# Payout to card

The Payout to card product allows you or your application user (sender) to generate a payment link and then send this link to the potential recipient of your transfer. The recipient provides card number of the payment card to which he wants to receive the transfer.

# Introduction

**Payout to Card** lets you and your users send funds directly from balance to a recipient via a simple payment link — no need to know their card details. Just share the link through SMS or messengers like WhatsApp or Telegram.

The recipient opens the link, enters their card number, and instantly receives the transfer.

Once your company completes the KYB process, you’ll be able to create balances, manage payouts, and track all transactions in our intuitive Admin Panel.

**Tip:** Check the DEMO version of the application [here.](https://payout-to-xpay-frontend.verestro.dev/demo)

## How to connect with us?

Integration with Payout to xPay can be divided into two parts. The first stage is [business onboarding](https://developer.verestro.com/books/payout-to-xpay/page/onboarding), where the terms of the contract are defined and all documents are confirmed (including KYB verification).

The second stage is technical integration. At this stage your company instance will be created in our system. Once we complete these steps, you can integrate your application with our API following [Technical documentation.](https://developer.verestro.com/books/payouts-to-cards/page/technical-documentation)

**Note:** It is required that you have an account in Acquirer's system which will settle your transactions. For more informations please contact our Sale Department. We are suggesting to use [Fenige](https://www.fenige.com/) - our partner acquiring institution.

# Overview

The chapter focuses on the description of each of the components involved in the payout process and what each component is responsible for. All mentioned components and their responsibilities are made and managed by Verestro.

### Terminology

| **Name**

| **Description**

|

| Customer/Merchant

| Institution which uses and integrates with Verestro products.

|

| Acquirer | An external institution that communicates with the card issuer, protects against fraud and taking responsible for executing the transaction and checking the correctness of 3D Secure authentication. |

| Balance | The current balance of funds for a given user stored in the Antaca service. |

| Card | A payment instrument issued by the issuer to a given user. You can send and receive funds using the card. |

| Issuer

| The Bank/card issuer. It determines whether a given transaction can be performed and whether 3D Secure authentication is needed.

|

| Payout

| A method that allows you to order a transfer from your balance to provided payment card.

|

| User

| An end user, e.g. the entity to which the card was issued.

|

| Component

| An application service that is a part of the entire technical solution, for example Payout API.

|

## Application components

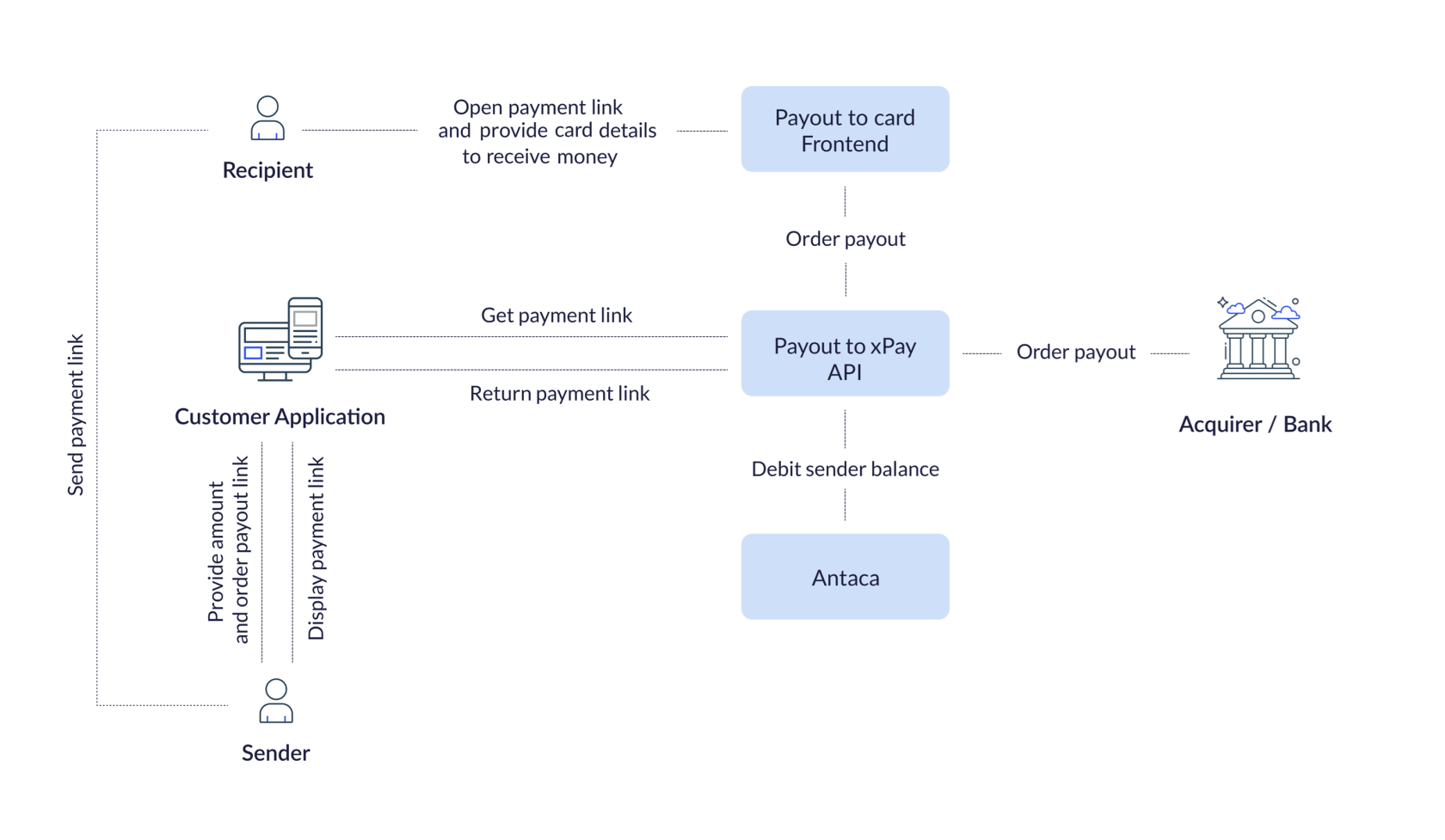

This chapter is describing all components involved in the processes included in the Payout to card product. Each of the sections below describes each of the components. Internal services are the key elements of the solution implemented on the Verestro side. Each of them has a separate responsibility in the entire Payout to card process. Below diagram describes every internal components in our Payout to card application. Payout to card is our internal service integrated with [Antaca](https://developer.verestro.com/books/card-issuing-and-core-banking), thus enabling sender balance management, generating pay me link allowing to order payouts and connecting with acquirer to perform ordered transfer and handling 3D Secure process.'

[](https://developer.verestro.com/uploads/images/gallery/2025-09/0q7payout-to-card-diagram.png)

| **Component**

| **Description**

|

| [Payout API](https://developer.verestro.com/books/payout-to-xpay/page/overview#bkmrk-admin-panel-1)

| The backend component of the Payout to card application. It is responsible for opening a payment session, generating a payment link and ordering the transaction to an acquiring institution.

|

| [Payout frontend app](https://developer.verestro.com/books/payout-to-xpay/page/overview#bkmrk-admin-panel-1)

| The frontend component of the Payout to card application. It contains a frontend view to which the recipient of the payment link is redirected. In addition, it allows recipient to provide card data to receive money transfer from potential money sender.

|

| [Antaca API](https://developer.verestro.com/books/payout-to-xpay/page/overview#bkmrk-antaca)

| Backend component which manages balances and allows certain operations related to them. Such operations include creating a new balance, debiting and crediting a balance or deactivating a balance. This component is not part of the Payout to card application, but it is crucial to this service as the funds of the payout sender are taken from his balance in Antaca.

|

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

actor "Sender" as sender

participant "Customer App" as customer

participant "Payout App" as verestrobackend

actor "Recipient" as user

== Customer's part of the process ==

sender->customer: Order payout (trx data)

customer->verestrobackend: Create payment link(trxData, balanceId)

verestrobackend->verestrobackend: Check if the user has sufficient funds

customer<-verestrobackend: Return payment link

sender<-customer: Return payment link

====

sender-->user: Send payment link

note left of user: Clicks on link

== Verestro's part of the process ==

user->verestrobackend: Redirect recipient to payment link webview

note right of verestrobackend: Recipient sees that he can claim money from sender

note right of verestrobackend: Recipient provides payment card number

verestrobackend<-verestrobackend: Make payout to recipient card

customer<-verestrobackend: Notify customer about payout status

user<--verestrobackend: Top up card if status success

====

@enduml

### Payout to card

A component that supports all key **Payout to Card** processes. Each process is described below in the order of steps, starting from the payout initiation by the sender to the payment received on the proper card provided by the recipient. The **Payout to Card** component is responsible for the following actions:

| 1. **Initialization of the payment shipment**, i.e. the moment when the option to order a transfer to a given recipient was selected and completion of transfer information such as amount or currency was provided by money sender. Payout to card API checks whether the sender has sufficient funds in the balance. |

| 2. **Payment link creation and thus opening a payment session in our system** (storing information about the planned transaction, such as amount and currency). The generated payment link is returned to the sender so that the sender can send it to the potential recipient as a SMS message or via other communicators. |

| 3. **Opening Payout to card frontend view**. This is the view to which the recipient is directed after clicking on the link received from the sender. This view shows what amount the sender is sending and how the recipient can receive the money (click on the proper button in the view to provide card number manually and receive the money). |

| 4. **Processing payment**. Payout to card API will perform the order to top up the recipient's card by contacting the acquiring institution and debiting the sender's balance in Antaca. |

### Antaca

This is the initial component in the payout process. [Antaca](https://developer.verestro.com/books/card-issuing-and-core-banking) is responsible for creating balances for you company and it's users, or allowing to credit/debit your balance depending on the direction of the funds. [Antaca](https://developer.verestro.com/books/card-issuing-and-core-banking) also monitors the balance of each entity, ensuring that the requested action on the balance is performed after meeting specific conditions, for example, it is not possible to debit the balance for more funds than are currently in the balance (you cannot send 100 EUR if you have only 99 EUR on your balance). It is also not possible to top up a balance that has been deactivated. The table below shows [Antaca](https://developer.verestro.com/books/card-issuing-and-core-banking)'s methods for creating, crediting and debiting a balance.

**Tip:** In the Payout to card product, Verestro is responsible for appropriately calling the Antaca methods that credit or debit the balance. You, as a Customer, only need to send us information on which balance and of what amount we should call a given operation.

# Use cases

This chapter describes the business functions that can be performed by having a company balance in the Verestro system and using Payout to card. We also present end user default views presented during using the application.

## Know your business

The first step to starting integration is to complete the KYB process. This process is required to identify and verify business clients. Automatic registration process ensures that all the information and documents provided by the clients gone properly through AML verification. Business client registration process may take around 10-15 minutes. [At this link you can find out what exactly the KYB process is and what it looks like](https://developer.verestro.com/books/know-your-business-kyb). KYB in Verestro is performed with the help of an external verification provider - Mobiltek.

**Note:** AML (Anti-Money Laundering) is a set of policies, procedures, and technologies that prevents money laundering.

## Customer balance management

Description of methods in Antaca service to create and manage the balance.

| **Method** | **Description**

|

| [Create balance](https://developer.verestro.com/books/money-transfer-via-card/page/use-cases#bkmrk-credit-balance)

| Method that allows you to create a balance for your company.

|

| [Credit balance](https://developer.verestro.com/books/money-transfer-via-card/page/use-cases#bkmrk-credit-balance)

| Method that allows you to top up the created balance.

|

| [Debit balance](https://developer.verestro.com/books/money-transfer-via-card/page/use-cases#bkmrk-debit-balance)

| Method that allows you to debit the created balance.

|

**Note:** The balance for your corporation is created during its registration in our system.

You can create end-user balances from the Administration Panel created for your corporation or use the [Create balance](https://developer.verestro.com/books/money-transfer-via-card/page/use-cases#bkmrk-credit-balance) method mentioned above.

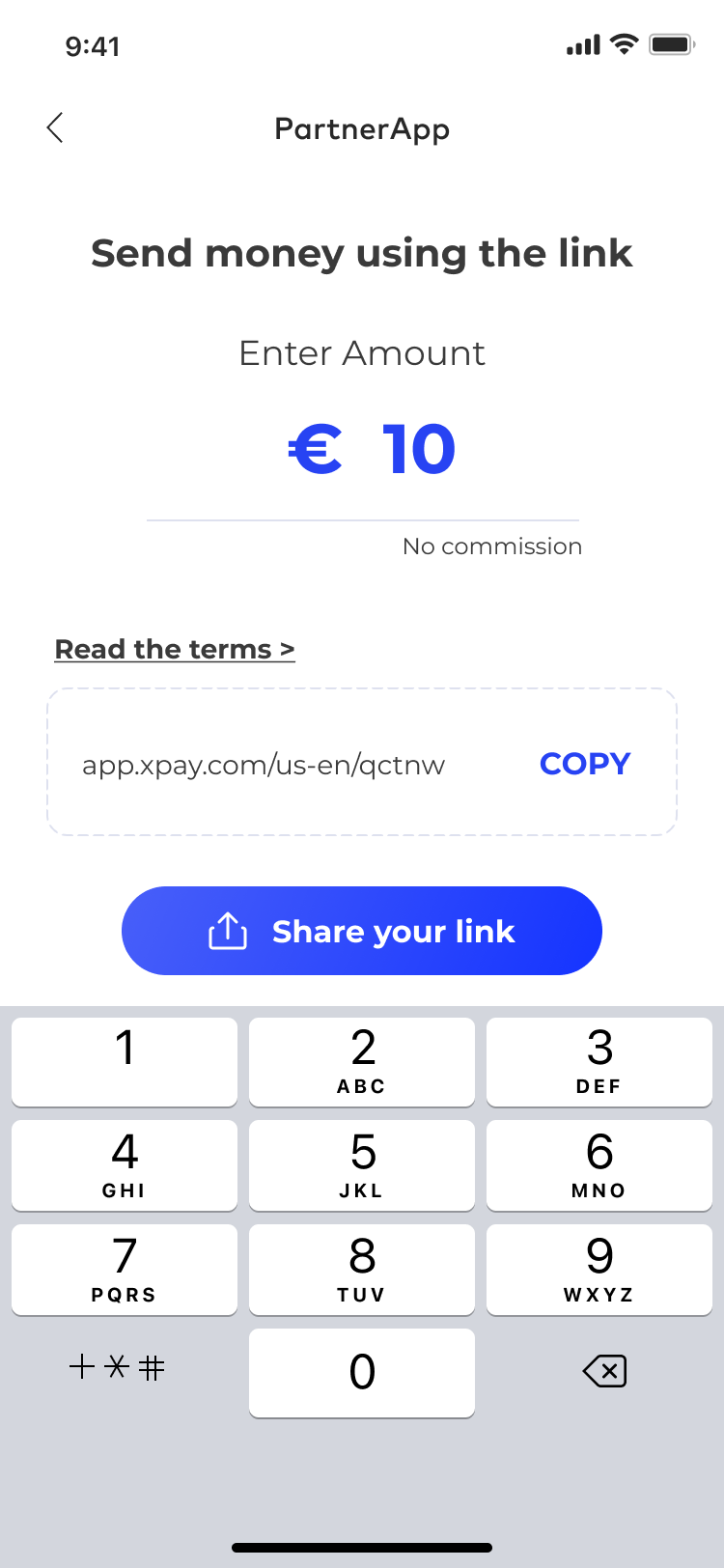

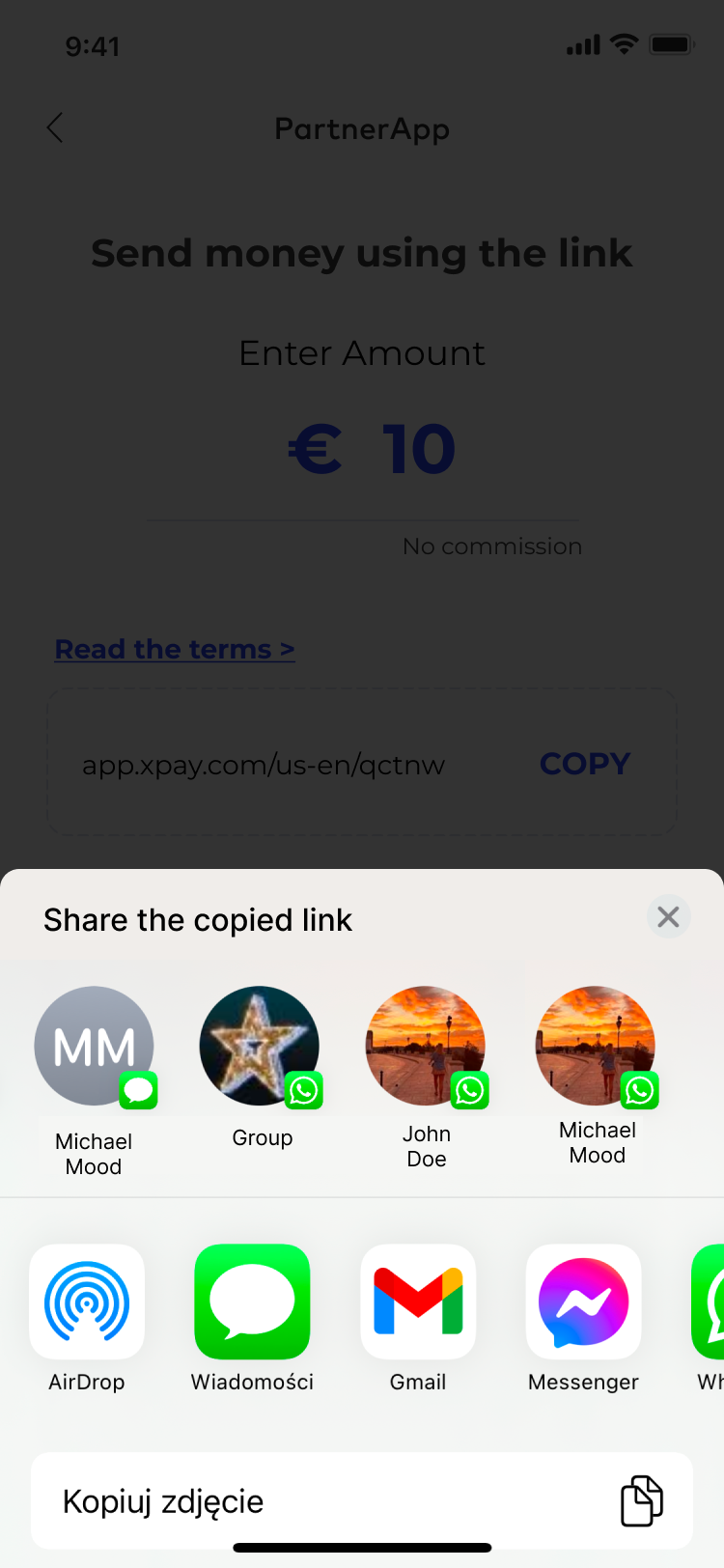

## Initialize payment link

The card top-up process begins when the payment link is initialized. As a customer, you must provide transaction metadata such as the amount and currency in which the payout will be made. After confirming the entered data, a link is generated that you can send to the recipient.

**Important!** The first screen below (PartnerApp view) imitates the view from your application and you will be responsible for implementing this view.

UML presenting initialize payment link step by step

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

participant "Sender" as sender

participant "Customer" as cust

participant "Verestro" as oro

participant "Recipient" as user

sender->cust: Send money using payout

note right of sender: Money Sender has a balance in Antaca Verestro

cust->oro: Initialize payment link (provide transaction metadata)

oro->cust: Return generated payment link

cust->sender: Return generated payment link

sender->user: Send link to the receiver

@enduml

| [](https://developer.verestro.com/uploads/images/gallery/2024-12/1-partner-app-sender-view.png)

| [](https://developer.verestro.com/uploads/images/gallery/2024-12/2-partner-app-sender-view.png)

|

| 1. Sender provides transaction metadata and order payment link (this step takes place in Customer's application). | 2. Sender gets payment link and sends it to the recipient. |

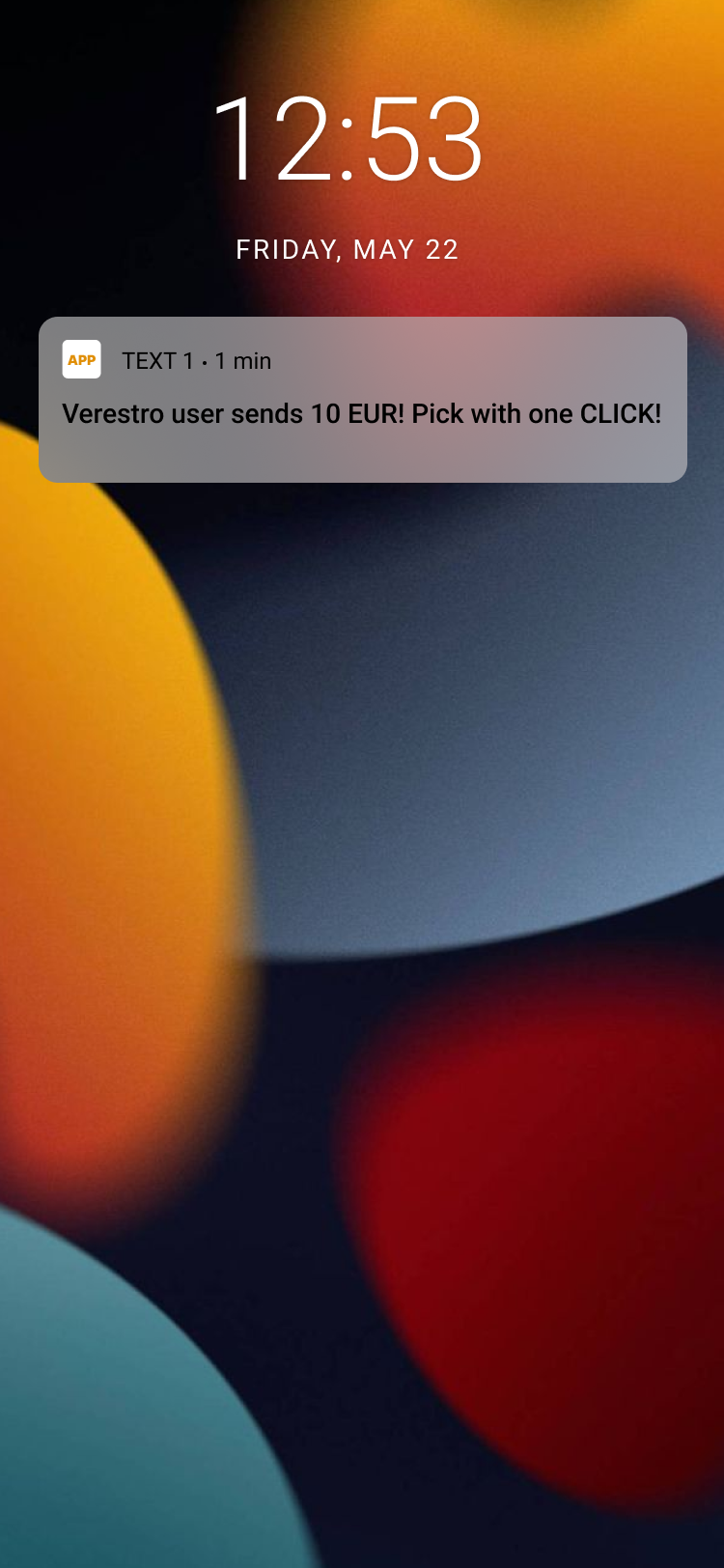

### Top-up card

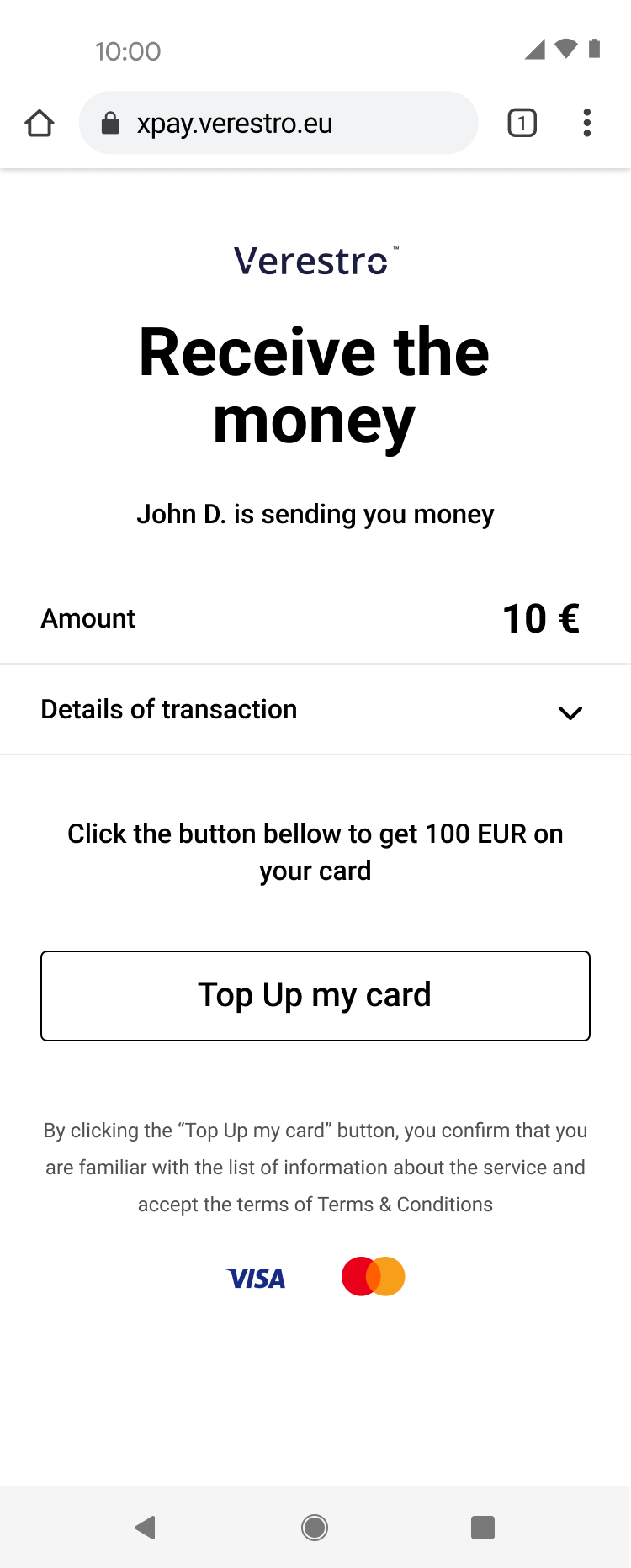

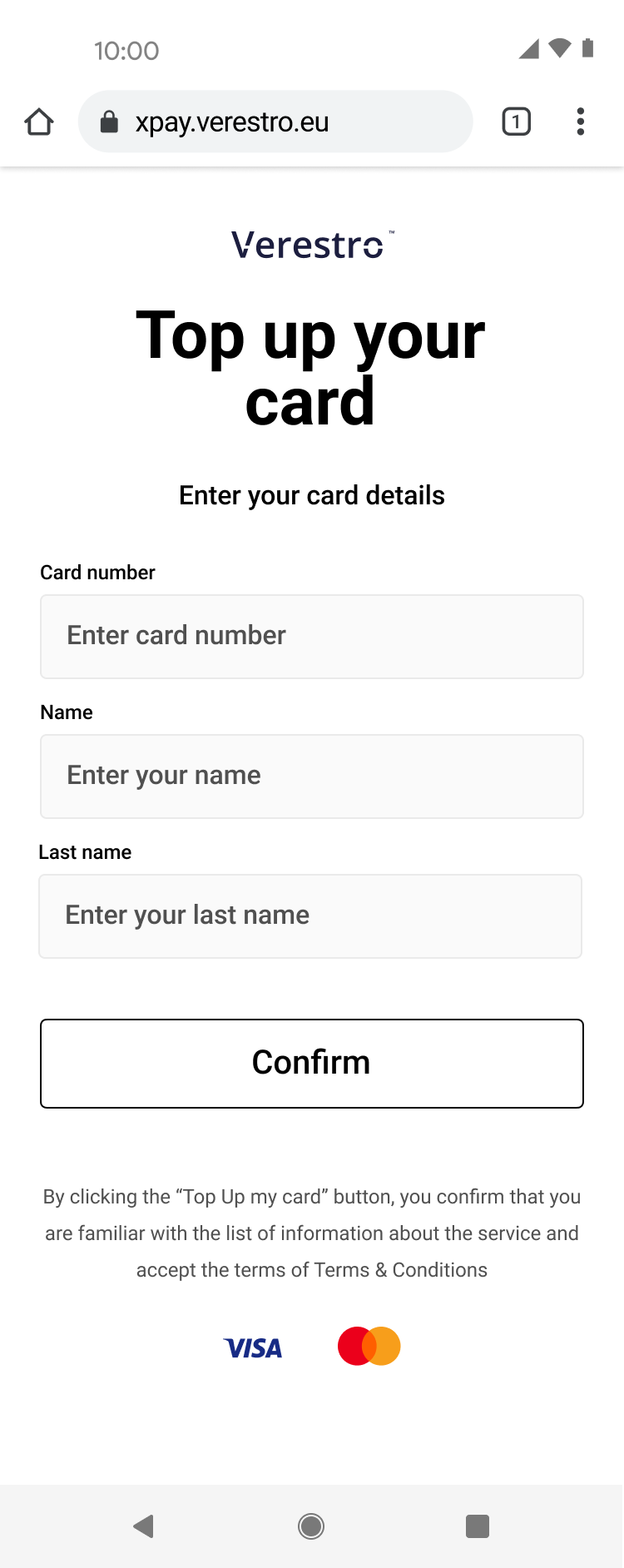

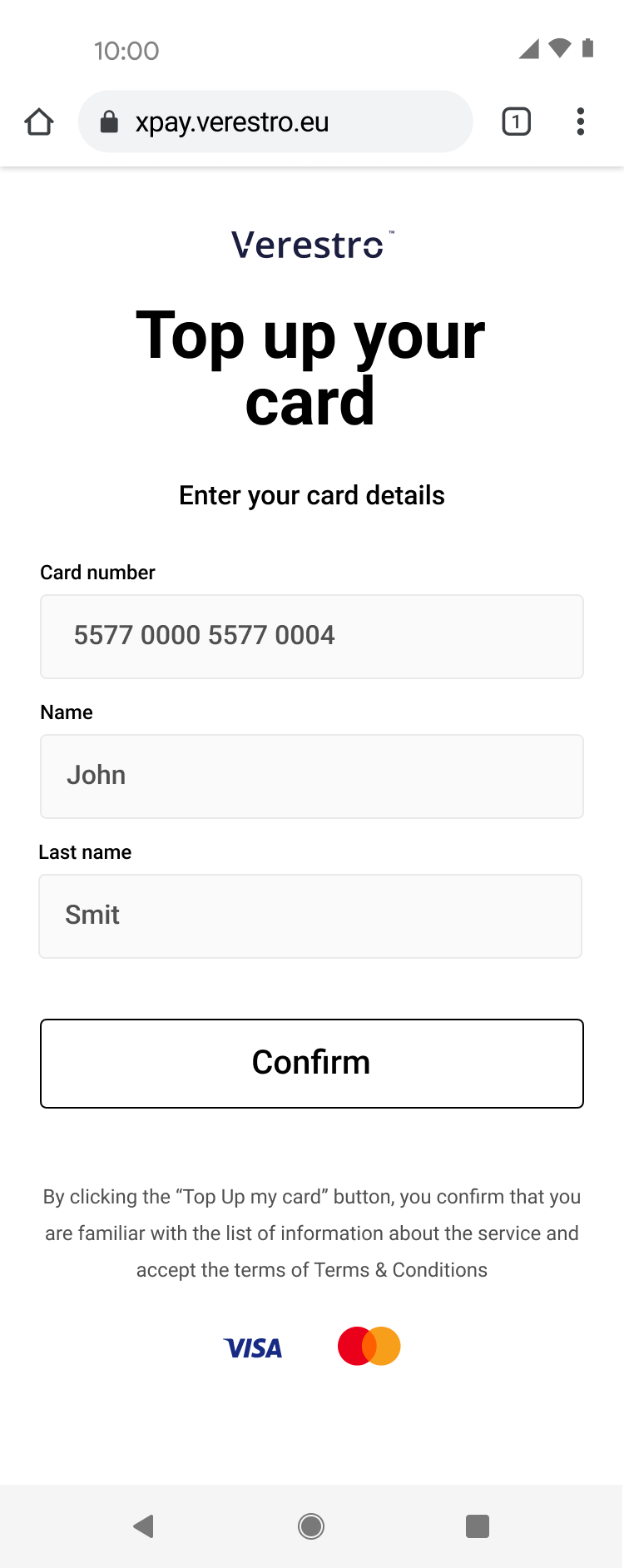

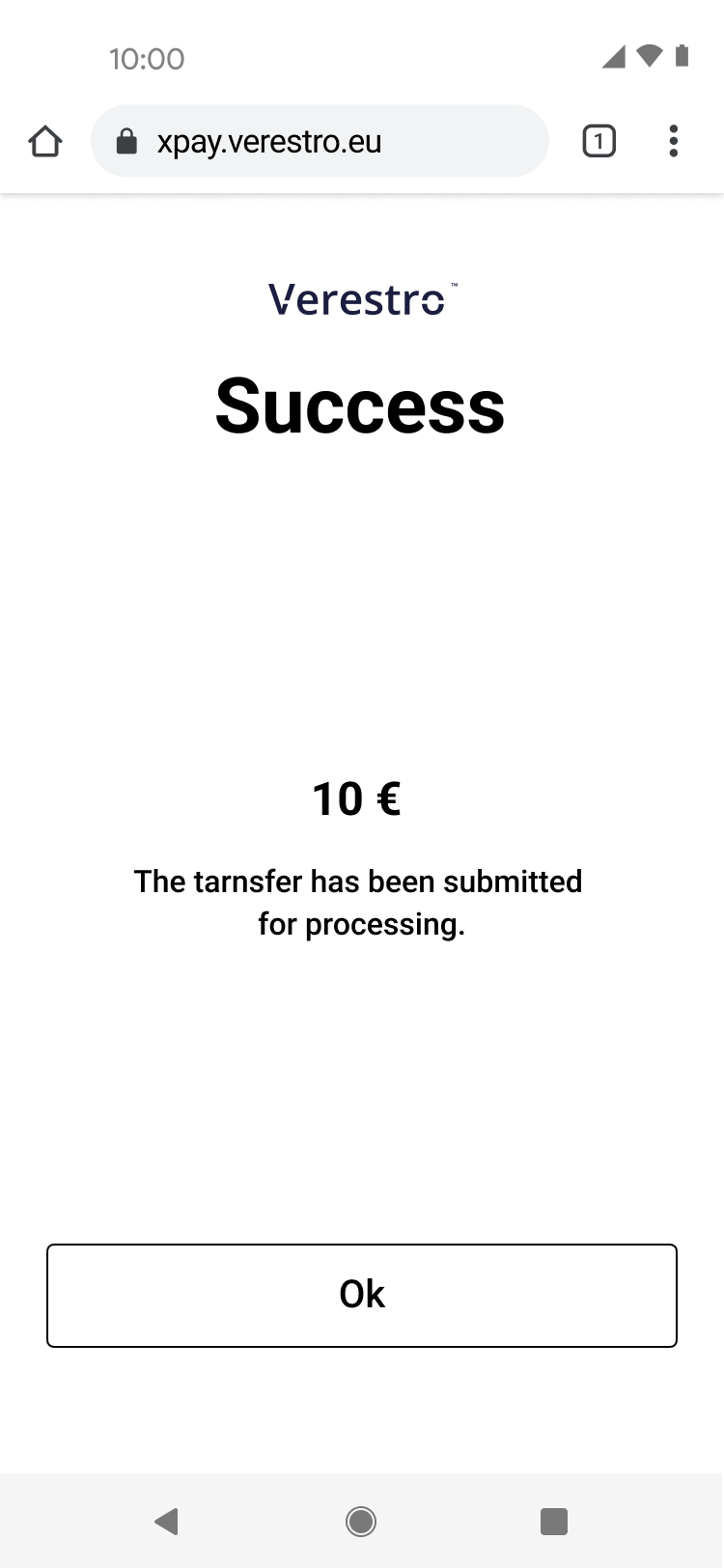

The recipient of a payment link sent by the sender is the beneficiary of the transfer. Upon opening the link, the recipient is redirected to our responsive webview, where he/she can see a message indicating that a specific person intends to transfer a certain amount in a given currency.

To claim these funds, the recipient is required to enter his/her card PAN (Primary Account Number) into the designated input field provided on this page. The recipient then confirms hir/her intention to accept the transfer by clicking the **“Confirm”** button. Once confirmed, the funds are credited to his/her balance immediately.

| [](https://developer.verestro.com/uploads/images/gallery/2025-09/nnZimage.png)

| [](https://developer.verestro.com/uploads/images/gallery/2025-09/Cetimage.png) | [](https://developer.verestro.com/uploads/images/gallery/2025-09/LHzimage.png)

| [](https://developer.verestro.com/uploads/images/gallery/2025-09/6nkimage.png)

| [](https://developer.verestro.com/uploads/images/gallery/2025-09/0KDimage.png)

|

| 3. Recipient gets message with payment link from the Sender and clicks that link. | 4. Recipient is redirected to Payout to card and view (this step takes place in Verestro Payout to card application) and clicks **Top Up my card** button. | 5. The form to provide card number and cardholder details is shown to the Recipient. | 6. Recipient provide his card's number and his name. | 7. The status of the top up is shown to the Recipient. |

UML presenting top up card provided manually

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

participant "Money Receiver" as user

participant "Verestro" as payt

participant "Google/Apple Pay" as xpay

participant "Acquirer" as acq

note right of user: Money Receiver gets payment link via SMS/Messenger/etc sent by Sender

user->user: Open payment link

note right of user: Link redirects Money Receiver to the web browser

user->payt: Choose xPay card

payt->xpay: Get xPay card token

xpay->payt: Return xPay card token

payt->payt: Debit Money Sender's balance (declared transaction amount)

payt->acq: Payout to card

acq->user: Top up card from xPay card token

@enduml

**Tip:** After the transaction is completed, a notification will be sent to you informing you of the completion of the transaction and whether it was a success or failure.

# Technical documentation

This chapter provides the instruction of the integration with the solution and with it's methods. By using below API you will be able to order quick money transfers to debit or credit cards in 150 major currencies. Lower the costs, save time and increase the end-user satisfaction. Functionality consists of five methods allowing to order payout, check commission and follow transfer status. All methods are secured with `Basic-Authorization` of your merchant account. The `Basic-Authorization` will be provided to you during the onboarding process. Prior using this solution is to open account in acquiring institution. To complete this steps, please contact our Sales Department. We will guide you through entire process.

Environment Test API base URL

```

http://payouts.verestro.dev/

```

Environment Production API base URL

```

NOT YET IMPLEMENTED

```

Sequence diagram presenting payout process

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

actor "Payer" as p

participant "Customer" as c

participant "Verestro" as v

p->c: Make payout (provide transaction data)

c->v: Calculate commission POST /client/calculate-commission/payout

c<-v: Return commission

p<-c: Show commission

p->c: Confirm

c->v: Order payout with transaction data POST /api/v2/client/send-money

v->v: Contact with acquiring institution for transaction to be processed

v->c: Return transaction order-Id with status

p<-c: Payout ordered

v-->c: (optional) Send webhook

c->v: (optional) Check transaction status GET /client/send-money/{order-Id}

v->c: Return http status and proper message

@enduml

**Important:** The success of the multicurrency send-money transaction depends primarily on the correctness of your currency configuration which is done by the Acquirer. To make transactions in a currency other than the currency of the card, contact the Verestro employee.

**Important:** From January 2021, there is an internal functionality to restrict access for the Customer to specific method. The Acquirer employee can disable access to a given endpoint, then the HTTP status 403 FORBIDDEN will be returned. You will be informed about each access restriction action.

**Note:** When performing authorization, remember that there are currencies with different number of decimal places. For example: VND has no pennies and KWD has three decimal places. Please take this into account in the Amout field. For more information on other currencies, see ISO 4217.

### Order payout

The method allows you to order a payout transfer. The request can be made in four forms depending on the type of reference indicating the receiver of the funds. Customer by selecting `amount` = `X` defines amount of payment in given currency. This amount is transferred to receiver payment instrument (receiver reference) in selected currency. In case there's need revaluation from one currency to another, system uses `higherRate` for this situation. For more details about specific rates please refer to `currencyRate` method.

| **Receiver reference**

| **Description**

|

| `CASH-PLAIN`

| Sender provides receiver's card number in plain text.

|

| `CASH-PLAIN-WITH-CALCULATE-COMMISSION-RESULT`

| Sender provides receiver's card number in plain text along with earlier calculated commission with [`calculateCommissionPayout`](https://developer.verestro.com/books/payouts/page/technical-documentation#bkmrk-calculate-commission).

|

POST /api/v2/client/send-money

CASH-PLAIN-WITH-CALCULATE-COMMISSION-RESULT

| **Headers**

|

| **Key**

| **Value**

|

| `Content-Type` | `application/vnd.sendmoney.v2+json` |

| `Basic-Authorization` | `Basic dXNlcm5hbWU6cGFzc3dvcmQ=` |

**Note:** The `Basic-Authorization` will be provided to you during the onboarding process.

Example request body in JSON format

```json

{

"calculateCommissionUuid" : "58e1fc52-dab0-46a2-9198-45eb34024c83",

"amount" : 1000,

"type" : "RECEIVER",

"requestId" : "2b76bfd8-cfe5-4858-a145-eaed73b8cd9c",

"transactionId" : "TRX220132AM",

"sender" : {

"type" : "CASH",

"firstName" : "Mark",

"lastName" : "Smith",

"street" : "Olszewskiego",

"houseNumber" : "17A",

"city" : "Lublin",

"postalCode" : "20-400",

"flatNumber" : "2",

"email" : "senderEmail@verestro.com",

"personalId" : "AGC688910",

"country" : "PL"

},

"receiver" : {

"type" : "PLAIN",

"firstName" : "Rob",

"lastName" : "Wring",

"birthDate" : "2024-03-19",

"cardNumber" : "5117964247989169",

"currency" : "PLN",

"countryOfResidence" : "PL"

}

}

```

| **Parameter**

| **Type**

| **Description**

|

| `amount` | number

**required** | The total transfer amount (in pennies). |

| `type` | string

**required**

| Transaction in `SENDER` or `RECEIVER` currency, for specific transaction type. `CARD_CARD`: above, `CASH_CARD`: `RECEIVER` , `CASH_CARD`: `SENDER`. |

| `requestId` | string

**required** | UUID generated by the the client, used to identify single transaction. Ensures that the transaction with the given parameter is processed only once. |

| `transactionId`

| string **required** | UUID generated by the the client to assign transaction identifier. |

| `calculateCommissionUuid`

| string | Unique [`calculateCommission`](https://developer.verestro.com/books/payouts/page/technical-documentation-draft#bkmrk-calculate-commission) result identifier that allows to use calculated commission in transaction. |

| `sender` | object **required** | Object containing datailed payer's data. |

| `sender.type` | string **required** | For this configuration the value of this field must be `CASH`, otherwise request will be declined. |

| `sender.firstName` | string **required** | Payers's first name. |

| `sender.lastName` | string **required** | Payers's last name. |

| `sender.street` | string **required** | Payer's address. |

| `sender.houseNumber` | string **required** | Payer's house number. |

| `sender.city` | string **required** | Payer's city. |

| `sender.postalCode` | string **required** | Payer's postal code. |

| `sender.flatNumber` | string **required** | Payer's flat number. |

| `sender.personalId` | string **required** | Payer's personal id. |

| `sender.country` | string **required** | Payer's country. |

| `receiver` | object **required** | Object containing datailed receiver's data. |

| `receiver.type` | string **required** | For this configuration the value of this field must be `PLAIN`, otherwise request will be declined. |

| `receiver.firstName` | string **required** | Receiver's first name. |

| `receiver.lastName` | string **required** | Receiver's last name.

|

| `receiver.birthDate` | string **required** | Receiver's birth day. |

| `receiver.cardNumber` | string **required** | Receiver's card number PAN. |

| `receiver.currency` | string **required** | Currency for transaction. For example: PLN. |

| `receiver.countryOfResidence` | string | Country code in accordance with ISO 3166-1 Alpha-2. Is required for terminal crypto |

Example response body in JSON format - 202 - Accepted

```json

HTTP/1.1 202 Accepted

Content-Type: application/json

Content-Length: 56

{

"orderId" : "0621091f-a35a-4e91-a6bf-1f753304ae83"

}

```

| **Parameter**

| **Type**

| **Description**

|

| `orderId` | string($uuid) | The unique identifier of transaction.

|

Possible errors

Errors that may occur when attempting to transfer performing:

400 - Bad request

```json

HTTP/1.1 400 Bad Request

Content-Type: application/json

Content-Length: 104

{

"error" : {

"message" : "Another transaction with the same id has already been processed."

}

}

```

401 - Unauthorized

```json

HTTP/1.1 401 Unauthorized

Content-Type: application/json

{

"timestamp": "2021-12-22T12:39:53.168+0000",

"status": 401,

"error": "Unauthorized",

"message": "ERROR_USER_NOTFOUND",

"path": "/api/v2/client/send-money"

}

```

200 OK - Error validation

```JSON

HTTP/1.1 200 OK

Content-Type: application/json;charset=ISO-8859-1

{

"status": "ERROR_VALIDATION",

"error": {

"message": "Some information is missing or incorrect.",

"errors": [{

"field": "requestId",

"message": [

"may not be null"

]

}

{

"field": "type",

"message": [

"may not be null"

]

},

{

"field": "amount",

"message": [

"may not be null"

]

}

]

}

}

```

403 - Forbidden

```JSON

HTTP/1.1 403 Forbidden

Content-Type: application/json

{

"timestamp": 1610464313387,

"status": 403,

"error": "Forbidden",

"message": "No message available",

"path": "/client/send-money-3ds"

}

```

**Tip:** Payout API allows users to select the direction of revaluation by providing specify type value in [`orderPayout`](https://developer.verestro.com/books/payouts-to-cards/page/technical-documentation#bkmrk-%C2%A0-0) request. User by selecting `type` = `SENDER` defines amount of funding in given currency. This amount is collected from sender card in selected currency. In case there's need revaluation from one currency to another, system uses `lowerRate`.

POST /client/currency-rate

Example request body in JSON format

```

{

"provider" : "MASTERCARD",

"from" : "USD",

"to" : "PLN",

"effectiveDate" : "2017-06-05 12:00:00"

}

```

| **Parameter**

| **Type**

| **Description**

|

| `provider` | string **required** | VISA or MASTERCARD or MAESTRO. |

| `from` | string

**required**

| Source revaluation currency. |

| `to` | string

**required**

| Destination revaluation currency. |

| `effectiveDate` | string

| Date from which the currency rate is needed. This is optional field. When there is no effectiveDate field, then currency rate is getting from request date. (Format "yyyy-MM-ddHH:mm:ss") |

Example response body in JSON format - 200 - OK

```json

HTTP/1.1 200 OK

Content-Type: application/json

Content-Length: 104

{

"status" : "SUCCESS",

"success" : {

"lowerRate" : 3.735908,

"higherRate" : 3.8522295

}

}

```

| **Parameter**

| **Type**

| **Description**

|

| `status`

| string | Status of the revaluation.

|

| `success`

| object | Rate for revaluation.

|

| `success.lowerRate`

| decimal

| Rate for revaluation from funding to payment

|

| `success.higherRate`

| decimal

| Rate for revaluation from payment to funding

|

Possible errors

200 - OK

```json

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

{

"status": "CURRENCY_INVALID",

"error": {

"message": "Invalid currency."

}

}

```

```

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

{

"status": "CURRENCY_RATES_INVALID",

"error": {

"message": "Invalid currency rates."

}

}

```

```

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

{

"status": "ERROR_VALIDATION",

"error": {

"message": "Some information is missing or incorrect.",

"errors": [

{

"field": "sender.currency",

"message": [

"Currency is not supported"

]

},

{

"field": "receiver.currency",

"message": [

"Currency is not supported"

]

}

]

}

}

```

GET /client/send-money/details/{orderId}

| **Query parameter**

| **Value**

|

| `orderId` | `` |

Example response body in JSON format - 200 - OK

```json

{

"transactionId" : "TRX220132AM",

"amount" : 1000,

"amountInUsDollar" : 268,

"bigDecimalAmount" : 10.0,

"commission" : 200,

"bigDecimalCommission" : 2.0,

"orderId" : "00549d98-08cb-45d2-8673-4dcafa81f498",

"createdDate" : "03-04-2018, 14:01",

"fundingRrn" : "014011103023",

"paymentRrn" : "014011103024",

"arn" : "05411640143500000019325",

"3DS" : true,

"revaluationResult" : {

"revaluationFundingAmount" : 1000,

"bigDecimalRevaluationFundingAmount" : 10.0,

"fundingCurrency" : "PLN",

"revaluationPaymentAmount" : 1000,

"bigDecimalRevaluationPaymentAmount" : 10.0,

"paymentCurrency" : "PLN",

"determineCurrencyRate" : {

"from" : "PLN",

"to" : "PLN",

"currencyRate" : "1"

}

},

"receiver" : {

"firstName" : "John",

"lastName" : "Novak",

"provider" : "MASTERCARD",

"hiddenCardNumber" : "557455******1623",

"bankName" : "Alior Bank SA"

},

"sender" : {

"firstName" : "Caroline",

"lastName" : "Novak",

"provider" : "MASTERCARD",

"hiddenCardNumber" : "511796******9169",

"bankName" : "Alior Bank SA"

}

}

```

| **Response parameters**

|

| **Parameter**

| **Type**

| **Description**

|

| `amount` | number | Amount of the transferred cash of the currency in pennies \[1PLN = 100\]. |

| `amountInUsDollar` | number | Amount of the transferred cash in pennies in USD currency \[1PLN = 100\]. |

| `bigDecimalAmount` | number | Amount of the transferred cash with decimal precision. |

| `commission` | number | Amount of the commission added to the ordered transfer in pennies \[1PLN = 100\] |

| `bigDecimalCommission` | number | Amount of the commission added to the ordered transfer with decimal precision. |

| `orderId` | string | Unique transaction identifier. |

| `transactionId` | string | This parameter is used to send you your own internal transaction identifier. This field is also sent by the [`webhook`](https://developer.verestro.com/books/payouts/page/technical-documentation#bkmrk-webhook) method.

|

| `createdDate` | string | Date of transaction order. |

| `fundingRrn` | string | Funding retrieval reference number. |

| `paymentRrn` | string | Payment retrieval reference number. |

| `arn` | string | Acquirering institution reference number. |

| `3DS` | boolean | The value: `true`/`false` informs whether 3DS was performed or not. |

| `revaluationResult` | object | Detailed information about revaluation between sender currency and receiver currency. |

| `revaluationResult.revaluationFundingAmount` | number | Amount of the funding transaction in `fundingCurrency` in pennies \[1PLN = 100\]. |

| `revaluationResult.bigDecimalRevaluationFundingAmount` | number | Amount of the funding transaction in decimal precision. |

| `revaluationResult.fundingCurrency` | string | Currency code the same as sender’s card currency. |

| `revaluationResult.revaluationPaymentAmount` | number | Amount of the payment transaction in `paymentCurrency` in pennies \[1PLN = 100\]. |

| `revaluationResult.bigDecimalRevaluationPaymentAmount` | number | Amount of the payment transaction in decimal precision. |

| `revaluationResult.paymentCurrency` | string | Currency code the same as receivers's card currency. |

| `revaluationResult.determineCurrencyRate` | object | Details about currency conversion. |

| `revaluationResult.determineCurrencyRate.from` | number | Currency coverted "from". |

| `revaluationResult.determineCurrencyRate.to` | number | Result of the conversion. |

| `revaluationResult.determineCurrencyRate.currencyRate` | number | Currency rate. |

Possible errors

203 - Non-authoritative information

**Important!** After you get 203 and if you don’t get a response (200 - succeeded or 500 - declined) within 60 seconds then please contact us.

```JSON

HTTP/1.1 203 Non-Authoritative Information

```

401 - Unauthorized

```JSON

{

"timestamp": "2023-03-29T19:16:01.288+00:00",

"status": 401,

"error": "Unauthorized",

"path": "/api/v1/transactions/9609a08e-cd80-4e6e-8664-f1e6b2f2dc50"

}

```

404 - Not found

```JSON

HTTP/1.1 404 Not Found

Content-Type: application/json

Content-Length: 51

{

"errorStatus" : "ERROR_TRANSACTION_NOT_FOUND"

}

```

422 - Unprocessable entity

```JSON

HTTP/1.1 422 Unprocessable Entity

Content-Type: application/json

Content-Length: 1287

{

"transactionId" : "TRX220132AM",

"amount" : 1000,

"amountInUsDollar" : 268,

"bigDecimalAmount" : 10.0,

"commission" : 200,

"bigDecimalCommission" : 2.0,

"orderId" : "00549d98-08cb-45d2-8673-4dcafa81f498",

"createdDate" : "03-04-2018, 14:01",

"fundingRrn" : "014011103023",

"paymentRrn" : "014011103024",

"arn" : "05411640143500000019325",

"3DS" : true,

"revaluationResult" : {

"revaluationFundingAmount" : 1000,

"bigDecimalRevaluationFundingAmount" : 10.0,

"fundingCurrency" : "PLN",

"revaluationPaymentAmount" : 1000,

"bigDecimalRevaluationPaymentAmount" : 10.0,

"paymentCurrency" : "PLN",

"determineCurrencyRate" : {

"from" : "PLN",

"to" : "PLN",

"currencyRate" : "1"

}

},

"receiver" : {

"firstName" : "John",

"lastName" : "Novak",

"provider" : "MASTERCARD",

"hiddenCardNumber" : "557455******1623",

"bankName" : "Alior Bank SA"

},

"sender" : {

"firstName" : "Caroline",

"lastName" : "Novak",

"provider" : "MASTERCARD",

"hiddenCardNumber" : "511796******9169",

"bankName" : "Alior Bank SA"

},

"transactionStatus" : "DECLINED",

"cardBlockType" : "TEMP",

"cardBlockedUntil" : "2024-03-21T01:04:17.573",

"errorStatus" : "ERROR_SENDER_CARD_IS_BLOCKED"

}

```

422 - Unprocessable entity CASH-CARD

```JSON

HTTP/1.1 422 Unprocessable Entity

Content-Type: application/json

Content-Length: 1358

{

"transactionId" : "TRX220132AM",

"amount" : 1000,

"amountInUsDollar" : 268,

"bigDecimalAmount" : 10.0,

"commission" : 200,

"bigDecimalCommission" : 2.0,

"orderId" : "00549d98-08cb-45d2-8673-4dcafa81f498",

"createdDate" : "03-04-2018, 14:01",

"fundingRrn" : "014011103023",

"paymentRrn" : "014011103024",

"arn" : "05411640143500000019325",

"3DS" : false,

"revaluationResult" : {

"revaluationFundingAmount" : 1000,

"bigDecimalRevaluationFundingAmount" : 10.0,

"fundingCurrency" : "PLN",

"revaluationPaymentAmount" : 1000,

"bigDecimalRevaluationPaymentAmount" : 10.0,

"paymentCurrency" : "PLN",

"determineCurrencyRate" : {

"from" : "PLN",

"to" : "PLN",

"currencyRate" : "1"

}

},

"receiver" : {

"firstName" : "John",

"lastName" : "Novak",

"provider" : "MASTERCARD",

"hiddenCardNumber" : "557455******1623",

"bankName" : "Alior Bank SA"

},

"sender" : {

"firstName" : "Caroline",

"lastName" : "Novak",

"provider" : "CASH"

},

"transactionStatus" : "DECLINED",

"merchantSettlementCurrency" : "USD",

"fenigeCommissionInMerchantSettlementCurrency" : 0.05,

"transactionAmountInMerchantSettlementCurrency" : 2.68,

"cardBlockType" : "TEMP",

"cardBlockedUntil" : "2024-03-21T01:04:18.165",

"errorStatus" : "ERROR_SENDER_CARD_IS_BLOCKED"

}

```

500 - Internal server error

```JSON

HTTP/1.1 500 Internal Server Error

Content-Type: text/plain;charset=ISO-8859-1

PAYMENT_TRANSACTION_DECLINED:CODE_05

```

**Note:** To use the webhooks functionality, please notify Verestro Sales Department. After that we will configure URL address and a secret token which you will be using to communicate with webhook service. Please notice you must specify the URL - webhook will be sent to this address. The secret token will be generated by the Verestro employee and sent to the client.

Sequence diagram presenting webhook process

@startuml

skinparam ParticipantPadding 30

skinparam BoxPadding 30

skinparam noteFontColor #FFFFFF

skinparam noteBackgroundColor #1C1E3F

skinparam noteBorderColor #1C1E3F

skinparam noteBorderThickness 1

skinparam sequence {

ArrowColor #1C1E3F

ArrowFontColor #1C1E3F

ActorBorderColor #1C1E3F

ActorBackgroundColor #FFFFFF

ActorFontStyle bold

ParticipantBorderColor #1C1E3F

ParticipantBackgroundColor #1C1E3F

ParticipantFontColor #FFFFFF

ParticipantFontStyle bold

LifeLineBackgroundColor #1C1E3F

LifeLineBorderColor #1C1E3F

}

participant "Customer" as c

participant "Verestro" as v

c->v: Transaction request

c<-v: Response

v->v: Transaction processing...

v->c: Transaction processing finnished callback (webhook)

c->v: Response HTTP Status 200 OK

@enduml

**Tip:** In order to protect client API by polling or other undesirable actions, the webhook service uses headers. If you want to use get webhook notification, you need to handle required headers on your side.

**Tip:** To build `X-MERCHANT-SECRET` header:

1. Concatenate secret token established by you and Verestro's employee with `orderId` of transaction

2. Hash with SHA256 function result of above operation

Example of X-MERCHANT-SECRET building

```

import hashlib

# secret token established by client with verestro's employee

secret = 'mNaU9TaK4m9myYYFBJgKu8slNH2fCKutJyzXwI'

# orderId received from webhook's request

order_id = 'c168a885-acfa-4a91-a1ad-ed7a042b7238'

# concatenate strings in correct order

concatenated = secret + order_id

# use SHA256 hashing function

hashed = hashlib.sha256(concatenated.encode('utf-8')).hexdigest()

# then compare 'hashed' variable with content of 'X-MERCHANT-SECRET' header

```

TRANSACTION\_APPROVED

```

Content-Type: application/json

X-MERCHANT-SECRET: 3cbd17f561150a1394cabbe2b6031fd83f3f3081abe28c32b7fed16f32aebc4a

X-MERCHANT-TIMESTAMP: 1614800720

{

"orderId": "c168a885-acfa-4a91-a1ad-ed7a042b7238",

"transactionId": "TRX220132AM",

"status": "APPROVED",

"responseCode": "CODE_00",

"amount": 900,

"amountCurrency": "PLN",

"amountInUsDollar": 248,

"revaluationResult": {

"revaluationFundingAmount": 900,

"bigDecimalRevaluationFundingAmount": 9,

"fundingCurrency": "PLN",

"revaluationPaymentAmount": 900,

"bigDecimalRevaluationPaymentAmount": 9,

"paymentCurrency": "PLN",

"determineCurrencyRate": {

"from": "PLN",

"to": "PLN",

"currencyRate": "1"

}

},

"commissionAmount": 46,

"commissionCurrency": "PLN"

}

```

TRANSACTION\_DECLINED

```

Content-Type: application/json

X-MERCHANT-SECRET: 3cbd17f561150a1394cabbe2b6031fd83f3f3081abe28c32b7fed16f32aebc4a

X-MERCHANT-TIMESTAMP: 1614800720

{

"orderId": "42e8a03a-eb2e-4208-b99b-ac2ad6308498",

"transactionId": "TRX220132AM",

"status": "DECLINED",

"responseCode": "CODE_05",

"errorMessage": "FUNDING_TRANSACTION_DECLINED:CODE_05",

"amount": 900,

"amountCurrency": "PLN",

"amountInUsDollar": 248,

"revaluationResult": {

"revaluationFundingAmount": 900,

"bigDecimalRevaluationFundingAmount": 9,

"fundingCurrency": "PLN",

"revaluationPaymentAmount": 900,

"bigDecimalRevaluationPaymentAmount": 9,

"paymentCurrency": "PLN",

"determineCurrencyRate": {

"from": "PLN",

"to": "PLN",

"currencyRate": "1"

}

},

"commissionAmount": 46,

"commissionCurrency": "PLN",

"merchantAdviceCode": "03 - Do not try again"

}

```

TRANSACTION\_REVERSED

```

Content-Type: application/json

X-MERCHANT-SECRET: 3cbd17f561150a1394cabbe2b6031fd83f3f3081abe28c32b7fed16f32aebc4a

X-MERCHANT-TIMESTAMP: 1614800720

{

"orderId": "1b498361-f8db-406e-943b-ca2b12b7aa38",

"transactionId": "TRX220132AM",

"status": "REVERSED",

"responseCode": "CODE_00",

"amount": 1000,

"amountCurrency": "PLN",

"amountInUsDollar": 273,

"revaluationResult": {

"revaluationFundingAmount": 1000,

"bigDecimalRevaluationFundingAmount": 10,

"fundingCurrency": "PLN",

"revaluationPaymentAmount": 262,

"bigDecimalRevaluationPaymentAmount": 2.62,

"paymentCurrency": "USD",

"determineCurrencyRate": {

"from": "PLN",

"to": "USD",

"currencyRate": "0.2616157"

}

},

"commissionAmount": 1,

"commissionCurrency": "PLN"

}

```

| **To start using Money Transfers via Card you need to go through a few on-boarding steps:**

|

| 1\. Please contact our sales - *salesteam@verestro.com*

|

| 2\. Please respond to some introduction question that will let us prepare proposal for you.

|

| 3\. You will receive offer for card issuing and payouts processes.

|

| 4\. If you accept the offer you will be asked to provide some company documents required for the AML verification process.

|

| 5\. You need to perform KYB process to pass verification of your company.

|

| 6\. And finally you will enable you your own balance in Verestro Payout to Card program.

|

### Technical onboarding

**Tip:** Please remember to inform us on which environment you want us to configure an account for you. Verestro Payout to Card offers two environments: `TEST` and `PROD`.

**Important!** Implementation of the solution is work in progress...