pback: Send transaction postback to provided URL (16) (optional - configurable)

@enduml

| ThreeDs mode

| Description

|

| `FRICTIONLESS`

| The response containing the `FRICTIONLESS` mode denotes that payment is successfully finnished. Additional 3DS authentication is not required.

|

| `CHALLENGE`

| The response containing this mode denotes that the card holder must be additionally authenticated. Along with the `CHALLENGE` mode, the Bank also returns an encoded HTML template, which is displayed to the end user in the Verestro Paytool Frontend, thus allowing the end user to perform 3DS authentication.

|

#### `FRICTIONLESS`

In this threeDs mode there is not any additional action from the end user side required.

The sequence diagram below illustrates the threeDs process for frictionless mode step by step

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

actor "End User" as user

participant "Paytool Frontend" as pfront

participant "Paytool Backend" as pback

participant "Acquirer" as acq

participant "Bank" as bank

user->pfront: End user confirmed transaction (1)

note right of user: For example the end user choosed payment with plain card number (1.1)

pfront->pback: Provide transaction request to perform (2)

pback->acq: Provide transaction request to perform (3)

acq->bank: contact with end user's bank (4)

bank->acq: Return FRICTIONLESS status - transaction succeed (5)

acq->pback: Provide bank's response (6)

pback->pfront: Provide bank's response (6.1)

pfront->user: Display transaction status (7)

@enduml

The sequence diagram below illustrates the threeDs process for challenge mode step by step

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

actor "End User" as user

participant "Paytool Frontend" as pfront

participant "Paytool Backend" as pback

participant "Acquirer" as acq

participant "Bank" as bank

user->pfront: End user confirmed transaction (1)

note right of user: For example the end user choosed payment with plain card number (1.1)

pfront->pback: Provide transaction request to perform (2)

pback->acq: Provide transaction request to perform (3)

acq->bank: contact with end user's bank (4)

bank->acq: Return CHALLENGE status along with bank HTML template (5)

acq->pback: Provide bank's response (6)

pback->pfront: Provide bank's response (6.1)

pfront->pfront: Decode bank HTML template (7)

pfront->user: Display bank content to the end user (8)

user-->bank: Perform 3DS authentication (9)

user<--bank: Authentication succeed (10)

acq<-bank: Provide success status and authentication ID (11)

pback<-acq: Provide success status and authentication ID (11.1)

pfront<-pback: Provide success status and authentication ID (11.2)

pfront->pback: Finalize transaction and provide authentication ID (12)

pback->acq: Finalize transaction and provide authentication ID (12.1)

acq->bank: Finalize transaction (12.2)

bank->acq: Transaction succeed (13)

acq->pback: Provide transaction status (14)

pback->pfront: Provide transaction status (15)

pfront->user: Display transaction status (16)

@enduml

| [](https://developer.verestro.com/uploads/images/gallery/2023-05/image-1684330553924.png) | [](https://developer.verestro.com/uploads/images/gallery/2023-05/image-1684330621724.png) |

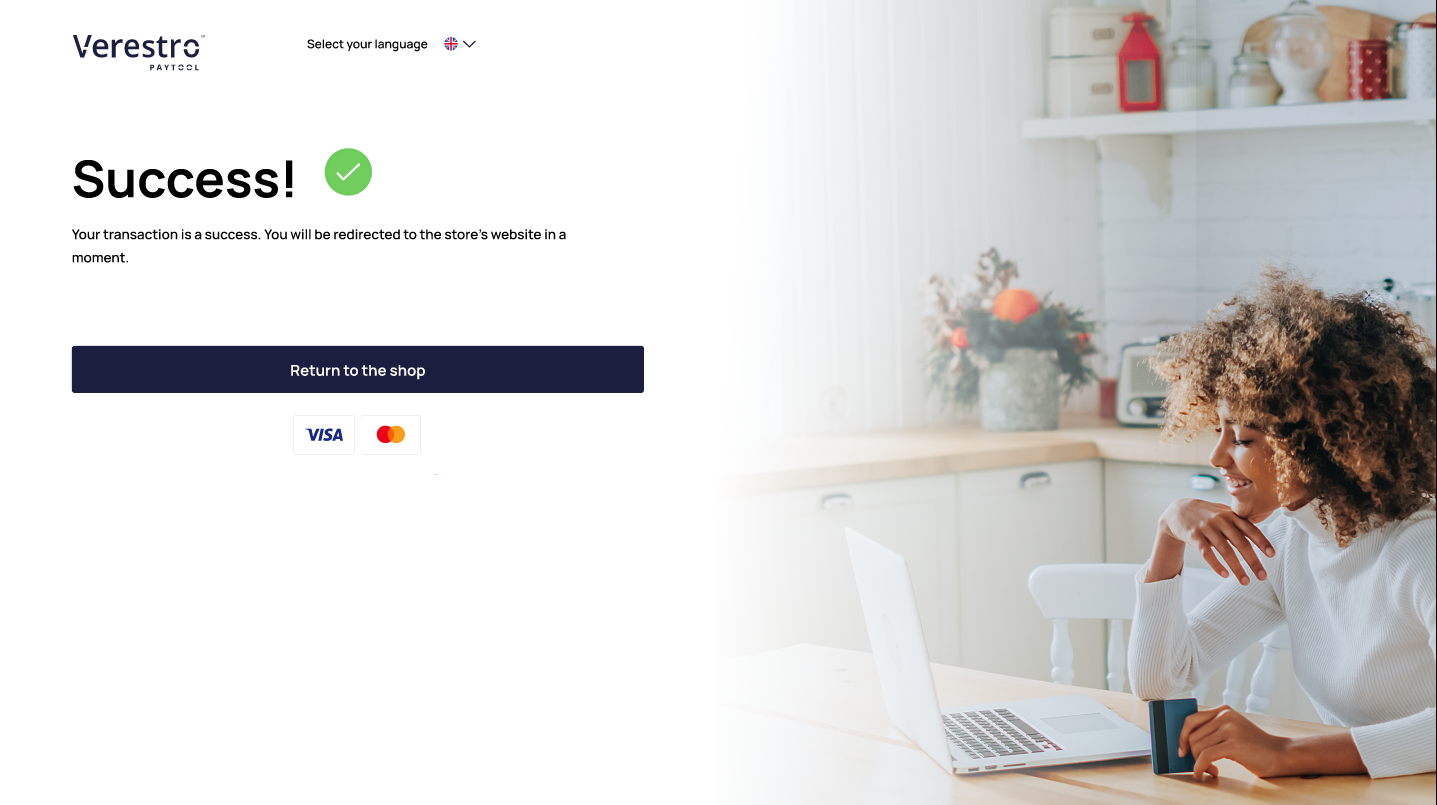

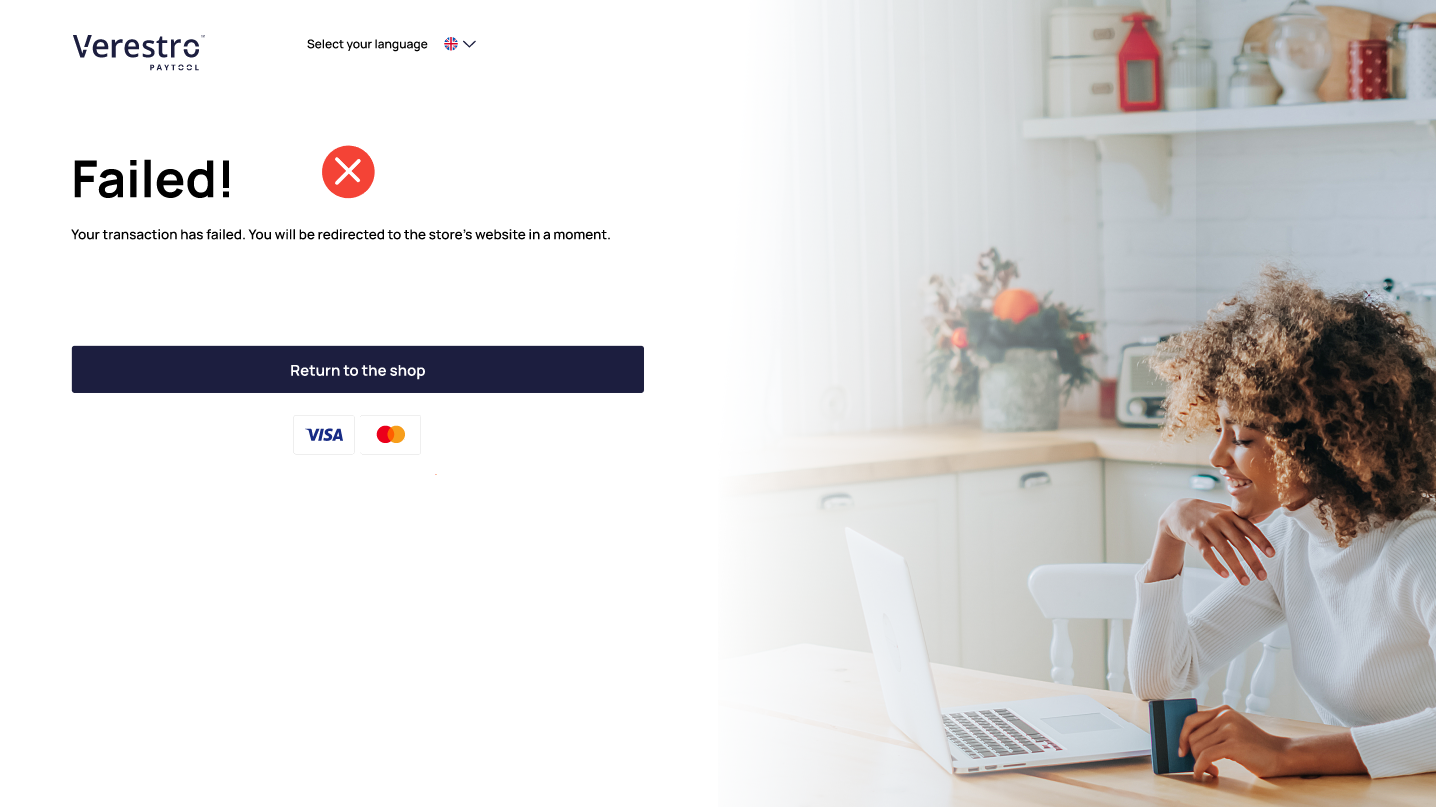

### Notification after transaction

As mentioned in the [Transaction result](https://developer.verestro.com/books/paytool/page/use-cases#bkmrk-notifications) chapter, Paytool solution supports the sending of post-transaction notifications informing you about the status of a given transaction made in your context. This functionality is optional and it is up to you to decide whether you want to receive post-transaction notifications. This decision is made during the [onboarding](https://developer.verestro.com/books/merchant-paytool/page/onboarding) process and always can be edited. We recommend using this functionality, as this allow you to receive information on each of the transactions made using Verestro Paytool.

**Important:** In order for you to receive [notification after transaction](https://developer.verestro.com/books/paytool/page/how-to-integrate#bkmrk-transaction-postback), you must define your own endpoint. You can provide us your notification URL address during the [onboarding](https://developer.verestro.com/books/merchant-paytool/page/onboarding) process or later. We will use this notification URL address to send you post-transaction notifications.

Post-transaction notification example sent by Verestro Paytool to the Customer

```json

{

"transactionId": "string",

"orderNumber": "9afds032dad",

"transactionState": "FAILED",

"amount": 0,

"message": "string",

"currency": "string",

"externalTransactionId": "string",

"transactionType": "ONE_TIME_PAYMENT",

"cardDetails": {

"cardProvider": "MASTERCARD",

"cardNumber": "512485******4875"

},

"failedDetails": {

"code": "SYSTEM_ERROR",

"message": "E0200: Transaction rejected, card is blocked"

}

}

```

**Note:** The appearance of the e-mail notification is configurable.

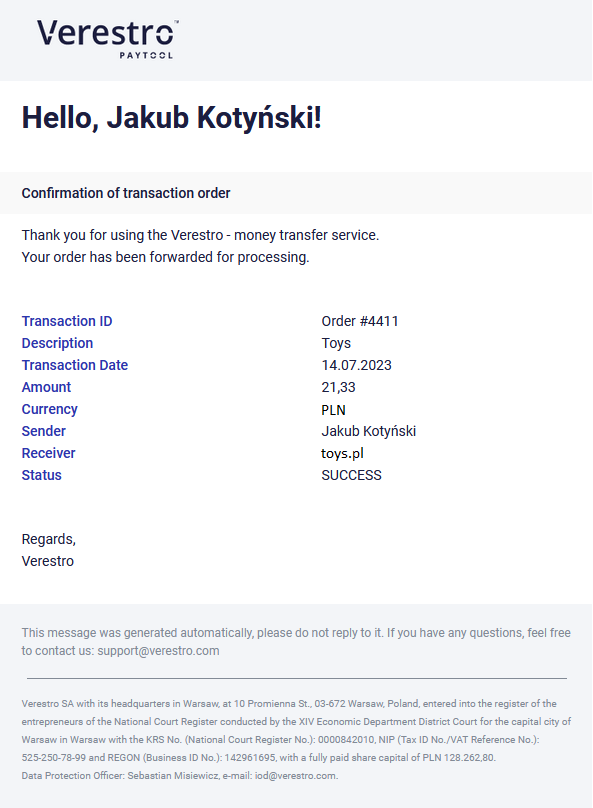

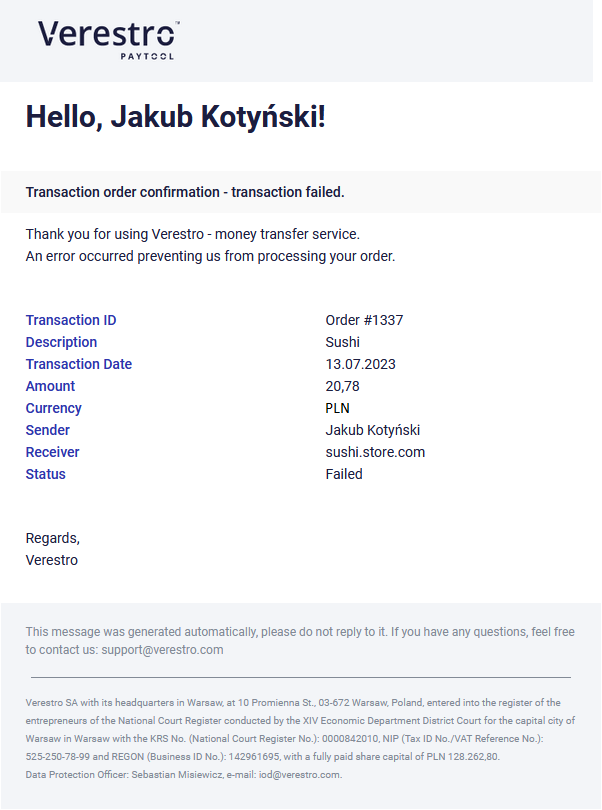

| Example e-mail notification after successful transaction

| Example e-mail notification after failed transaction

|

| [](https://developer.verestro.com/uploads/images/gallery/2023-07/image-1689254790584.png)

| [](https://developer.verestro.com/uploads/images/gallery/2023-07/image-1689254800782.png)

|