**Available functionalities vary based on the specific deployment configuration and access rights.**

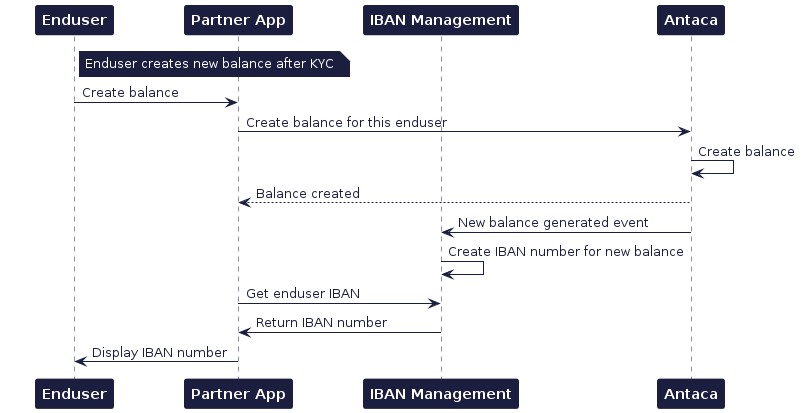

## Account Management You have the ability to create and delete bank accounts, as well as retrieve their details based on the balance within the Verestro ecosystem. Virtual accounts generated for your users are directly linked to the balance. ### Bank account creation This process enables you to generate bank accounts for your users, assigned to balances in a specific currency. Depending on the configuration and permissions, various mechanisms for generating virtual accounts are available: - **Automatically after balance creation** – once the KYC process is approved and the balance is created, the account will be generated automatically for the user.  - **Via API** – use the dedicated method [`POST /secure/bank-accounts`](https://developer.verestro.com/books/iban-management/page/technical-documentation#:~:text=POST,Generate%20bank%20account). To use this method, the balance must be created before attempting to create the account.In the case of a corporation, a successfully completed **KYB process** is required, as well as **providing the corporation entity with an address** using the [Lifecycle API](https://developer.verestro.com/books/user-lifecycle-card-management-api-sdk/page/technical-documentation).

### Bank account details The [`GET /secure/bank-accounts`](https://developer.verestro.com/books/iban-management/page/technical-documentation#:~:text=Bank%20Accounts-,GET,/secure/bank%2Daccounts,-Get%20bank%20accounts) allows you to retrieve the full details of a virtual bank account linked to a specific `balanceID`. Using this method, you can check the status of a generated bank account and display it to your users, allowing them to receive incoming transfers or top up their balance via external transfers. If an enduser initiates an outgoing transfer, the IBAN assigned to the balance from which the funds are being debited will appear as the sender's account number in the transfer history. ### Bank account deletion You have the option to delete a bank account: - **Directly**, by using the dedicated method `DELETE /secure/bank-accounts` – in this case, the balance remains active, and it will be possible to generate a new account linked to the same balance; - **[By deleting the balance](https://developer.verestro.com/books/card-issuing-and-core-banking/page/technical-documentation-4Wl#:~:text=Secure%20%2D%20Balance-,DELETE,Delete%20balance,-Secure%20%2D%20Cards)** – in this case, the virtual bank account will also be deleted.Before removing your balance, remember that the balance is shared by all payment methods, including cards!

## Transfers The IBAN Management Service allows you to facilitate incoming and outgoing payments for your master account, as well as for your users' virtual accounts. ### Incoming transfers This functionality enables the enduser to receive transfers. Endusers of your application can share their IBAN with potential payers. This type of transfer tops up the enduser's balance. When funds are transferred to a virtual bank account, the transaction is processed automatically. To receive notifications about such transfers, appropriate configuration within the [Transaction History Core (THC)](https://developer.verestro.com/books/transaction-history-api) is required. ### Outgoing transfers By using the [`POST /secure/bank-accounts/transfers`](https://developer.verestro.com/books/iban-management/page/technical-documentation#:~:text=Bank%20Accounts%20Transfers-,POST,/secure/bank%2Daccounts/transfers,-Create%20transfer%20sending) method, you can enable your users to execute transfers, as well as initiate transfers directly from the master balance. The user balance serves as the primary identifier for initiating a transfer. However, for transfers originating from the master balance, both the master balance and the master account are required. As available transfer options vary depending on the sender and beneficiary details, we recommend using the [`POST /secure/bank-accounts/transfers/options`](https://developer.verestro.com/books/iban-management/page/technical-documentation#:~:text=Create%20transfer%20sending-,POST,/secure/bank%2Daccounts/transfers/options,-Calculate%20transfer%20sending) method. By submitting transfer data before initialization, you can verify the correctness of the input, identify potential error causes, check available transfer options, and determine if any additional fields are required. You can find transfer types [here](https://developer.verestro.com/link/323#bkmrk-bank-available-trans). ## Reporting At Verestro, we provide various channels for retrieving transfer information. Using the methods and services below, you can verify the status and check the details of your transactions. ### Transfer details - Use the [`GET /secure/bank-accounts/transfers/{transactionId}`](https://developer.verestro.com/books/iban-management/page/technical-documentation#:~:text=transfer%20sending%20options-,GET,Find%20transfer%20sending,-Technical%20endpoints) method to retrieve full details of a specific outgoing transfer. This returns comprehensive data including `payment data`, `delivery mode`, `payment system`, `receiver` and `status`. - Use the [`GET /external/transactions/{id}`](https://developer.verestro.com/books/transaction-history-api/page/technical-documentation-thc-external-api#:~:text=transactions%20with%20pagination-,GET,/external/transactions/%7Bid%7D,-Get%20single%20transaction) method to retrieve detailed information about a specific transaction based on its unique identifier. ### Transfer history Transaction history can be retrieved via the Transaction History Core or monitored directly through the Administration Panel. - To retrieve and display transaction lists to your endusers, use the [`GET /external/transactions`](https://developer.verestro.com/books/transaction-history-api/page/technical-documentation-thc-external-api#:~:text=Inbound%20API-,GET,/external/transactions,-Get%20transactions%20with) endpoint. This allows for automated, paginated data fetching directly into your application. - For back-office operations and manual verification, use the dedicated tab in the Admin Panel. Detailed information about the IBAN Management Service functionalities available in the panel can be found [here](https://developer.verestro.com/books/administration-panel/page/iban-management-administration-panel-overview). ### Transfer notifications Integration with the Transaction History Core enables you to receive notifications for both transfer creation and related status updates. To enable this: 1. **Expose an endpoint:** you must expose a dedicated [`POST /transaction-event`](https://developer.verestro.com/books/transaction-history-api/page/technical-documentation-thc-external-api#:~:text=POST,/transaction%2Devent) endpoint on your server. 2. **Receive event**: when a transaction status changes, our system will send an event to your endpoint. 3. **Fetch details:** each event contains a unique identifier. Use this ID to call the [`GET /external/transactions/{id}`](https://developer.verestro.com/books/transaction-history-api/page/technical-documentation-thc-external-api#:~:text=transactions%20with%20pagination-,GET,/external/transactions/%7Bid%7D,-Get%20single%20transaction) method and retrieve the full, latest record. @startuml skinparam ParticipantPadding 30 skinparam BoxPadding 30 skinparam noteFontColor #FFFFFF skinparam noteBackgroundColor #1C1E3F skinparam noteBorderColor #1C1E3F skinparam noteBorderThickness 1 skinparam sequence { ArrowColor #1C1E3F ArrowFontColor #1C1E3F ActorBorderColor #1C1E3F ActorBackgroundColor #FFFFFF ActorFontStyle bold ParticipantBorderColor #1C1E3F ParticipantBackgroundColor #1C1E3F ParticipantFontColor #FFFFFF ParticipantFontStyle bold LifeLineBackgroundColor #1C1E3F LifeLineBorderColor #1C1E3F } participant "IBAN Management" as ims participant "Transaction History Core" as THC participant "Partner's Server" as issuer ims->THC: Report performed transfer THC->issuer: Send notification event on the Partner endpoint issuer->THC: Get transaction details by received transaction id issuer<--THC: Return transaction details @enduml